“`html

Nvidia (NASDAQ: NVDA) has seen remarkable success in 2024, with stock gains nearing 180% at the time of writing. This surge is largely attributed to increased demand for its graphics cards in artificial intelligence (AI) servers.

Despite this growth, the median 12-month price target for Nvidia’s stock stands at $150 according to 64 analysts, suggesting only a 9% potential increase from current prices. However, Bank of America recently updated its price target from $165 to $190, which implies a potential gain of 38%.

Let’s explore the reasons behind these numbers and see if Nvidia can exceed expectations and achieve even greater gains in the future.

Nvidia’s Strong AI Market Position and New Processors Fuel Growth

Bank of America has increased its price target for Nvidia due to the company’s commanding presence in the AI chip market, where it currently holds an estimated market share of 80% to 85%. This dominant position allows Nvidia to tap into a $400 billion market opportunity.

The positive outlook is also supported by the launch of Nvidia’s next-generation Blackwell processors. Key supplier TSMC has reported excellent earnings, and Nvidia’s CEO Jensen Huang described the demand for the new Blackwell chips as “insane.” Nvidia has indicated that it is poised to sell billions of dollars worth of these processors in the fourth quarter of the current fiscal year.

Looking ahead, demand for Blackwell chips is expected to outstrip supply by 2025. Major cloud-computing companies such as Amazon Web Services, Dell Technologies, Google, Meta, Microsoft, OpenAI, Oracle, Tesla, and xAI are preparing to utilize the Blackwell platform.

Nvidia’s Blackwell platform promises significant enhancements over its predecessor, the Hopper chips. Specifically, the company pledges a fourfold increase in AI training performance and a thirtyfold increase in AI inference. Additionally, Blackwell aims to reduce costs and energy consumption for training large language models (LLMs) by up to 25 times compared to Hopper.

With the introduction of Blackwell, Nvidia is set to strengthen its lead in the AI chip segment, supporting Bank of America’s predictions of maintaining a large market share that allows for substantial long-term growth.

Promising Financial Growth Signals More Upside Potential

Bank of America anticipates that the AI accelerator market could surge to $280 billion by 2027 and ultimately exceed $400 billion in the long term. Nvidia has already recorded approximately $49 billion in revenue from its data center segment this year, with $42 billion coming from AI graphics card sales and the remainder from networking solutions.

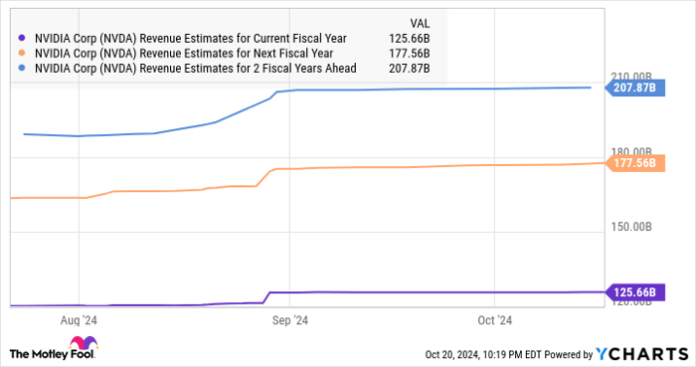

Projected revenues suggest Nvidia might close fiscal 2025, which ends in January, with $84 billion from AI accelerators. If Nvidia captures a conservative 75% of the AI accelerator market by 2027, it could generate around $210 billion in revenue from this sector, a substantial increase from this year’s projected numbers.

When considering potential revenues from sales of AI networking chips, Nvidia’s growth could surpass analysts’ expectations.

NVDA Revenue Estimates for Current Fiscal Year data by YCharts.

Furthermore, the long-term projection of a $400 billion revenue opportunity in AI chips suggests room for Nvidia to enhance its revenue in the coming years. Analysts forecast that Nvidia’s earnings could increase at an impressive annual rate of 57% over the next five years. Such strong growth may entice the market to reward Nvidia’s stock with higher valuations both now and in the future.

Consequently, Nvidia’s AI stock appears well-positioned to approach the updated price target set by Bank of America and could climb even higher thereafter. For investors seeking to invest in AI stocks, Nvidia is currently trading at 35 times forward earnings, which appears reasonable, especially compared to the Nasdaq-100 index’s forward earnings multiple of 30.

Don’t Miss This Opportunity for Potential Growth

If you ever feel like you missed out on purchasing top-performing stocks, now is your chance to take notice.

Our team of analysts occasionally provides a “Double Down” stock recommendation for companies thought to be on the verge of significant growth. If you’re concerned about missing your opportunity, now is the time to invest.

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,991!

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,618!

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $406,922!

Currently, we’re issuing “Double Down” alerts for three remarkable companies that you may not want to miss.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 21, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Bank of America, Meta Platforms, Microsoft, Nvidia, Oracle, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`