Just over a week ago, Microsoft MSFT released its fiscal second quarter results, surprising the market with Q2 earnings of $2.93 a share beating estimates by 6% and sales of $62.02 billion, outstripping expectations by over 1%.

Despite this, Microsoft’s stock performance has remained stagnant since it exceeded Q2 expectations. However, analysts remain bullish on the company’s outlook.

Growth & Recent Performance

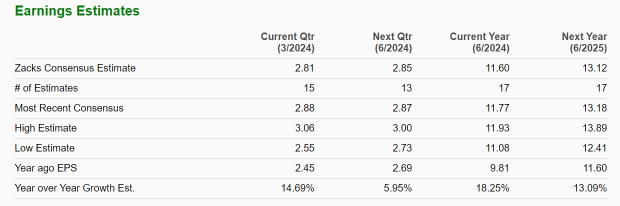

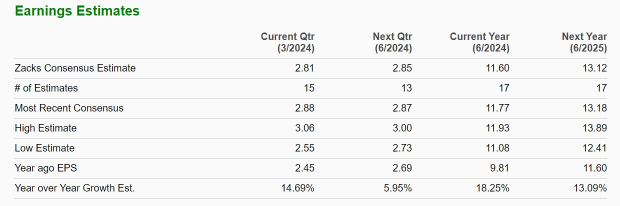

Amidst the storm of quarterly reports from its peers such as Amazon (AMZN), Apple (AAPL), and Meta Platforms (META), it might have been easy to overlook Microsoft’s Q2 report. Nonetheless, Microsoft’s Q2 earnings soared 26% year over year, with quarterly sales also rising by 17%. This growth has been primarily fueled by its cloud services, and annual earnings are now projected to surge by 18% in fiscal 2024 to reach $11.60 per share, while total sales are forecasted to climb by 15% to $243.38 billion.

Image Source: Zacks Investment Research

Over the last year, Microsoft’s stock has surged by +54%, and the expectation of double-digit EPS and sales growth in FY25 is likely to keep investors engaged.

Image Source: Zacks Investment Research

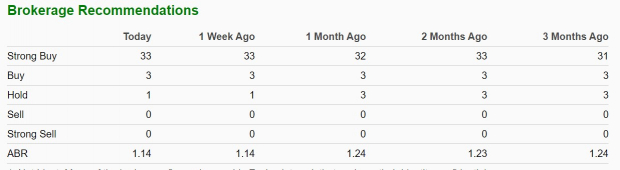

Earnings Estimate Revisions & Broker Recommendations

Building a stronger case for buying Microsoft’s stock is the fact that the earning estimates for FY24 and FY25 have significantly increased over the last 30 days, with a 3% rise in the last week alone.

Image Source: Zacks Investment Research

Currently, Microsoft holds an Average Broker Rating (ABR) of 1.14 on a scale of 1 to 5 (Strong Buy to Strong Sell). In line with this, 33 out of 37 brokers covering Microsoft’s stock and providing data to Zacks have strong buy ratings, with three holding buy ratings and only one at a hold.

Image Source: Zacks Investment Research

Bottom Line

There seems to be more potential for Microsoft’s stock to grow, with the Average Zacks Price Target of $438.97 a share, indicating an 8% upside. Furthermore, Microsoft’s stock currently holds a Zacks Rank #2 (Buy) in line with the trend of positive earnings estimate revisions following the favorable Q2 results.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s credited with a “watershed medical breakthrough” and is developing a bustling pipeline of other projects that could make a world of difference for patients suffering from diseases involving the liver, lungs, and blood. This is a timely investment that you can catch while it emerges from its bear market lows.

It could rival or surpass other recent Stocks Set to Double like Boston Beer Company, which shot up +143.0% in little more than 9 months and NVIDIA, which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.