Consumers Project Increased Holiday Spending Amid Economic Concerns

U.S. consumers are anticipated to spend $2,100 on holiday shopping this year, reflecting a 7% increase from 2023, according to a recent survey conducted by Bank of America.

The upcoming holiday season is expected to be lively, as more shoppers are inclined to begin purchasing earlier and spending more, despite ongoing economic uncertainties.

Online shopping remains on the rise, with many consumers using reward points to help manage costs. Gift cards continue to be a popular gift choice among various age groups.

See Also: Oil Prices Fall As US, Top Israeli Negotiators Plan Meeting In Doha For Gaza Cease-Fire, Hostage Talks

A Shift Toward Early Holiday Shopping

The survey indicates that 54% of consumers plan to shop on Black Friday, making it the most favored day for holiday discounts.

Additionally, 49% of respondents intend to start their holiday shopping on Black Friday, Cyber Monday, or even earlier, suggesting that early discounts are highly sought after.

On average, Americans expect to spend $2,100 during the holiday season, a 7% rise compared to the previous year. Spending habits vary by generation; Baby Boomers are estimated to budget around $800, while Gen X aims for $1,200. Notably, Millennials plan to spend approximately $4,000, and Gen Z forecasts about $3,300.

Financial Strain and Consumer Preferences

The survey reveals that 62% of Americans foresee financial strain for this holiday season, though this is an improvement from last year’s 67%. Younger generations, particularly Gen Z and Millennials, feel the most pressure, with 68% of each group expecting difficulties. This compares to 63% of Gen X and 54% of Baby Boomers who share similar concerns.

Close to 60% of participants plan to shop more at discount retailers this year, favoring wholesalers/big-box stores (54%), e-commerce platforms (41%), and dollar stores (39%).

Online shopping is increasingly vital for holiday spending. The survey found that 48% of respondents intend to shop online more frequently, while 13% plan to reduce their online purchases. This trend mirrors Bank of America’s data, which shows a surge in online retail spending of about 35% during the holiday months compared to others.

Millennials are leading the online shopping trend, with 43% of their purchases made digitally, while Gen Z follows with 33%.

Gift Cards: A Timeless Favorite

Gift cards remain a highly preferred choice for holiday giving. The Bank of America survey found that nearly 99% of recipients value these cards. More than six in ten consumers received gift cards last year, with 35% stating they prefer them over traditional gifts. Furthermore, 61% express equal satisfaction with both options.

When it comes to usage, 47% of consumers reported using all their holiday gift cards last year, while 19% used most and 9% used about half.

As the survey indicates, 75% of consumers plan to purchase gift cards starting in October, with 13% shopping in October, 35% in November, and 27% waiting until December. Gen Z is at the forefront, with 79% having received gift cards during the holidays, followed by 75% of Millennials, 69% of Gen X, and 52% of Baby Boomers.

Understanding the Market: Timing Retail Stock Purchases

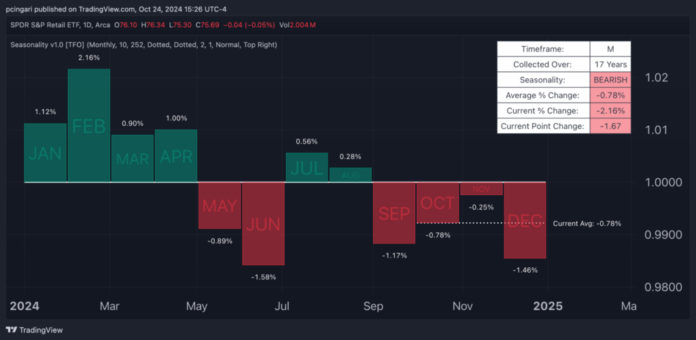

An analysis of the SPDR S&P Retail ETF XRT—which includes major players like Amazon.com Inc. AMZN, Walmart Inc. WMT, Target Corp. TGT, and Best Buy Co. Inc. BBY—reveals an interesting trend: while the holiday season appears prosperous for consumers, it is usually a tough time for retail stocks.

Data over the past 17 years indicates that holiday months often show average declines in retail performance, with the biggest gains occurring during the first four months of the year.

December stands as the second-worst month for retail stocks, seeing an average decline of 1.46%, while January and February are generally favorable, with average increases of 2.16% and 1.1%, respectively, according to TradingView data.

This unexpected trend may be attributed to the timing of earnings reports. Investors typically hold back until post-holiday results, which provide insights into the success of the shopping season. Following the release of positive results, there is often a flurry of buying, leading to stock price increases early in the new year instead of during the holiday season.

Now Read:

Image: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.