Nvidia (NASDAQ: NVDA) is widely recognized as one of the leading stocks in the artificial intelligence (AI) sector. Interestingly, the company also offers a dividend. However, some unusual changes to that dividend occurred earlier this year.

Nvidia’s Uncommon Dividend Strategy in 2024

Companies experiencing rapid growth usually increase their dividend payments, but Nvidia’s recent actions tell a different story.

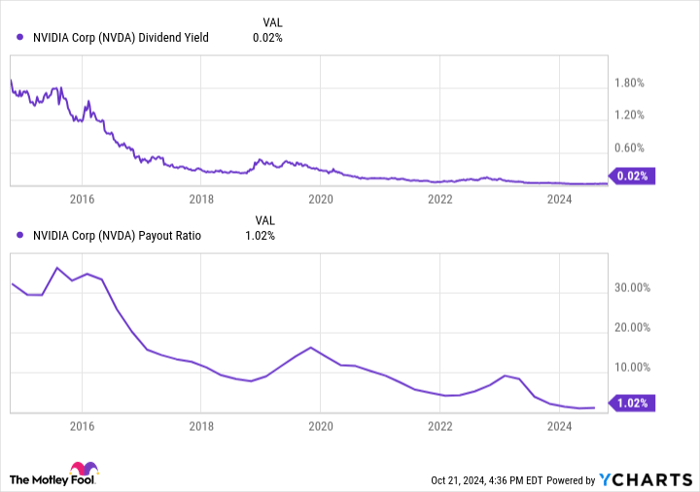

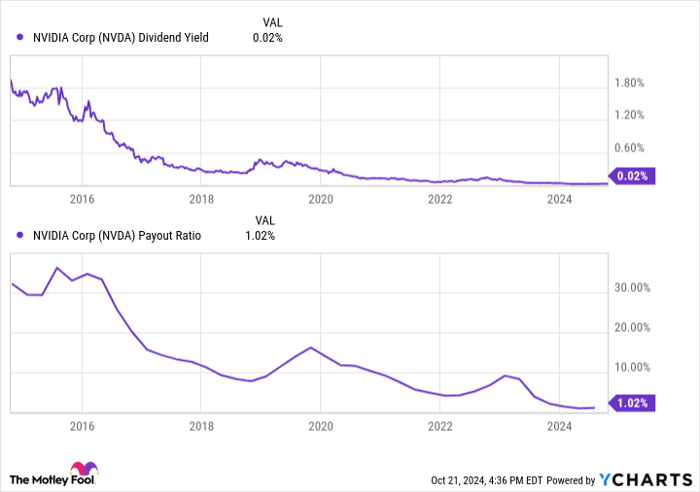

In 2020, Nvidia provided a quarterly dividend of $0.16 per share. But in 2021, that amount was slashed to $0.04 per share. By early 2024, it was further reduced to just $0.01 per share per quarter. These changes have brought Nvidia’s dividend yield down to a minimal 0.02%, with a payout ratio of only 1% of the company’s earnings.

It’s important to note that these figures don’t consider Nvidia’s stock splits, which can distort perceptions of dividend growth. Earlier this year, Nvidia executed a 10-for-1 stock split. When adjusted for this split, the current quarterly dividend of $0.01 per share translates to $0.10 per share on a pre-split basis, which is more than double the prior payout. A similar adjustment applies to the 4-for-1 stock split carried out in 2020.

NVDA Dividend Yield data by YCharts

Nvidia has not encountered financial troubles; in fact, its stock price has surged over 1,000% since 2020, largely due to a booming demand for AI GPUs – a market where Nvidia holds between 70% and 95% of the share. This soaring demand has substantially boosted profits. Thus, even though the dividend rates appear to have decreased, they actually have risen when accounting for stock splits, although these gains have been outpaced by an even larger increase in earnings, leading to a dramatically lower payout ratio.

In conclusion, Nvidia remains firmly a growth stock rather than an income stock. Despite what the surface figures suggest, Nvidia is steadily increasing its dividend rate, a fact that is somewhat obscured by significant stock splits.

A Unique Opportunity for Investors

Have you ever felt you missed out on investing in top companies? If so, you’ll want to pay attention to this.

Our expert analysts occasionally select a “Double Down” stock – companies they believe are set for significant growth. If you think you’ve already missed your window, now is the ideal time to act before it slips away. Here’s how past recommendations have performed:

- Amazon: A $1,000 investment in 2010 would now be worth $20,803!*

- Apple: A $1,000 investment in 2008 would now be worth $43,654!*

- Netflix: A $1,000 investment in 2004 would now be worth $404,086!*

Right now, we are announcing “Double Down” alerts for three exceptional companies, possibly offering a rare investment chance.

View 3 “Double Down” stocks »

*Stock Advisor returns as of October 21, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.