Sell Weak Dividend Stocks and Buy Growth: A Strategy for October

As we head into October, many investors have seen their dividend stocks rise sharply this year. However, the month brings heightened volatility, influenced by a growing conflict in the Middle East and an upcoming contentious election.

Now may be the time to sell underperforming dividend stocks now while taking advantage of better opportunities. One such stock to consider selling, which may not have performed well for years, is Nordstrom Inc. (JWN). However, don’t just retreat to safer options; there are still attractive dividend growers available.

Nordstrom: A Stock to Sell

Nordstrom Inc. (JWN) currently yields 3.5%, which is decent but falls short of the typical 1.2% yield seen in the S&P 500 stocks. I am concerned about its business model as e-commerce continues to expand rapidly. It operates 93 Nordstrom department stores and 269 Nordstrom Rack discount stores.

A significant issue is Nordstrom’s debt, totaling $2.6 billion in long-term obligations. Although the company is working to reduce this debt, it still represents 72% of its market capitalization, limiting its ability to compete effectively against e-retailers as well as specialized retail sectors.

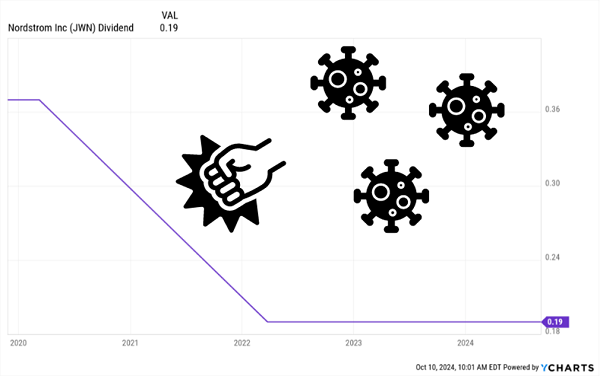

The company’s dividend was suspended in 2020 and restored in 2022, but at only half of its previous value. Over the past year, an alarming 91% of the company’s free cash flow has been allocated to dividends, which is not sustainable long-term.

Despite these challenges, Nordstrom plans to open 32 new locations by fall 2025, an aggressive expansion strategy considering the competitive landscape. The company’s past attempts at expansion, such as its unsuccessful push into Canada from 2014 to 2023, highlight the risks involved.

Thanks to a broader market rally, shares of Nordstrom have climbed 18.5% this year to around $22, though they remain significantly lower than the $82 peak seen a decade ago. It may be wise to sell now while the stock is up.

Buy FedEx: A Strategic Investment

Unlike Nordstrom, FedEx Corp. (FDX) stands out as a prime opportunity. The company’s upcoming growth is closely tied to e-commerce, which continues to rise. By avoiding individual retailers, FedEx benefits from overall market trends.

In terms of e-commerce growth, sales are projected to exceed $6 trillion globally this year, with estimates reaching $7.96 trillion by 2027. China leads the market at nearly $2.2 trillion, while the United States follows at $981 billion.

The current economic situation presents a favorable environment for FedEx, particularly with both U.S. and Chinese stimulus actions. U.S. government spending is approximately $2 trillion more than tax revenues, which can help sustain economic momentum, benefiting shipping and logistics companies like FedEx.

The stock saw a drop following weak first-quarter profits, providing investors with a buy window. As of now, FDX could see about 40% upside potential while maintaining a solid growth trajectory for its dividends.

October: A Volatile Month to Make Strategic Moves

Historically, October has been known for volatility in the stock market. Given the current market conditions, now is an excellent opportunity to sell stagnant stocks like Nordstrom and turn your attention to promising investments like FedEx, which boasts both growth and a reliable dividend.

Investors should not overlook the potential of FedEx, which has consistently increased its dividend by an impressive 590% over the past decade. With a payout currently representing only 49% of its free cash flow, there’s room for further growth compared to Nordstrom’s alarming 91% payout ratio.

For those seeking additional growth opportunities, I’ve identified 5 more dividend stocks that are poised for success. These stocks are positioned to increase in value and provide reliable income even in uncertain markets.

Also see:

- Warren Buffett Dividend Stocks

- Dividend Growth Stocks: 25 Aristocrats

- Future Dividend Aristocrats: Close Contenders

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.