U.S. Rig Count Sees Uptick: What It Means for Major Energy Stocks

Baker Hughes Company (BKR) reported that the U.S. rig count has risen compared to last week. This rotary rig count is a key indicator for the oil and gas industry, commonly found in major newspapers and trade publications.

Since 1944, Baker Hughes has published weekly data that helps energy service providers understand the current business climate of the oil and gas sector. By comparing the number of active rigs with the previous week, companies can assess demand for their oilfield services, guiding their operational strategies.

With the rig count increasing, investors may want to monitor major oil and gas exploration firms like Devon Energy Corp (DVN) and Diamondback Energy (FANG). Let’s delve into the specifics of the latest rig count data.

Analyzing Baker Hughes’ Rig Count Data

Total U.S. Rig Count Sees Increase: The number of rigs engaged in oil and natural gas exploration in the United States rose to 586 for the week ending October 11, up from 585 the previous week. This figure shows a decline from the 622 rigs active a year ago, indicating a slowdown in drilling. Analysts believe this trend may signal improved efficiency among shale producers, though concerns remain about the availability of promising drilling locations.

Onshore rigs reached 567, slightly above last week’s count of 566, while offshore operations remained steady at 18 rigs.

U.S. Oil Rig Count Climbs: The oil rig count grew to 481 for the week ending October 11, compared to 479 the previous week. Nonetheless, this count is far lower than the peak of 1,609 recorded in October 2014 and is a drop from last year’s 501.

U.S. Natural Gas Rig Count Declines: The natural gas rig count fell to 101, down from 102 the week before, and also below last year’s figure of 117. Currently, the number of natural gas-directed rigs is 94% less than the all-time high of 1,606 recorded in 2008.

Breakdown of Rig Types: Vertical drilling rigs totaled 12, down from 14 last week. In contrast, horizontal/directional rigs, which leverage advanced technologies for extracting gas from dense rock, increased to 574 from 571.

Rig Count in the Leading Basin

The Permian Basin, the most productive area in the U.S., reported a total of 304 oil and gas rigs, unchanged from the previous week but below last year’s count of 311.

Strong Oil Prices Could Benefit DVN and FANG

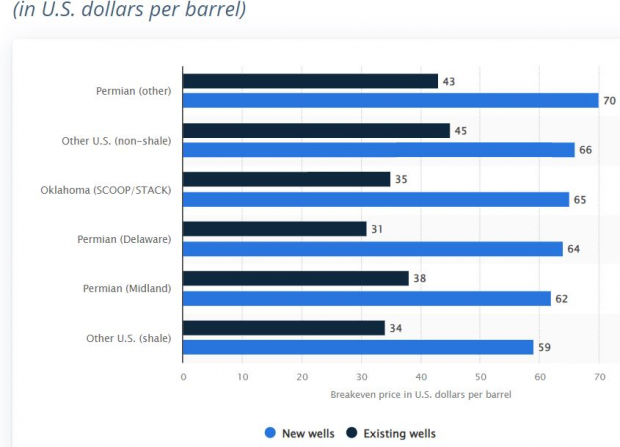

West Texas Intermediate (WTI) crude is currently priced around $70 per barrel, creating a favorable environment for exploration and production firms. Despite a cooling in drilling activity as companies focus on shareholder returns, the high price of oil continues to benefit energy producers. U.S. companies enjoy lower breakeven prices across all shale plays, particularly for existing wells, putting them in a good position for profitability.

Breakeven WTI Price for U.S. Producers

Image Source: Statista

Image Source: Statista

Given the current landscape, investors targeting medium to long-term growth should consider energy stocks such as Devon Energy and Diamondback Energy.

Devon Energy stands as a significant player in oil and gas exploration, particularly across the Delaware Basin. Recently, the company completed a $5 billion acquisition of Grayson Mill Energy’s business in the Williston Basin, enhancing its oil production capacity and expanding its drilling locations. This move is expected to bolster Devon Energy’s key financial metrics, holding a Zacks Rank of 3 (Hold).

Similarly, Diamondback Energy, a top operator in the Permian Basin, reports improved productivity per well in the Midland Basin, suggesting it may continue to see production growth. This company also carries a Zacks Rank of 3.

The recent merger with Endeavor has strengthened FANG’s position in the Permian Basin, expanding their footprint to about 838,000 net acres. With a breakeven oil price below $40 per barrel, this positions the company favorably for future operations.

U.S. Infrastructure Growth on the Horizon

A significant initiative to revive the U.S. infrastructure is imminent. This bipartisan effort will lead to substantial spending, potentially creating lucrative opportunities.

The key question remains, “Will you invest in the right stocks early to maximize growth potential?”

Zacks has released a Special Report to assist investors in identifying such opportunities. This report highlights five companies likely to benefit from infrastructure spending on an extensive scale.

Download FREE: How To Profit From Trillions In Infrastructure Spending >>

For the latest recommendations from Zacks Investment Research, you can also download 5 Stocks Set to Double. Click for your free report.

Devon Energy Corporation (DVN) : Free Stock Analysis Report

Baker Hughes Company (BKR) : Free Stock Analysis Report

Diamondback Energy, Inc. (FANG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.