The start of the New Year has seen U.S. markets pause after last year’s historic rally, with the S&P 500 struggling to reach new highs. The market seems to be catching its breath, as we continue to see sellers step in repeatedly over the first two weeks. Despite coming close, the S&P 500 has not yet closed above the coveted threshold, indicating a possible temporary sign of exhaustion and waning buying pressure.

However, from a longer-term perspective, the market remains in an established uptrend, with technology, especially semiconductor stocks, showing relative strength in 2023. Buoyed by a powerful artificial intelligence theme, the concept of relative strength is being employed to identify the best performing securities over time.

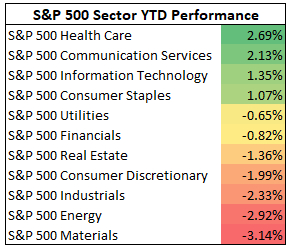

Tracking Sector Performance Year-to-Date

Examining sector performance tells an interesting story. Health care and communication services sectors have exhibited the strongest trend year-to-date, while the energy and materials sectors have lagged. This mixed bag of sector performance indicates both defensive and aggressive pockets of the market are near the top, suggesting that we are still in the early stages of market movements, akin to the first inning of a twelve inning stretch.

While it’s important to note that past performance is not indicative of future results and that technical indicators like relative strength rely on historical data, it is also true that historical trends do tend to persist longer than expected, much like the scientific principle that “an object in motion tends to stay in motion.”

Investing for the Long-Term

Having an intermediate or long-term time horizon in investing can help to navigate through temporary volatility. It’s about positioning portfolios in the direction that stocks are most likely to go and taking advantage of major trends to allow investing capital to compound over time. The key lies in understanding that no one can consistently predict market tops and bottoms, but investors can benefit from identifying and capitalizing on major trends.

Individual Outperformers: Highlight on Health Care

Within the leading health care sector, the large-cap pharmaceutical industry has demonstrated relative strength. Two standout stocks in this space are Eli Lilly (LLY) and Novartis (NVS), showing impressive outperformance compared to the major indices.

Eli Lilly, a global pharmaceutical company, has seen its stock rise by an impressive 10.5% this year, with expected fiscal 2024 earnings to grow by a staggering 91% compared to last year. Similarly, Novartis has rallied nearly 7% this year, and its 2024 Zacks Consensus Estimate reflects a potential growth rate of 10.1% relative to last year.

Final Thoughts

Utilizing relative strength to identify outperforming stocks within leading sectors can be a rewarding strategy. As the S&P 500 continues to hover near all-time highs, investors are encouraged to make use of available resources and research to navigate through the market.

While the market dynamics remain uncertain, staying informed about top-performing stocks and industry trends is crucial for making informed investment decisions.

To read this article on Zacks.com click here.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly tripling the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2024. You can still be among the first to see these just-released stocks with enormous potential.

Novartis AG (NVS) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.