Nuclear Power: Fueling Tech Giants in the AI Era

As the rise of artificial intelligence (AI) dramatically increases energy consumption, major technology companies are turning to nuclear power to meet their growing demands. The International Energy Agency has predicted that data centers might consume up to a third of the expected surge in U.S. electricity usage between 2024 and 2026.

Microsoft (NASDAQ: MSFT) has taken decisive action by inking a 20-year agreement with Constellation Energy (NASDAQ: CEG) to supply energy to its data centers. Meanwhile, Amazon is investing heavily, situating a $650 million data center next to Pennsylvania’s Susquehanna nuclear plant. Additionally, Alphabet, Google’s parent company, is exploring advanced nuclear technologies, notably fusion power.

Image source: Getty Images.

These investments reflect a significant shift toward nuclear energy as tech giants strive to satisfy their enormous energy needs. Below, we delve into three nuclear stocks that may rise alongside the AI revolution.

A Leader in Small Reactors

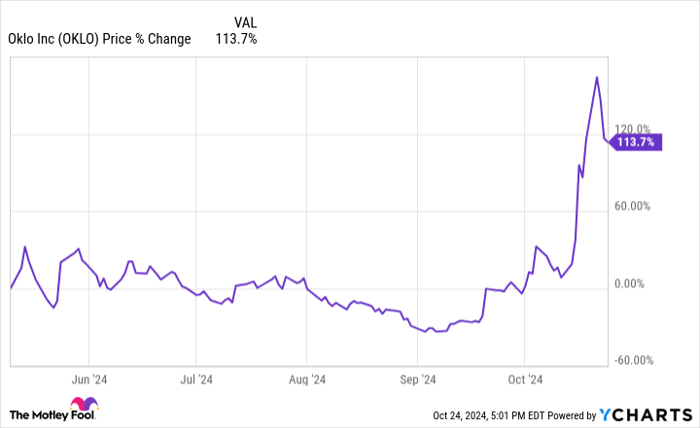

Oklo (NYSE: OKLO), supported by OpenAI CEO Sam Altman, is pioneering the next generation of nuclear power. Since its public debut last May, its stock has shown an impressive 113% return, far outstripping the S&P 500.

OKLO data by YCharts

The company specializes in advanced small modular reactors (SMRs), designed to enhance safety and flexibility while remaining compact. Oklo’s innovative Aurora reactors are set to begin operations in 2027, aligning well with the increasing demand for clean energy from the tech industry.

Despite being years away from significant revenue, early investors demonstrate strong confidence in Oklo’s potential. However, as with many early-stage nuclear firms, investors should be prepared for price volatility as the company moves toward commercialization.

A Reliable Nuclear Ally

Constellation Energy has made headlines with its 20-year agreement to restart a reactor at Three Mile Island for Microsoft. This partnership highlights the growing belief in nuclear energy’s importance for AI’s future.

Following its aggressive moves in the nuclear sector, Constellation has seen its shares rise over 126% this year, significantly outperforming the S&P 500. Being the largest nuclear operator in the U.S. gives the company a distinct advantage in catering to tech companies seeking dependable, carbon-free energy.

With its extensive nuclear infrastructure and successful operational history, Constellation is well positioned as a key partner for tech firms securing reliable energy sources for their AI projects. This advantageous market standing paired with rising tech sector demand sets the stage for potential growth and returns for its investors.

Innovating Nuclear Fuel

Lightbridge (NASDAQ: LTBR) is changing the landscape of nuclear fuel with its cutting-edge metallic fuel design. This innovation could greatly enhance the efficiency and safety of current and new reactors.

As the demand for reliable power from data centers increases, Lightbridge’s advanced fuel technology could become crucial. The new fuel design aims to boost power output while improving safety, making it appealing for utilities catering to the escalating energy needs of tech firms.

The stock price of Lightbridge has risen alongside other nuclear-based companies as investors recognize the sector’s essential role in meeting the energy demands driven by AI data centers. Although its shares have significantly outperformed the S&P 500 this year, the company’s focus on nuclear fuel efficiency positions it favorably for future growth.

Investing in Tomorrow

These three companies reveal various facets of the nuclear power revival. Oklo represents innovative reactor designs, Lightbridge offers enhanced fuel technology, and Constellation brings established nuclear infrastructure. Each provides investors with distinct avenues to participate in the growing nuclear energy sector, making them worth considering for a balanced investment portfolio.

Is Now the Time to Invest $1,000 in Oklo?

Before making an investment in Oklo, it’s essential to evaluate the following:

The Motley Fool Stock Advisor team has identified what they consider the 10 best stocks to buy at present, and Oklo is not among them. They believe the selected stocks have significant potential for high returns in the future.

Consider this: if you had invested $1,000 in Nvidia when it was recommended on April 15, 2005, your investment would now be worth $860,447!

Stock Advisor offers investors guidance on building their portfolio, regular updates from analysts, and two new stock selections each month. Since 2002, the service has outperformed the S&P 500 by more than four times*.

See the 10 stocks »

*Stock Advisor returns as of October 21, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. George Budwell has positions in Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, Constellation Energy, and Microsoft. The Motley Fool recommends various options, including long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. Please refer to The Motley Fool’s disclosure policy for details.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.