Top Oversold Stocks in Consumer Staples: Are They Worth the Buy?

The consumer staples sector is currently presenting value opportunities for investors. Certain stocks in this industry appear to be significantly undervalued, suggesting potential for growth.

The Relative Strength Index (RSI) is a tool that traders use to determine a stock’s momentum. It analyzes the stock’s performance on days when prices go up compared to days when prices go down. An RSI below 30 indicates that a stock might be oversold, making it an attractive buy for investors, according to Benzinga Pro.

Below is a list of notable stocks in the consumer staples sector that are currently considered oversold, with RSI values near or below 30.

Coty Inc COTY

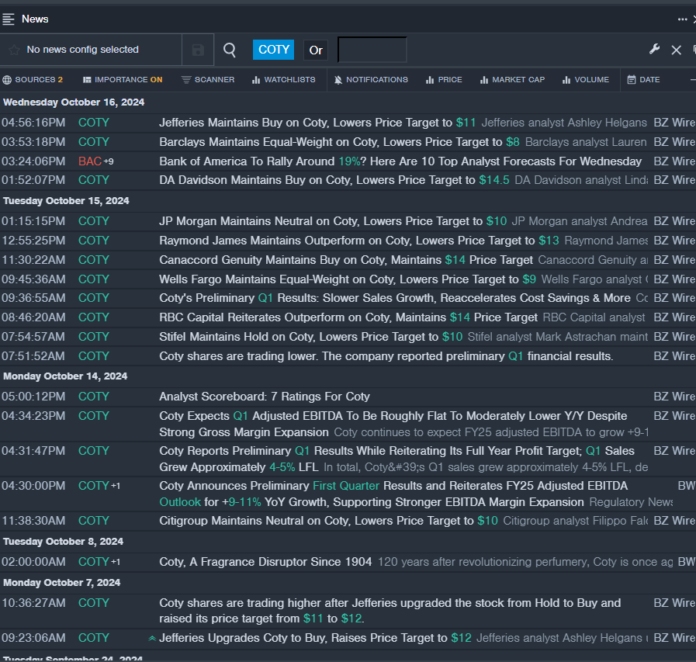

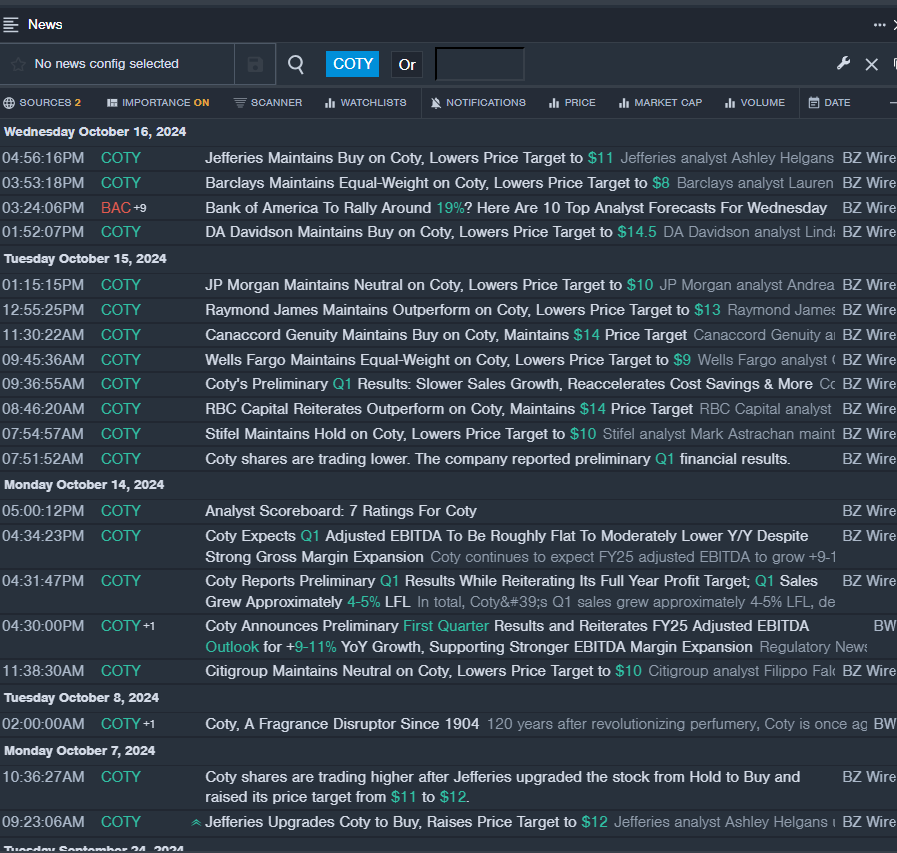

- On Oct. 14, Coty reported its preliminary first-quarter results and maintained its FY25 adjusted EBITDA outlook, projecting growth of 9-11% year-over-year. Despite this positive outlook, the stock has declined roughly 11% over the last five days, reaching a 52-week low of $7.95.

- RSI Value: 29.19

- COTY Price Action: Coty shares fell by 2.3%, closing at $7.99 on Wednesday.

- Benzinga Pro’s real-time newsfeed provided updates on the latest developments for COTY.

22nd Century Group Inc XXII

- On Sept. 13, 22nd Century Group’s CEO Lawrence Firestone acquired 39,000 shares at an average price of 27 cents each, as noted in an SEC filing. However, the stock has plummeted approximately 43% over the past five days, hitting a 52-week low of $0.10.

- RSI Value: 22.29

- XXII Price Action: Shares of 22nd Century Group fell by 17.4%, ending at $0.11 on Wednesday.

- Benzinga Pro’s charting tool helped highlight this trend in XXII’s performance.

Mangoceuticals MGRX

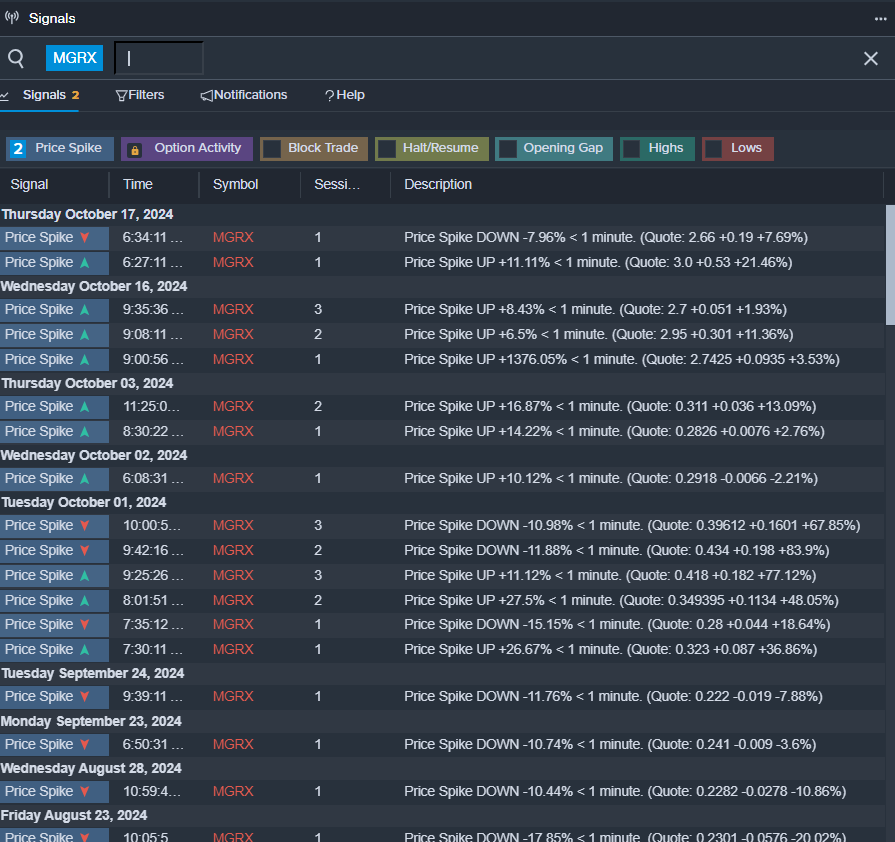

- Recently, on Oct. 14, Mangoceuticals announced a 1-for-15 reverse stock split. This news may have contributed to a 21% drop in shares over the past five days, with a 52-week low of $2.14.

- RSI Value: 29.63

- MGRX Price Action: Shares of Mangoceuticals fell 6.8%, closing at $2.47 on Wednesday.

- Benzinga Pro’s signals feature helped indicate a potential breakout in MGRX shares.

Read More:

Market News and Data brought to you by Benzinga APIs