Exploring the Top Picks Among the Magnificent Seven Stocks

The “Magnificent Seven” stocks have provided impressive returns for investors in recent years. This select group of tech companies is experiencing rapid growth and generating significant profits, which they are using to further expand into areas like artificial intelligence (AI).

Investors interested in these top stocks should examine their underlying growth potential. Companies that consistently show the highest growth in revenue and earnings typically yield the best long-term returns.

Currently, two of the fastest-growing companies in this group also feature reasonable price-to-earnings (P/E) ratios that could lead to exceptional returns. Below, we explore the two Magnificent Seven stocks to consider buying now.

1. Nvidia

Nvidia (NASDAQ: NVDA) produces vital hardware essential for processing and training advanced AI models in data centers. The company has established a dominant position in the market for AI accelerators, particularly graphics processing units (GPUs), propelling its revenue growth to triple-digit rates and delivering substantial returns for its shareholders.

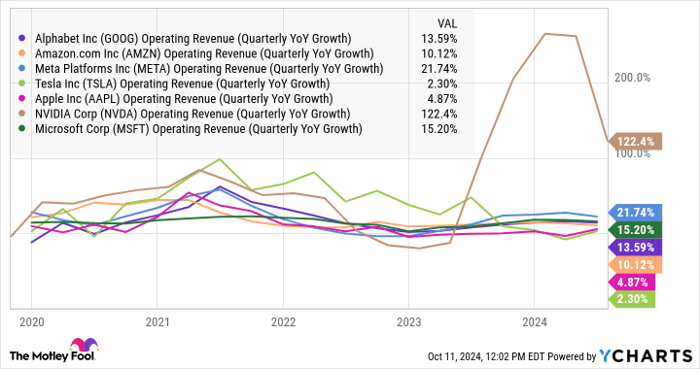

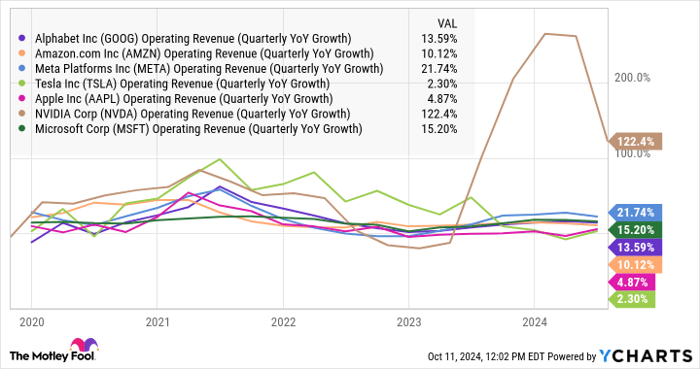

Nvidia currently leads the Magnificent Seven in revenue growth. In the latest quarter, the AI chip manufacturer reported a 122% increase in year-over-year revenue. Although this growth is slowing, analysts predict Nvidia will achieve 42% revenue growth next year, surpassing its peers.

Data by YCharts.

Data centers require increasingly powerful processors, and Nvidia has substantial resources available for tech innovation. Over the years, it has invested an impressive $45 billion in research and development, focusing on creating the most potent GPUs. This investment has yielded outstanding returns for shareholders.

Despite its leadership, Nvidia faces rising competition as major cloud service providers—the company’s largest customers—develop their own customized AI chips. While these alternatives currently cannot match the capabilities of Nvidia’s GPUs, investors should recognize that the AI chip landscape is changing, which could challenge Nvidia’s growth in the future.

This competitive pressure is prompting Nvidia’s management to diversify beyond GPUs. Its acquisition of Mellanox in 2020 effectively transformed Nvidia into a more comprehensive data center solutions provider, expanding into networking hardware. Nvidia’s networking revenue surged by 114% year over year last quarter, reaching $3.7 billion. Growth in this segment will further strengthen Nvidia’s competitive position.

Nvidia has established itself as a trusted brand across various computing sectors, including gaming. Its forthcoming Blackwell computing platform is expected to significantly enhance AI performance for demanding workloads. Major companies like Tesla, xAI, Amazon Web Services, and Microsoft are anticipated to incorporate Blackwell into their data centers.

Projecting forward, analysts estimate Nvidia’s earnings will grow annually at 36%, outpacing other Magnificent Seven companies. With the stock trading at a forward P/E ratio of 34 based on next year’s earnings estimate, investing in Nvidia today could lead to impressive returns by 2025.

2. Meta Platforms

The parent company of Facebook and Instagram, Meta Platforms (NASDAQ: META), is another fast-growing contender with strong potential to outperform its peers in the Magnificent Seven. Although the company has experienced substantial growth this year, its shares remain attractively valued.

Meta’s revenue benefitted from a resurgence in digital advertising over the past year, reflecting a 22% year-over-year rise in the second quarter. This marks the second-highest growth among the Magnificent Seven. The company is effectively leveraging AI to enhance its advertising efforts, evidenced by significant purchases of Nvidia GPUs to bolster its AI infrastructure.

Since the introduction of its Llama family of large language models in February 2023, Meta has seen its revenue growth double compared to the previous year. The company is putting money into new AI features, like Meta AI for its social media platforms, while maintaining strict control over operating costs. This strategic cost management led to a remarkable 73% jump in earnings per share year over year in Q2.

AI optimizations in Meta’s Advantage+ advertising tool have resulted in improved ad delivery efficiency. The company notes that these enhancements are yielding a 22% higher return on ad spending for U.S. advertisers, illuminating the strong momentum driving revenue growth.

In the evolving AI landscape, Meta stands to gain considerably. It has generated $49 billion in trailing free cash flow, providing substantial resources to lead in AI development. Meta’s commitment to technology investment, coupled with its 3.27 billion daily active users, positions it strongly for growth within the $699 billion digital ad market.

Analysts forecast Meta’s earnings to increase at an annualized rate of 19% over the coming years, placing it third among the Magnificent Seven. With a forward P/E ratio of 23 based on next year’s earnings estimate, it is also one of the most attractively priced stocks in this group, enhancing its potential for outpacing the broader market. If Meta meets its earnings forecasts, investors could see their money double over the next four years.

Should you invest $1,000 in Nvidia right now?

Before considering an investment in Nvidia, it is worth noting:

The Motley Fool Stock Advisor analyst team has highlighted what they believe to be the 10 best stocks for investors today, and Nvidia is not on that list. The selected stocks have the potential to yield substantial returns in the coming years.

Reflecting on Nvidia, which was included on the list on April 15, 2005… an investment of $1,000 at that time would now be worth $826,069!*

Stock Advisor assists investors with a straightforward plan for success, offering guidance on portfolio construction, regular analyst updates, and two new stock recommendations each month. Since 2002, the Stock Advisor service has more than quadrupled the performance of the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of October 14, 2024

Members of The Motley Fool’s board of directors include John Mackey, former CEO of Whole Foods Market; Randi Zuckerberg, a former Facebook director; and Suzanne Frey, an executive at Alphabet. Additionally, John Ballard holds positions in Meta Platforms, Nvidia, and Tesla, while The Motley Fool recommends stocks like Alphabet, Amazon, and Apple among others. The Motley Fool has specific options trading recommendations as well. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.