Lessons from the Dot Com Era: Why Valuation Holds True Today

“You’re going to lose half your shareholders.”

This stark warning came to SoGen International Fund manager Jean-Marie Eveillard during the late 1990s.

Eveillard’s cautious investment strategy failed to keep pace with the soaring Nasdaq, leading to unease among investors and peers alike.

In response, Eveillard stated firmly:

“I’d rather lose half our shareholders than half our shareholders’ money.”

However, as the Dot Com bubble expanded, many of his investors exited, and the SoGen fund’s assets diminished by nearly two-thirds.

Ironically, nearly a decade later, those investors might look back and wish they hadn’t sold.

Understanding the Backstory

Eveillard’s experience during the 1990s stands as a remarkable example of contrarian investing.

Investment expert Eric Fry revisited this narrative in his latest Investment Report. Before diving into Eric’s relevant investment insights, let’s outline Eveillard’s approach.

Known for his deep value philosophy, Eveillard drew inspiration from Benjamin Graham and Warren Buffett. Yet as the late 1990s brought the Dot Com boom, his cautious stance set him apart from many peers, jeopardizing his standing in the investment community.

Eric noted:

From early 1997 to late 1999, the S&P 500 more than doubled, while the SoGen fund increased by just 29%. Heavy investment in cash and precious metals weighed down performance.

Many began to question if Eveillard was out of touch.

His shareholders criticized him for what they viewed as “excessive prudence,” leading to widespread withdrawals. Nevertheless, Eveillard remained steadfast, prioritizing cash over temporary successes.

In 1999, as the NASDAQ surged 86%, Eveillard’s fund returned a mere 7%.

This prompted frustrated investors to flee, further igniting doubt among his colleagues. Reflecting on this phase, he would later express:

I was ridiculed. People told me I didn’t understand the new era.

Vindication After the Burst

When the Dot Com bubble collapsed in 2000, many were caught off guard. The Nasdaq plummeted by 78% over two years.

In contrast, the SoGen International Fund not only weathered the storm but achieved a 26% gain.

This marked the beginning of a new chapter. Eric highlighted the long-term results:

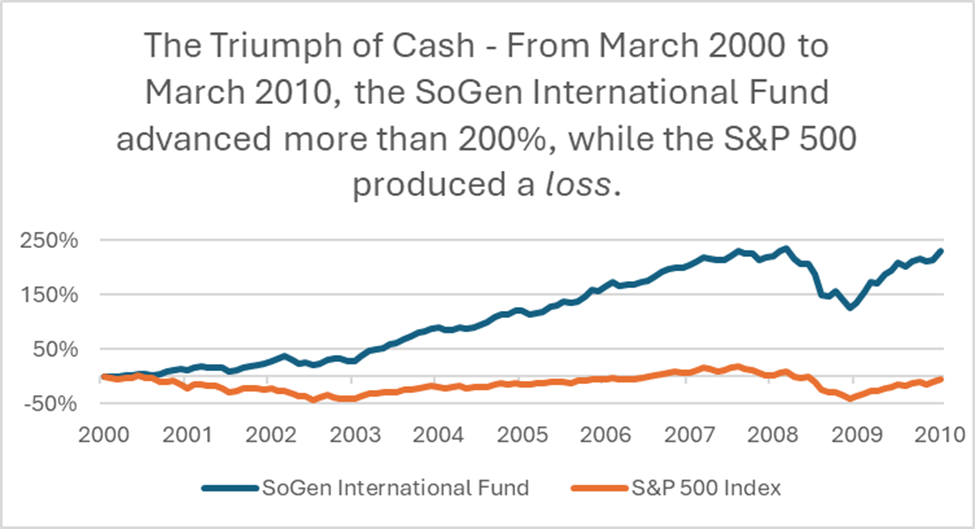

Between March 31, 2000, and March 31, 2010, the S&P 500 Index yielded a negative total return, while Eveillard’s SoGen International Fund more than tripled!

While many spent ten years recovering from significant losses, Eveillard continued to generate fresh gains.

Current Market Insights from Eric Fry

Eric recounts this story as he advises investors to consider raising cash by selectively selling high-valuation stocks.

Although Eric is not predicting an immediate market downturn, he emphasized three critical points:

- Valuation matters.

- Currently, with a P/E ratio of 26.4, stocks are among the highest since 1953. History shows that at these levels or higher, there have been 10-year losses 73% of the time.

- To have cash available for future purchases when prices drop, raising cash at high stock prices is essential.

Eric elaborates:

Sometimes cash feels like a fallback option – something to hold when you lack better ideas. However, cash can transform into a powerful tool when stock prices stagnate.

That’s why he recommends raising cash in this high-valuation climate, but not liquidating entirely; instead, consider opportunistic selling during market strength.

This approach can be challenging, as it may feel uncomfortable to miss out on rising markets. As Eveillard poignantly remarked, “It’s warmer inside the herd… it can be very cold outside of it.”

Eric’s strategy makes sense: to buy low after a market correction, one must sell high when opportunities arise.

He presents this concept effectively:

You can start viewing your cash as “returns in waiting.”

If you’re a Investment Report subscriber and haven’t yet read this month’s edition, make sure to catch up. Click here to log in.

And should you wish to learn more about how to subscribe, [please click here].

Investing Insights: Navigating the Shift in AI Stocks

In the latest issue of Investment Report, Eric highlights the significance of selective stock purchases in the current market climate.

This leads to a critical warning from esteemed investor Louis Navellier…

Anticipate a Major Change in the AI Sector

For those unfamiliar with the Digest, Louis is a well-known quant investor. This means he relies on precise numbers and data rather than instinct in making investment decisions.

His methods employ advanced computers and custom algorithms to identify potential investment opportunities based on quantitative analysis.

Previously, Louis recommended Nvidia, a stock that has soared since its recommendation in 2019. As of yesterday, Nvidia reached an all-time high, resulting in a staggering 3,196% gain for Louis’ subscribers.

While he believes Nvidia still has room for growth, Navellier warns that the AI sector is evolving. Many investors are focused on “first generation” AI stocks like NVIDIA Corporation (NVDA). According to Louis, while Nvidia will continue to be profitable, it has become somewhat outdated.

The next wave lies with the “second generation” of AI stocks. These companies will utilize generative AI to innovate and revamp existing industries, driving transformational changes seen once every quarter-century.

Those who embrace this second wave of AI are poised for substantial gains, while those who resist may face significant losses.

Consider the collapse of some beloved companies during the Dot Com era, such as Pets.com and Webvan. Their demise serves as a reminder of the risks in the market.

Today is the final day to access Louis’ research on this pressing topic. For more details before it’s taken down, click here.

Combining Eric’s and Louis’ insights, we create a strategic approach for today’s investment landscape…

Exercise caution, maintain cash reserves, and choose AI stocks wisely.

To support this strategy, let’s look at another indication…

Warren Buffett’s Market Wisdom

If you hold Warren Buffett in high regard as an investor, his insights might interest you, particularly regarding valuation metrics.

This brings us to “the Buffett Indicator,” a term popularized by Buffett in a 2001 interview with Fortune.

This indicator measures the total market capitalization of a country’s stock market against its Gross Domestic Product (GDP). It serves as a tool to determine whether a market is overvalued or undervalued.

Buffett stated:

[The ratio is] probably the best single measure of where valuations stand at any given moment.

Buffett explained his interpretation of the indicator by saying:

If the ratio approaches 200%—as it did in 1999 and a part of 2000—you are playing with fire.

So, where do we stand today?

According to Barchart from Tuesday:

Warren Buffett Indicator hits 199%, the highest level in history, surpassing the Dot Com Bubble and the Global Financial Crisis.

As expected, critics emerged, asserting that the ratio is flawed if considered alone. Some argue that many U.S. firms are global companies, suggesting a need to compare global market cap with global GDP instead.

This perspective is valid, yet it evokes the dismissive reactions faced by investors during the Dot Com boom when concerns about unsustainable valuations were prevalent.

I was ridiculed. People told me I didn’t understand the new era.

In light of this analysis, proceed with caution, keep cash on hand, and select AI stocks judiciously.

Wishing you a pleasant evening,

Jeff Remsburg