Investing Insights: Two Buffett Stocks to Watch Until 2030

While many aspects of the market may shift by 2030, the investment principles of Warren Buffett remain timeless. Known for his wise investing strategies, Buffett emphasizes finding solid businesses to invest in for the long haul instead of chasing quick profits.

Looking ahead, we can gain valuable insights from Buffett and his team’s picks. Here, we will explore two Buffett-favored stocks that have the potential for significant returns leading up to 2030: Amazon (NASDAQ: AMZN) and Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B).

1. Amazon: A Leader in Multiple Markets

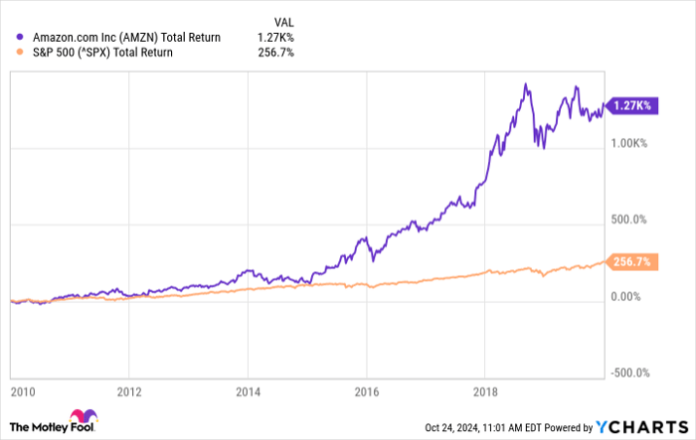

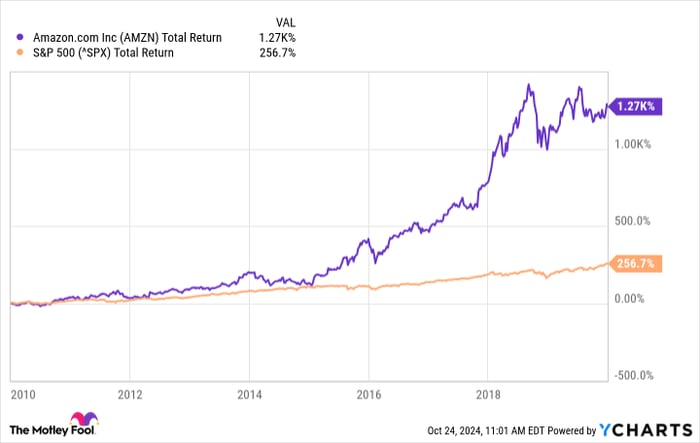

Amazon significantly outperformed the market in the 2010s, a decade marked by low interest rates that fueled growth stocks due to cheaper borrowing costs and increased consumer spending.

AMZN Total Return Level data by YCharts.

In recent years, however, interest rates have risen sharply, prompting investors to lean toward companies known for stable revenues and profits. Amazon fits this profile well as a dominant player across several industries.

Leading in e-commerce, Amazon’s platform is among the most visited globally, which supports its robust advertising business. Furthermore, its Amazon Web Services (AWS) unit commands a leading market position in cloud computing.

Additionally, Amazon has expanded into video and music streaming, ensuring steady growth in both revenue and profit. The company is also making significant strides in artificial intelligence (AI), offering a variety of AI services through AWS, such as Amazon Q, a digital assistant, and Amazon Polly, an application that converts text to speech.

According to the company’s management, its AI division is on track for a multibillion-dollar run rate, with considerable growth potential still ahead. Given Amazon’s strong foothold in these sectors, it is well-positioned for success moving forward, as evidenced by the high switching costs associated with its services.

The outlook remains positive as Amazon continues to explore diverse growth avenues, which could yield market-beating returns as the decade unfolds.

2. Berkshire Hathaway: Diversification at Its Best

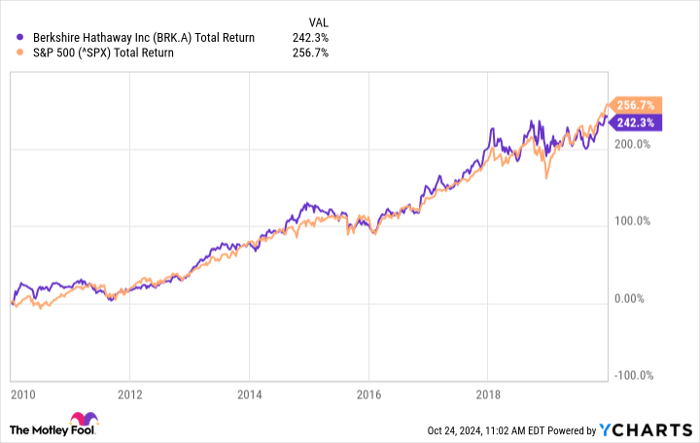

Berkshire Hathaway, under Warren Buffett’s leadership, slightly lagged behind the total returns of the S&P 500 during the 2010s, yet it remains one of Buffett’s favored investments.

BRK.A Total Return Level data by YCharts.

Buffett’s ongoing share repurchase efforts demonstrate his confidence in Berkshire Hathaway’s value, even as he has reduced his holdings in other substantial companies, like Apple.

How can Berkshire Hathaway excel in surpassing market performance through 2030? One inherent challenge is that the S&P 500 comprises a wide array of sectors, which can help balance losses but also dilutes the impact of any single company’s success.

Berkshire Hathaway provides a level of diversification comparable to an index, owning major corporations across various industries, including the well-known insurance company Geico and other assets like Duracell and Fruit of the Loom.

The conglomerate’s consistent strong financial performance, further enhanced by Buffett’s rigorous investment standards, leads to a portfolio of winners likely to outperform typical index funds.

Additionally, Berkshire Hathaway’s strategy of maintaining substantial capital reserves enables it to invest strategically when opportunities arise, particularly when stocks are undervalued relative to their intrinsic worth.

With Buffett now in his 90s, his successor has been designated: Greg Abel, the current CEO of Berkshire Hathaway Energy. Whether Buffett remains involved or not, Berkshire Hathaway’s tactics for long-term success are expected to persist.

In today’s challenging market environment, this stock is likely to attract many investors seeking reliability, making Berkshire Hathaway a strong candidate for outperforming the market through 2030.

A Second Chance for Financial Opportunity

Have you ever felt you’ve missed your chance to invest in successful companies? Now might be the perfect time to act.

On rare occasions, our team recommends a “Double Down” stock, signaling firms they believe are poised for significant price increases. If you’re concerned about missing an investment opportunity, consider acting now before it’s too late. The data speaks volumes:

- Amazon: A $1,000 investment in 2010 would be worth $21,706 today!*

- Apple: A $1,000 investment in 2008 would have grown to $43,529!*

- Netflix: A $1,000 investment in 2004 has surged to $406,486!*

Currently, we’re issuing “Double Down” alerts for three exceptional companies, and opportunities like this could be rare in the future.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 28, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Prosper Junior Bakiny has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Apple, and Berkshire Hathaway. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.