“`html

The Medical Services sector is undergoing a notable transformation fueled by innovations and digital advancements. The growing demand for remote treatments has accelerated the development of digital healthcare solutions in recent years. As telemedicine and AI-powered services expand, the reliance on data analytics continues to climb.

According to a recent report from Mordor Intelligence, the global healthcare analytics market is projected to exceed $130 billion by 2029, with a CAGR of 22.9% from 2024 to 2029. Key players—including Elevance Health, Inc. ELV, Doximity DOCS, and HealthEquity HQY—are set to benefit substantially from these industry shifts.

Despite this progress, a severe shortage of manual workers in healthcare has emerged as a global challenge, impacting healthcare systems. A report by Mercer released in August 2024 forecasts a shortfall of more than 100,000 healthcare workers in the U.S. by 2028. The most significant gap will be among nursing assistants, with an anticipated deficit of over 73,000 in this role. As a result, labor costs and health care expenses are rising significantly.

Industry Overview

The Zacks Medical Services industry consists of third-party providers and caregivers that support core healthcare companies while achieving economic efficiency. This sector comprises pharmacy benefit managers, contract research organizations, wireless MedTech firms, third-party testing labs, surgical facilities, and healthcare workforce solutions. Over time, the industry has shifted from volume-based to value-based care, emphasizing the need for advanced facilities and specialized services. It is now recognized as a fundamental component of modern healthcare management.

Three Trends Influencing the Medical Services Sector

The Digital Revolution: The expansion of digital platforms in the medical device field, including remote monitoring, robotic surgeries, big-data analytics, 3D printing, and electronic health records, has gained momentum in the U.S. A 2024 report from Statista indicates this market will grow at a 9.2% CAGR from 2024 to 2028, aiming for a volume of $275 billion by 2028. Companies embracing AI have reported up to a 50% decrease in treatment costs and significant improvements in patient outcomes.

Growth of Nursing Care Services: As awareness of specialized medical caregiving rises, the need for healthcare staffing services has surged. Post-pandemic recovery is evident despite challenges like workforce shortages and escalating costs. The demand for nursing staff, driven by increasing chronic diseases, is set to rise. Research and Markets predict the global healthcare staffing market will hit $62.8 billion by 2030, with a CAGR of 6.9% from 2023 to 2030.

Continued Staffing Shortages: The end of the COVID-19 emergency has not alleviated the significant staffing shortages impacting healthcare workers. Many frontline professionals are leaving the field, influenced by ongoing pressures and an aging population—around 10,000 individuals aged 59-77 are enrolling in Medicare daily. The World Health Organization projects a shortfall of 15 million healthcare workers globally by 2030. Consequently, hospitals have seen labor costs rise by 15.6% per adjusted discharge compared to pre-pandemic figures, as reported by HR for Health.

Zacks Industry Rank Highlights Challenges

The Zacks Medical Services industry is part of the broader Zacks Medical sector and holds a Zacks Industry Rank of #170, indicating it resides in the bottom 32% of over 250 Zacks industries. This ranking reflects the less favorable near-term outlook for the industry.

Our observations reveal that the top half of Zacks-ranked industries outperforms the bottom half by more than 2 to 1, underscoring the importance of stock selection in this context.

Underperformance Compared to the Sector and S&P 500

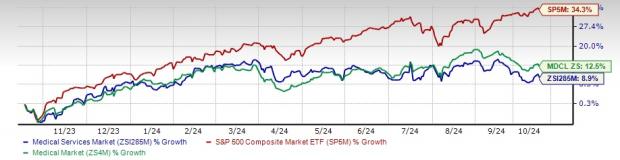

Over the past year, the Medical Services Industry has lagged behind both its sector and the S&P 500. Its stocks have collectively gained just 8.9%, in contrast to the Medical sector’s 12.5% and the S&P 500’s impressive 34.3% increase.

One-Year Price Performance

Current Valuation Metrics

Using forward 12-month price-to-earnings (P/E) ratios, a common metric for valuing medical stocks, the industry currently trades at 15.01X. This compares to the S&P 500’s 22.09X and the sector’s 22.75X. Over the last five years, the industry’s P/E has reached a high of 19.80X, a low of 11.83X, and has a median of 15.52X, as demonstrated in the charts below.

Price-to-Earnings Forward Twelve Months (F12M)

Price-to-Earnings Forward Twelve Months (F12M)

Three Promising Stocks to Consider

Here are three stocks from the Medical Services industry that have shown positive earnings estimate revisions and currently hold either a Zacks Rank #1 (Strong Buy) or #2 (Buy).

Elevance

“`

Strong Earnings Growth Expected from Major Health Insurers

Elevate Your Expectations with Elevance Health

Based in Indianapolis, IN, Elevance Health (previously known as Anthem) stands as one of the largest publicly traded health insurers in the United States by membership. The company’s revenue growth has been bolstered by premium rate increases and an upsurge in commercial business memberships. Strategic acquisitions and partnerships have further strengthened its business foundation. Notably, a robust segment in Medicare Advantage, along with successful contract acquisitions, is likely to stimulate future membership growth.

For 2024, Elevance Health’s projected earnings growth rate is set at 12.4%. The Zacks Consensus Estimate anticipates a 1.5% year-over-year rise in the company’s revenues. Presently, Elevance Health holds a Zacks Rank #1.

Price and Consensus: ELV

Doximity: Connecting Medical Professionals

Doximity is a digital platform designed for U.S. medical professionals. The platform boasts over 80% membership of U.S. physicians across various specialties and practice areas. Doximity offers verified clinical members efficient digital tools, enabling collaboration among colleagues, staying current with medical news and research, managing careers, and conducting virtual patient visits.

This stock also garners a Zacks Rank #1, with an expected earnings growth rate of 10.5% for fiscal 2025. The Zacks Consensus Estimate for Doximity’s fiscal 2025 revenues predicts a year-over-year increase of 9.4%.

Price and Consensus: DOCS

HealthEquity: Leading in Healthcare Account Management

HealthEquity, based in Draper, UT, offers integrated solutions for healthcare account management, including health reimbursement arrangements and flexible spending accounts. The company serves health plans, insurance firms, and third-party administrators across the United States. HealthEquity’s ongoing success in Health Savings Accounts (HSAs) positions it well as a leader in the HSA sector.

For fiscal 2025, the expected earnings growth rate for HealthEquity stands at a robust 37.3%. The Zacks Consensus Estimate indicates that HealthEquity’s revenues are projected to rise by 18.2% year-over-year. Currently, this stock holds a Zacks Rank #2.

Price and Consensus: HQY

To read this article on Zacks.com click here.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.