Technology Sector’s Strong Performance

The current earnings season, now tapering off, has been a beacon of positivity, driven primarily by the robust performance of the Technology sector. This surge has not only improved the overall earnings landscape but has also showcased stellar results from industry stalwarts like Apple, NVIDIA, and Celsius Holdings.

Let’s delve deeper into the quarterly performances of these companies that have set unprecedented records in their respective domains.

Apple: Steady Growth Amid Expectation Miss

Apple, darling of the market, revealed staggering figures in its recent quarterly report. With sales nearing $120 billion and EPS hitting $2.18, the tech giant managed to exceed expectations, even though falling slightly short of the Zacks Consensus estimate. Despite this marginal hiccup, Apple saw a 2% sales growth year-over-year and a substantial 16% surge in EPS.

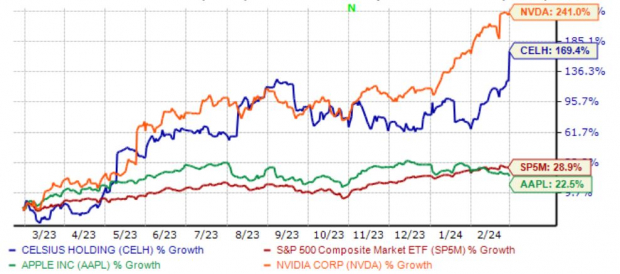

One notable record was the Services revenue, reaching an all-time high of $23.1 billion and growing by 11% from the previous year. The Services segment continues to be a pivotal growth driver for Apple, diversifying its revenue streams away from the iPhone. However, post-earnings, AAPL shares witnessed a 7% decline year-to-date, trailing the S&P 500 index.

NVIDIA: Powering Ahead with Record Growth

NVIDIA, the AI juggernaut, turned heads with its quarterly earnings report, topping the charts with an unprecedented Q4 revenue of $22.1 billion and an EPS of $5.16. The extraordinary growth rates of 409% and 485%, respectively, blew past consensus estimates by 13% and 8%, highlighting the company’s phenomenal performance.

The Data Center department emerged as the star performer, achieving a record $18.4 billion in sales, a monumental 410% increase year-over-year. The relentless demand for NVIDIA’s AI chips propelled this exceptional surge, with figures surpassing analyst predictions by almost $1.5 billion.

Analysts have further bolstered their expectations for NVIDIA, crowning it with a Zacks Rank #1 (Strong Buy) designation, underscoring the confidence in the company’s future prospects.

Celsius Holdings: A Sizzling Success Story

Celsius Holdings marked its presence with a stellar showing in its latest quarterly report. With Q4 revenue hitting $347 million, a remarkable 95% increase from the previous year, the company set a new record. Additionally, quarterly earnings per share stood at $0.17, exceeding consensus estimates and showcasing a significant jump from $0.01 in the corresponding period.

The market reacted favorably to Celsius Holdings’ results, propelling its shares up by an impressive 170% over the last year. The impressive results were underpinned by robust growth in both International and North American markets, demonstrating the company’s ability to attract new customers and enhance consumption occasions.

Final Thoughts: Riding the Wave of Exceptional Performance

As the earnings season draws to a close, the upbeat sentiment has been palpable, driven by the standout performance of the Technology sector. Companies like Apple, NVIDIA, and Celsius Holdings have not only met but surpassed market expectations, setting new benchmarks for themselves and their peers.

These companies, with their innovative strategies and relentless drive for excellence, exemplify the dynamism and resilience of the corporate world. Investors are left to wonder – what new records will these industry leaders set in the quarters to come?