How Nvidia Became the Leader in AI and Semiconductor Technology

In January 1999, a small graphics chip company named Nvidia (NASDAQ: NVDA) went public at $12 per share. Few expected this Silicon Valley start-up would evolve into the world’s most valuable semiconductor firm.

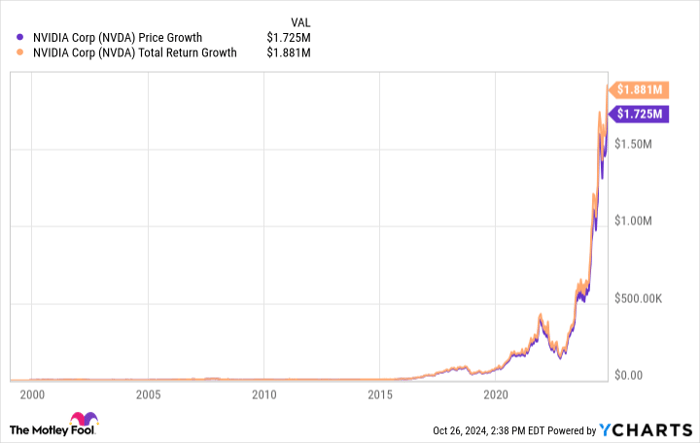

If you had invested $500 in Nvidia’s IPO, it would be worth $1.88 million today, assuming dividends had been reinvested. This return significantly beats the performance of the S&P 500 over the same period.

NVDA data by YCharts

Let’s delve into how this impressive journey started from a simple California diner to becoming a driving force in the artificial intelligence (AI) sector.

The Birth of a New Vision in Computing

Nvidia’s story began in a Denny’s restaurant close to San Jose, where founders Jensen Huang, Chris Malachowsky, and Curtis Priem mapped out a plan to change computer graphics. Their key innovation, the graphics processing unit (GPU), would transform pixelated images into vivid visuals.

![]()

Image Source: Getty Images.

This initial gaming focus later allowed Nvidia to branch into AI and data centers. The skills developed in gaming laid the groundwork for future advancements.

Pioneering Technologies through Parallel Processing

Nvidia’s rapid ascent is largely due to its groundbreaking GPU architecture, which can perform millions of calculations at the same time. Initially revolutionizing gaming, this ability later proved crucial for AI applications.

Today, Nvidia’s chips support a wide range of technologies, from self-driving cars to major cloud services like Amazon Web Services and Microsoft Azure. The flexibility of GPU technology has opened numerous high-growth markets, indicating that Nvidia’s competitive edge is just beginning to realize its full potential.

Success through Strategic Evolution

Nvidia’s knack for adapting has been striking. The team realized early that GPU technology had applications far beyond gaming.

In 2006, Nvidia introduced the Compute Unified Device Architecture (CUDA), a platform that turned graphics processors into multifunctional computing powerhouses. This move positioned Nvidia to lead during the AI boom.

By allowing GPUs to tackle complex computational tasks outside of graphics, CUDA gave Nvidia a unique advantage in a rapidly growing and lucrative tech market.

The AI Boom as a Growth Engine

The explosion of AI technology has accelerated Nvidia’s expansion. The company reported $26.3 billion in data center revenue for the latest quarter, marking a remarkable 154% increase compared to the previous year.

This surge in AI demand has pushed Nvidia’s market value up to $3.47 trillion. Earlier this year, the chip giant even outperformed tech giants Microsoft and Apple briefly, becoming the world’s most valuable publicly traded company.

The Impact of Stock Splits

Nvidia has employed stock splits to enhance its shareholder-friendly reputation. Since its public offering, the company has executed six splits, including a notable 10-for-1 split in June 2024.

Through these splits, one initial share has grown into 480 shares, making it more accessible for individual investors while keeping the overall market value intact.

The Road Ahead for Nvidia

Nvidia is embarking on a bold journey with its upcoming Blackwell architecture, designed with AI workloads in mind. Analysts expect this technology could contribute billions in revenue by early 2025. CEO Jensen Huang envision a $100 trillion AI economy, indicating the semiconductor industry’s transformation is merely beginning.

The company’s significant investments in research and development, along with its increasing footprint in enterprise AI solutions, suggest that Nvidia’s impressive growth might still be in its early phase. Strategic alliances with leading cloud providers and growing software offerings further position Nvidia to benefit from the next wave of AI advancements.

Is Nvidia a Smart Investment Right Now?

Before making an investment in Nvidia, keep this in mind:

The Motley Fool Stock Advisor analyst team recently found what they believe are the 10 best stocks to invest in right now, and Nvidia wasn’t included. The highlighted stocks are you could see substantial returns in the future.

Consider this: if you invested $1,000 in Nvidia when it was recommended on April 15, 2005, you would now have $867,372!

Stock Advisor offers investors an easy-to-follow guide for success, with advice on building a portfolio, regular analyst updates, and two new stock picks every month. This service has more than quadrupled the S&P 500’s returns since 2002.

See the 10 stocks »

*Stock Advisor returns as of October 21, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board. George Budwell holds positions in Apple, Microsoft, and Nvidia. The Motley Fool owns and recommends Amazon, Apple, Microsoft, and Nvidia. The Motley Fool endorses long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. A disclosure policy is in place.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.