Top Stocks to Buy in a Thriving Market

Even as stock markets set new record highs, several companies present solid buying opportunities. The focus should be on the potential future growth of these stocks rather than their current market status.

The following four stocks are poised for impressive growth, making them attractive options for investors looking to capitalize now.

1. Taiwan Semiconductor Manufacturing

In today’s tech-driven world, sophisticated chips have become essential components in all devices, from smartphones to servers powering AI models. Taiwan Semiconductor Manufacturing (NYSE: TSM), commonly known as TSMC, plays a critical role in this industry. Almost all leading tech companies rely on TSMC for their chip needs.

Positioned favorably within the current tech landscape, TSMC’s management predicts a compound annual growth rate (CAGR) of 15% to 20% in revenue for the next several years, outperforming the market at large. This growth trajectory makes TSMC a noteworthy investment.

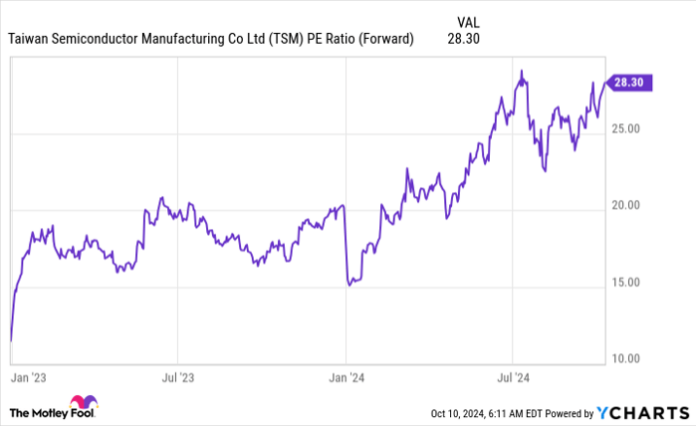

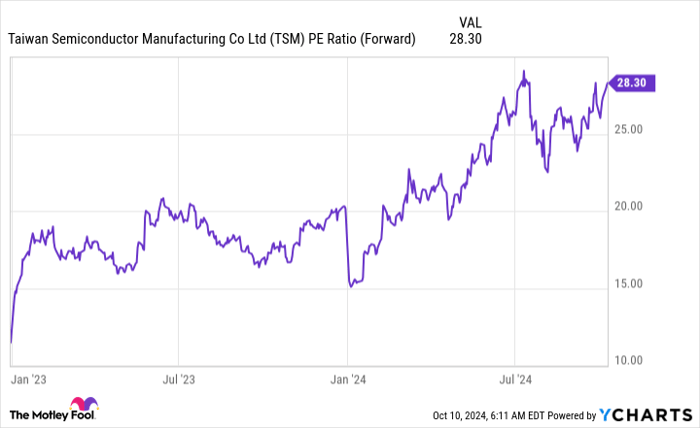

Currently, TSM is the priciest stock on this list, trading at 28 times its projected earnings.

TSM PE Ratio (Forward) data by YCharts

With its strong performance history and market-leading position, TSMC’s premium price seems justified. Consequently, it remains an excellent buy for investors looking ahead.

2. Alphabet

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) is well-known as the parent company of Google. Its dominance in search has translated into substantial revenue, but its growth rate has slowed compared to some faster-rising competitors.

Despite this maturity, Alphabet is making significant investments in generative AI technology, positioning itself well for future growth. Notably, it trades at a forward earnings ratio of 21.2, below the S&P 500’s 23.5.

This lower valuation, combined with Alphabet’s consistent earnings growth of over 30% year-on-year, makes it a solid investment choice in a market where many stocks are viewed as overpriced.

3. Meta Platforms

Meta Platforms (NASDAQ: META), like Alphabet, derives most of its revenue from social media, including popular platforms like Facebook, Instagram, and Threads. This has led to robust cash flow, with its “Family of Apps” segment achieving a 50% operating margin in Q2.

Meta has directed substantial resources toward AI and mixed-reality innovations, such as its new Orion glasses. While some investors raise concerns about costs associated with these ventures, the potential for a valuable new revenue stream exists.

Currently trading at 27.6 times earnings, Meta has shown tremendous growth—22% year-over-year revenue increase and 73% jump in earnings per share in Q2—justifying its premium valuation.

4. PayPal

PayPal (NASDAQ: PYPL) has been navigating a turnaround phase for some time. Under the leadership of CEO Alex Chriss, who took over in August 2023, the company has made notable progress. Revenue growth has stabilized at around 8% in Q2, but PayPal is strategically reinvesting cash flows into share buybacks and new product launches.

After a period of adjustment, investors are starting to recognize these efforts. The stock has surged approximately 40% since July and currently trades at 18.5 times forward earnings, indicating it remains a good buy.

If the company continues to innovate and reduce share count, forward earnings estimates could improve, potentially enhancing the stock’s value even further. PayPal’s turnaround is just beginning, and this stock offers a compelling entry point for interested investors.

Should You Invest $1,000 in Taiwan Semiconductor Manufacturing?

Before purchasing shares of Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor team has recently identified their top 10 stocks for investors to consider… and Taiwan Semiconductor Manufacturing did not make the cut. The selected stocks could lead to substantial returns in the upcoming years.

For instance, when Nvidia was recommended on April 15, 2005, a $1,000 investment would have grown to $826,069!*

Stock Advisor offers investors straightforward strategies for success, including insights on portfolio building, regular analyst updates, and two new stock recommendations each month. Since 2002, the Stock Advisor service has more than quadrupled the S&P 500’s returns.*

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

Randi Zuckerberg, a former director of market development at Facebook and sister of Meta Platforms CEO Mark Zuckerberg, serves on The Motley Fool’s board. Suzanne Frey, an executive at Alphabet, is also board member for The Motley Fool. Keithen Drury holds positions in Alphabet, Meta Platforms, PayPal, and Taiwan Semiconductor Manufacturing. The Motley Fool has investments in and recommends Alphabet, Meta Platforms, PayPal, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends options like shorting December 2024 $70 calls on PayPal. The Motley Fool adheres to a strict disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.