Exploring AI Opportunities: A Look at Tech Stocks That Might Multiply Your Investment

Goldman Sachs highlights that the tech sector has significantly influenced the U.S. stock market since 2010, contributing to 40% of the equity market’s gains over the past 14 years.

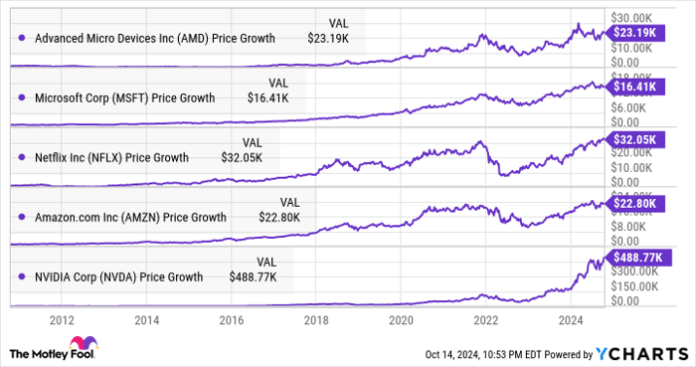

Many tech stocks have shown remarkable growth during this time. For instance, a $1,000 investment in Advanced Micro Devices would be worth over $23,000 today. Companies like Microsoft, Amazon, and Netflix have also generated strong returns, while Nvidia has achieved impressive growth, especially with the recent rise of artificial intelligence (AI).

AMD data by YCharts.

As AI continues to grow, Bloomberg predicts it could generate $1.3 trillion in revenue by 2032, up from this year’s estimate of $137 billion. For those aiming to build a million-dollar portfolio, investing in AI-focused companies and holding onto them for the long haul may be a smart move.

In this article, we will explore two companies poised for significant growth and potential gains for investors seeking AI-driven success.

1. Palantir Technologies

While companies like Nvidia are celebrated for their powerful chips that train AI models, those models require deployment for practical use. Palantir Technologies (NYSE: PLTR) assists customers in deploying these AI models through its Artificial Intelligence Platform (AIP).

AIP enables users to create generative AI applications and incorporate large language models (LLMs) into their processes. Palantir hosts “boot camps” to educate clients on how to implement generative AI effectively, resulting in substantial contracts.

Reportedly, clients adopting AIP aim to utilize the platform widely within their operations, which has led to a substantial increase in Palantir’s commercial customer base and contract value. That segment saw a 55% year-over-year growth in the second quarter, surpassing the overall customer base increase of 41%, which includes government clients.

In the second quarter, the company recorded $946 million in total contract value, marking a 47% increase from the previous year. AIP has also improved the net retention rate (NRR) to 114%, a rise of 300 basis points, indicating that existing customers are spending more annually.

This figure does not account for revenue from new clients gained in the past year, so it has not yet fully reflected the growth in Palantir’s U.S. commercial business.

Additionally, the total remaining deal value increased by 26% year over year to $4.3 billion, suggesting a positive outlook for future revenue growth. This figure represents the total value of ongoing contracts at the end of a reporting period. With $2.5 billion in revenue generated over the trailing 12 months, this remaining value indicates promising growth ahead.

Palantir’s adjusted operating margin also rose dramatically by 12 percentage points to 37% in the second quarter, owing to the strong unit economics of its business. In essence, the company is earning more profit per customer due to increased spending on its products through AIP.

Consensus estimates indicate that Palantir’s annual earnings growth could reach 57% over the next five years. With the global AI market projected to expand further, this growth might continue for an extended period.

For those seeking a solid AI investment with long-term potential, Palantir is worth considering before its stock price climbs significantly.

2. Oracle

The software platforms offered by Palantir operate on cloud infrastructure supplied by companies like Oracle (NYSE: ORCL). These two firms are already partners, with Palantir utilizing Oracle’s distributed cloud and AI infrastructure for its AIP and other services. Moreover, many companies depend on Oracle’s cloud for their AI endeavors.

Vendors are now renting Oracle’s cloud infrastructure to train AI models and deliver cloud-based AI services. Demand for Oracle’s cloud services has surged and consistently outstripped supply. Management reported an annualized revenue run rate of $8.6 billion for its infrastructure cloud services, driven by a 56% increase in consumption.

In the past year, Oracle’s revenue approached $54 billion, demonstrating how AI’s influence on demand for its cloud infrastructure has begun to make a notable difference. The company’s remaining performance obligations (RPO) climbed to $99 billion in the first quarter of fiscal 2025, up 53% year over year.

RPO represents the total value of contracts that will be fulfilled in the future. The growth of this figure, compared to Oracle’s revenue growth last quarter, suggests a stronger revenue outlook ahead.

Goldman Sachs indicates the infrastructure-as-a-service sector may generate $580 billion in revenue by 2030 due to AI, signifying a substantial opportunity for Oracle. Analysts predict an acceleration in growth after a 6% revenue increase to $53 billion in the previous fiscal year.

ORCL revenue estimates for next fiscal year, data by YCharts.

Given the vast opportunities ahead, Oracle is likely to maintain robust growth over the long run. Additionally, the stock trades at 28 times forward earnings, in contrast to the U.S. tech sector’s average price-to-earnings ratio of 46, making it an attractive option for building a million-dollar portfolio.

Should you invest $1,000 in Palantir Technologies right now?

Before investing in shares of Palantir Technologies, keep this in mind:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks to invest in right now, and Palantir Technologies is not on that list. The stocks selected could yield exceptional returns in the coming years.

For instance, when Nvidia was listed on April 15, 2005, if you had invested $1,000, you would have seen it grow to $839,122!*

Stock Advisor offers investors a straightforward path to success with guidance on portfolio building, regular analytical updates, and two new stock picks each month. Since 2002, Stock Advisor has significantly outperformed the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of October 14, 2024

John Mackey, the former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board of directors. Harsh Chauhan does not hold any positions in the stocks mentioned. The Motley Fool recommends the following stocks: Advanced Micro Devices, Amazon, Goldman Sachs Group, Microsoft, Netflix, Nvidia, Oracle, and Palantir Technologies. The Motley Fool has options positions in long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. Please refer to The Motley Fool’s disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.