At ETF Channel, we analyzed the iShares MSCI USA Value Factor ETF (Symbol: VLUE) by comparing the prices of its underlying holdings to the expected 12-month target prices set by analysts. The calculated average price target for VLUE is $120.25 per unit.

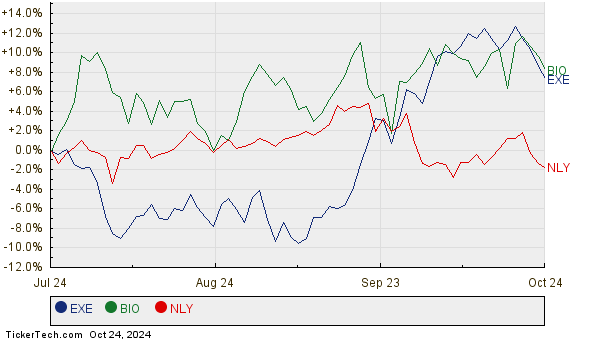

Currently, VLUE is trading around $109.27 per unit, suggesting that analysts anticipate a 10.05% increase in value based on their forecasts for these holdings. Among VLUE’s underlying assets, three standout stocks with significant upside potential are Expand Energy Corp (Symbol: EXE), Bio-Rad Laboratories Inc (Symbol: BIO), and Annaly Capital Management Inc (Symbol: NLY). For example, although EXE is priced at $83.29 per share, the average analyst target is notably higher at $95.94, indicating a possible upside of 15.18%. Similarly, BIO, currently priced at $335.08 per share, has an analyst target of $380.20, translating to a potential rise of 13.47%. Finally, analysts expect NLY’s stock to reach $21.89 per share, which is an 11.96% increase from its recent price of $19.55. The following chart displays the 12-month price history for EXE, BIO, and NLY:

Below is a summary table for the current analyst target prices mentioned:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares MSCI USA Value Factor ETF | VLUE | $109.27 | $120.25 | 10.05% |

| Expand Energy Corp | EXE | $83.29 | $95.94 | 15.18% |

| Bio-Rad Laboratories Inc | BIO | $335.08 | $380.20 | 13.47% |

| Annaly Capital Management Inc | NLY | $19.55 | $21.89 | 11.96% |

Investors might wonder whether analysts are justified in their price targets or if they are being overly optimistic about these stocks’ future performance. It’s crucial to consider whether analysts have a solid basis for their predictions, particularly given the ongoing changes in respective industries. While an ambitious price target can signal optimism, it may also lead to downgrades if analysts fail to adjust to recent market trends. These points warrant further exploration by investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Additionally:

• Chemicals Dividend Stocks

• NOA Stock Predictions

• HIE Dividend History

The views and opinions expressed herein belong solely to the author and do not necessarily reflect those of Nasdaq, Inc.