Truist Downgrades Amgen, Investment Trends Revealed

Truist Changes Amgen’s Rating

According to Fintel, Truist Securities downgraded their outlook for Amgen (SNSE:AMGN) from Buy to Hold on October 14, 2024.

Current Investment Trends in Amgen

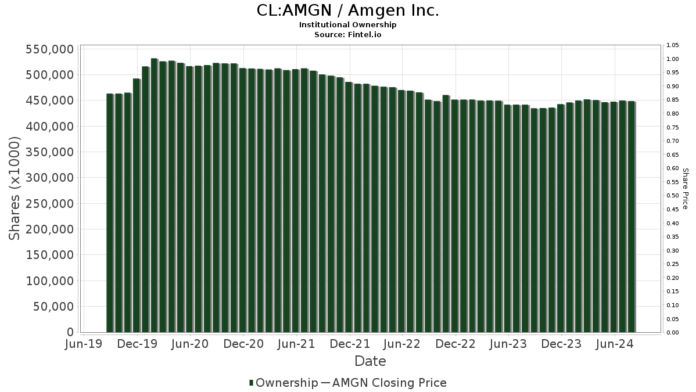

Amgen now has 4,098 funds or institutions reporting their positions, which is an increase of 54, or 1.34%, in the last quarter. The average portfolio weight for all funds invested in AMGN is 0.55%, marking a rise of 4.09%. Over the past three months, total shares owned by institutions have grown by 5.11% to reach 457,416K shares.

Insights from Other Shareholders

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) holds 16,954K shares, accounting for 3.16% ownership of Amgen. This is an increase from their previous holding of 16,847K shares, reflecting a growth of 0.63%. Their portfolio allocation in AMGN saw a rise of 7.54% last quarter.

Primecap Management, on the other hand, has reduced its holdings to 14,447K shares, down from 14,602K shares, resulting in a decrease of 1.07%. Nevertheless, they increased their portfolio allocation in AMGN by 5.54% during the past quarter.

The Vanguard 500 Index Fund Investor Shares (VFINX) has expanded its position to 13,768K shares, up from 13,482K shares, indicating an increase of 2.07%. Their allocation in AMGN was increased by 6.23% over the last three months.

Geode Capital Management has also grown its position to 12,019K shares, a rise from 11,643K shares, which represents an increase of 3.13%. Their portfolio allocation in AMGN rose by 7.64% over the last quarter.

Finally, Invesco QQQ Trust, Series 1 has holdings of 10,332K shares, increasing from 10,046K shares, a growth of 2.77%. The firm’s allocation in AMGN increased by 1.74% over the last quarter.

Fintel is a comprehensive investing research platform for individual investors, traders, financial advisors, and small hedge funds, providing detailed data on fundamentals, analyst reports, and fund sentiment.

This story originally appeared on Fintel and offers insights into market movements and investment strategies.

The views and opinions expressed herein are those of the author and may not reflect those of Nasdaq, Inc.