As the financial market continues to whirl like a tempestuous sea, there is always a yearning for a lighthouse, a beacon to signal a safe passage through turbulent waters. Daily analyst upgrades and downgrades, especially when accompanied by updated price targets, serve as such guiding lights for investors. They offer a structured plan and a glint of optimism about future performance when raised.

But, as with all financial forecasts, stocks don’t march in a straight line toward their price targets. Unforeseen events can toss them to and fro like ships in a storm. Yet, the upbeat shift in sentiment remains a primary takeaway from these upgrades.

Target Corporation: Aiming for New Horizons

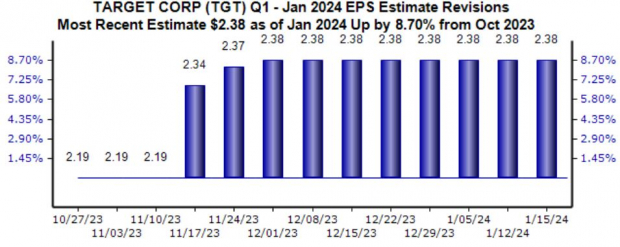

Target has metamorphosed from a traditional brick-and-mortar retailer into an omnichannel juggernaut, revamping its supply chain to spar with e-commerce titans. Morgan Stanley’s upgrade from equal weight to overweight, along with a new $165 per share price target indicating a remarkable +15% upside, is a vote of confidence. The company’s upcoming quarterly release, anticipated in February, has seen positive earnings estimate revisions. The Zacks Consensus EPS Estimate stands at $2.38, an almost 9% surge since October. Profitability has swelled, boasting a 26% year-over-year growth.

The company’s adverse share performance over the past few years has, in a curious twist, enriched its yield. Target now rakes in a 3.1% annual payout. Impressively, it has augmented its payout at a double-digit 15% five-year annualized dividend growth rate.

Home Depot: Building Up to New Heights

Unlike a cozy homestead, Home Depot offers a smorgasbord of branded and proprietary home improvement wares, alongside a suite of related services. Piper Sandler’s upgrade from neutral to overweight, accompanied by a price target hike to $400 and implying a handsome +11% upside, is buoyed by optimism in the home improvement sector.

Its earnings are projected to decline by 10% in the current year, but the company’s quarterly consistency can’t be overlooked. It has surpassed the Zacks Consensus EPS Estimate in 14 consecutive releases. The recent bump in sales and a modest EPS beat have set its shares adrift on a surging tide.

Starbucks Corporation: Brewing Success

Starbucks, the maestro of specialty coffee, has not gone unnoticed. Morgan Stanley hoisted SBUX shares to overweight, setting a price target of $120 per share, signaling an astronomical +30% upside from current levels.

Peeking ahead to FY25, consensus estimates predict an additional 17% bottom-line growth, buoyed by a 10% surge in revenues. Like a good coffee, Starbucks’ appeal extends beyond its initial taste. It carries a nearly 10% five-year annualized dividend growth rate, with shares currently yielding 2.5% annually, surpassing its respective Zacks Industry average of 2%.

The Bottom Line

Price targets, as any seasoned investor knows, are not gospel truths. They are but guides on an uncertain journey, subject to unforeseen squalls. Yet, the optimism that infuses these upgrades remains a beacon of hope for investors.

For those seeking stocks basking in the favorable coverage of recent upgrades, Target, Home Depot, and Starbucks beckon with the promise of potential rewards.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2024. You can still be among the first to see these just-released stocks with enormous potential.

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.