UBS Rates California Resources with a Strong Buy Recommendation

UBS has started covering California Resources (NYSE:CRC) with a strong Buy rating as of October 16, 2024.

Analyst Price Target Indicates 22.39% Growth Potential

According to recent data from September 25, 2024, the average one-year price target for California Resources stands at $63.53 per share. Predictions for this stock vary, with a low estimate of $55.55 and a high of $68.25. This average price target suggests an increase of 22.39% from the company’s last closing price of $51.91 per share.

For a broader perspective, check out our leaderboard of companies with the biggest price target upsides.

Positive Revenue Growth Expected

California Resources is projected to generate $2,658 million in annual revenue, marking an increase of 17.66%. Analysts anticipate a non-GAAP earnings per share (EPS) of 8.01.

Institutional Investor Sentiment Declines

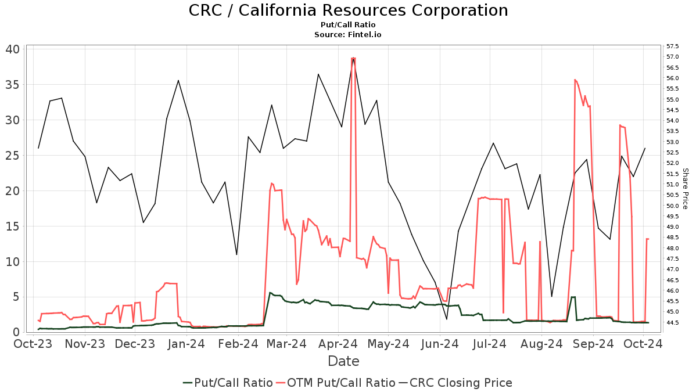

As of now, 700 funds or institutions hold positions in California Resources, representing a slight drop of 12 funds or 1.69% from the previous quarter. The average portfolio weight for all funds investing in CRC is 0.32%, which reflects an increase of 1.76%. Over the last three months, total shares owned by institutions rose by 0.27% to 88,943K shares.  The current put/call ratio stands at 1.33, hinting at a somewhat bearish outlook among investors.

The current put/call ratio stands at 1.33, hinting at a somewhat bearish outlook among investors.

Daniel Scott Gimbel retains 6,247K shares, which amounts to 7.00% ownership without any change this past quarter.

First Trust Advisors, with 5,639K shares (6.32% ownership), reported an increase from 4,565K shares, highlighting a gain of 19.04%. This firm also boosted its allocation in CRC by 19.70% recently.

Meanwhile, the RDVY – First Trust Rising Dividend Achievers ETF has increased its holdings to 4,400K shares (4.93% ownership), growing from 3,727K shares—an increase of 15.30%. Their portfolio allocation rose by 11.48% in the last quarter.

Contrarily, the IJR – iShares Core S&P Small-Cap ETF reduced its stake from 4,362K shares to 4,163K shares, a decline of 4.78%, resulting in a 4.26% reduction in their allocation.

Lastly, the CALF – Pacer US Small Cap Cash Cows 100 ETF raised its share count substantially from 2,307K to 3,561K, a 35.22% increase, with a 39.96% higher allocation over the last quarter.

Understanding California Resources

Background:

(This description is provided by the company.)

California Resources Corporation is the leading oil and natural gas exploration and production company in California. The firm operates solely within the state, utilizing integrated infrastructure for gathering, processing, and marketing its production. By applying advanced technology, California Resources is dedicated to providing affordable energy options for Californians.

Fintel serves as a comprehensive investment research platform for individual investors, traders, financial advisors, and small hedge funds.

Our data encompasses a global scope, including fundamentals, analyst insights, ownership trends, fund sentiment, options sentiment, insider trading, options flow, and unusual options trades, among other resources. Our unique stock recommendations are powered by sophisticated, backtested quantitative models aimed at enhancing profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.