NVIDIA and Palantir Shine in Bull Market’s Artificial Intelligence Boom

Wall Street marked the second anniversary of the current bull market last week, closing the S&P 500 at record highs. Since reaching a closing low of 3,577.03 on October 12, 2022, the S&P 500 has surged over 60%, according to Dow Jones Market Data.

This bull market has shown remarkable resilience for two years. Factors like a strong U.S. economy and the rise of artificial intelligence (AI) have significantly contributed to this growth. Analysts anticipate that enthusiasm surrounding AI will continue to propel the S&P 500 higher as we approach the end of this year and into the next. The broad adoption of AI is projected to foster real GDP growth, enhance earnings per share (EPS), and raise the S&P 500’s fair value.

The ongoing AI boom appears sustainable due to its practical applications, such as improving product efficiency and reducing costs. Notable players in the S&P 500 that are maximizing this AI revolution include NVIDIA Corporation (NVDA) and Palantir Technologies Inc (PLTR).

NVIDIA specializes in technologies vital for AI, particularly with its graphic processing unit (GPU) critical for training large language models and supporting AI functionalities. In contrast, Palantir’s AI capabilities, showcased through its successful Artificial Intelligence Platform (AIP), have gained substantial traction.

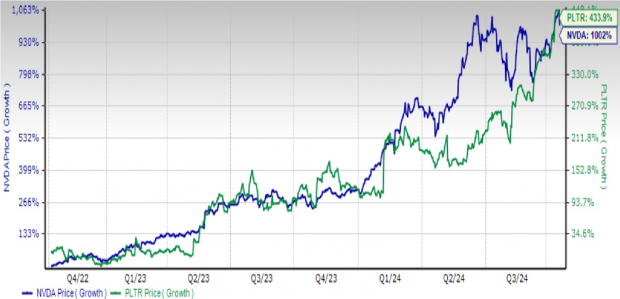

Over the last two years, NVIDIA and Palantir have seen their stock prices soar by 1002% and 433.9%, respectively. Both companies expect their stocks to continue rising, fueled by the ongoing excitement around AI. Here’s a closer look:

Image Source: Zacks Investment Research

Why NVIDIA Stock Could Keep Climbing

The Biden administration’s recent effort to limit U.S. chip exports may pose challenges for NVIDIA. However, the increasing demand for Blackwell chips is likely to uplift its stock value. CEO Jensen Huang noted an overwhelming demand for Blackwell chips, which are now in full production. This latest high-end chip offers greater AI capacity compared to its predecessor, the Hopper H100, attracting more interest from major companies like Microsoft Corporation (MSFT), Alphabet Inc. (GOOGL), and Meta Platforms, Inc. (META).

NVIDIA also dominates the GPU market, holding over 80% of it. This market is projected to grow significantly, from $75.77 billion this year to $1,414.39 billion by 2034, according to Precedence Research. Developers prefer NVIDIA’s efficient CUDA platform over the AMD ROCm platform, leading to a Zacks Consensus Estimate of $2.81 for NVIDIA’s EPS, which is up 72.4% from a year ago.

Image Source: Zacks Investment Research

What’s Driving Palantir Forward

Palantir has emerged as a key player in AI, particularly due to its strong connections to government contracts. The company has been instrumental in helping the government manage data efficiently and reduce costs.

Recently, Palantir’s AIP has attracted significant interest from commercial clients. In its most recent quarterly report, U.S. commercial revenues soared 55% to $159 million, and the number of commercial customers surged 83%, bringing the total to almost 300, a major increase from just 14 four years ago. Moreover, Palantir’s traditional government revenue rose by 23% during the same quarter. With the AI market expected to reach $1 trillion in a decade, Palantir’s stock is poised for considerable long-term gains. Currently, the Zacks Consensus Estimate for PLTR’s EPS is $0.36, reflecting a 33.3% increase year-over-year.

Image Source: Zacks Investment Research

The Positive Impact of Lower Interest Rates on NVDA & PLTR

A key factor influencing the stock prices of NVIDIA and Palantir is the Federal Reserve’s recent decision to cut interest rates by 50 basis points in its latest monetary policy meeting. This marks the first reduction after more than two years, with further cuts anticipated, reflecting controlled price pressures.

These interest rate cuts favor tech companies like NVIDIA and Palantir by reducing borrowing costs, thereby enhancing profit margins. Moreover, they have no detrimental effect on cash flows, which are crucial for growth plans.

Broker forecasts indicate a short-term price target of $200 for NVDA stock, a potential increase of 44.9% from its last closing price of $138.07. For PLTR stock, analysts set a price target of $50, reflecting a 15.2% upside from its last closing price of $43.40.

Currently, NVIDIA is rated as a Zacks Rank #2 (Buy), while Palantir has a Zacks Rank #3 (Hold).

Zacks Identifies Top Semiconductor Stock

This stock is a fraction of the size of NVIDIA, which has seen its stock price soar over 800% since the recommendation. While NVIDIA continues to perform well, this new semiconductor stock has significant growth potential.

With strong earnings growth and a growing customer base, it is ready to capitalize on the increasing demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor market is projected to rise significantly from $452 billion in 2021 to $803 billion by 2028.

Want to explore more investment opportunities? You can download the report on 5 Stocks Set to Double, available for free.

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Palantir Technologies Inc. (PLTR): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.