Verizon’s Mixed Results: A Closer Look at Subscriber Growth and Market Performance

Shares of Verizon Communications (NYSE: VZ) dipped following the company’s mixed quarterly report, despite solid growth in wireless subscribers. Year-over-year, the stock has gained over 30%, while it has risen just over 10% since the start of 2023.

One of the main attractions for investors is the company’s strong dividend, currently offering a forward dividend yield of approximately 6.5%.

Let’s explore Verizon’s third-quarter results to understand the stock’s decline and evaluate if now is a good time to invest.

Strong Growth in Wireless Subscribers

Verizon’s wireless sector remains robust, with a revenue increase of 2.7% to $19.8 billion. The company added 349,000 retail postpaid net subscribers during the quarter, including 239,000 retail postpaid phone additions.

The broadband segment also showed positive performance, with net additions of 389,000, bringing total broadband subscribers to 11.9 million—a 16% increase year over year. Most of these additions were in fixed wireless, alongside 43,000 net additions in Fios subscribers.

However, the conclusion of the Affordable Connectivity Program (ACP), which provided subsidies for internet services, has impacted prepaid revenue, resulting in a $40 million sequential decline. The company noted that excluding Safelink—which participated in this program—80,000 prepaid subscribers were added, marking the first net gain since acquiring TracFone in 2021.

Verizon Business, on the other hand, experienced a 2.3% revenue drop, landing at $7.4 billion, as the company continues to lose wireline customers in this sector.

In addition, wireless equipment revenue decreased by 8.1%, totaling $5.3 billion.

Overall, Verizon’s revenue was flat year on year at $33.3 billion. Adjusted earnings per share (EPS) declined from $1.21 a year ago to $1.19, beating analyst expectations by $0.01, but slightly under the $33.4 billion revenue forecast. Adjusted EBITDA increased by 2.5% to $12.5 billion.

Looking ahead, Verizon maintained its full-year outlook, projecting wireless revenue growth between 2% and 3.5%. It expects adjusted EPS between $4.50 and $4.70, with adjusted EBITDA set to rise by 1% to 3%.

Image source: Getty Images.

A Well-Supported Dividend

Verizon’s dividend remains secure and offers significant potential for growth. Thus far in 2023, the company has distributed $8.4 billion in dividends while generating $14.5 billion in free cash flow. This results in a 1.7x coverage ratio and bodes well for future dividend increases.

The company’s balance sheet also appears healthy, with a leverage ratio on unsecured debt (net unsecured debt/trailing-12-month adjusted EBITDA) steady at 2.5.

For the upcoming year, Verizon plans to increase capital expenditures (capex) to between $17.5 billion and $18.5 billion, up from the current $17 billion to $17.5 billion. A significant portion of this investment will support its broadband expansion. Additionally, Verizon has agreed to acquire Frontier Communications for $20 billion, integrating its fiber infrastructure into Fios.

By the end of 2025, Verizon aims for a leverage ratio on unsecured debt of between 2 and 2.25 times.

Is the Recent Price Decline a Buying Opportunity?

Even with the stock’s decline post-earnings, there are positive indicators. Verizon is demonstrating strong postpaid wireless and broadband growth and is generating ample cash to comfortably cover its dividend, pay down debt, acquire additional companies like Frontier, and invest in broadband growth.

The end of the ACP program is expected to weigh on performance until it rolls off, and the legacy wireline segment may continue to decline. However, the introduction of AI-focused smartphones like the iPhone 16 could possibly rejuvenate Verizon’s wireless device sales in the near future.

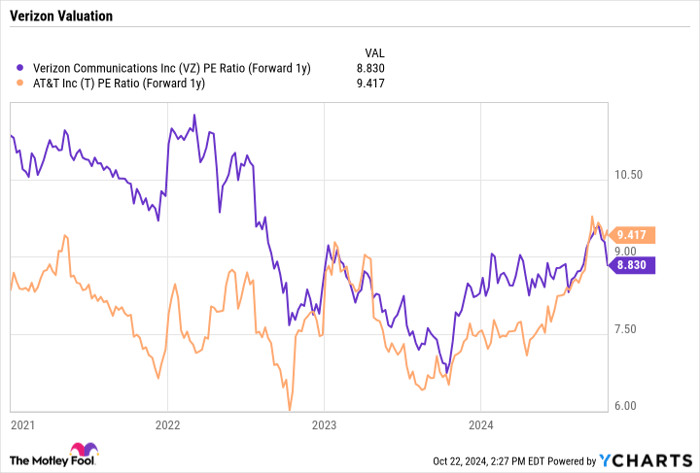

In terms of valuation, Verizon has a forward price-to-earnings (P/E) ratio of approximately 8.8 based on 2025 earnings projections, which is slightly above that of AT&T. Historically, Verizon has traded at a premium compared to its competitor.

VZ PE Ratio (Forward 1y) data by YCharts

Therefore, the negative response to Verizon’s earnings may be overstated. The company continues to perform well in its core areas, boasting a robust dividend that is well-covered and poised for growth. Consequently, I recommend considering purchasing the stock during this dip.

Should You Invest $1,000 in Verizon Communications Today?

Before investing in Verizon Communications, keep the following in mind:

The Motley Fool Stock Advisor team has recently identified what they believe to be the 10 best stocks to buy right now—and Verizon Communications was not included. The selected stocks are expected to yield significant returns in the coming years.

For instance, think about when Nvidia was recommended on April 15, 2005… if you had invested $1,000 then, that investment would now be worth $867,372!

Stock Advisor offers investors a clear path to success with guidance on building a portfolio, regular analyst updates, and two new stock picks each month. Since 2002, this service has more than quadrupled the return of the S&P 500.

See the 10 stocks »

*Stock Advisor returns as of October 21, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.