Welltower Inc. Set to Reveal Q3 Earnings with Promising Projections

Welltower Inc. (WELL), based in Toledo, Ohio, operates as a real estate investment trust (REIT) focusing on senior housing operators, post-acute care providers, and health systems. With a market capitalization of $78.2 billion, the company invests primarily in high-growth markets across the U.S., Canada, and the United Kingdom. Its Q3 earnings are anticipated to be disclosed after the market closes on Monday, Oct. 28.

Analysts Forecast Strong Earnings Growth

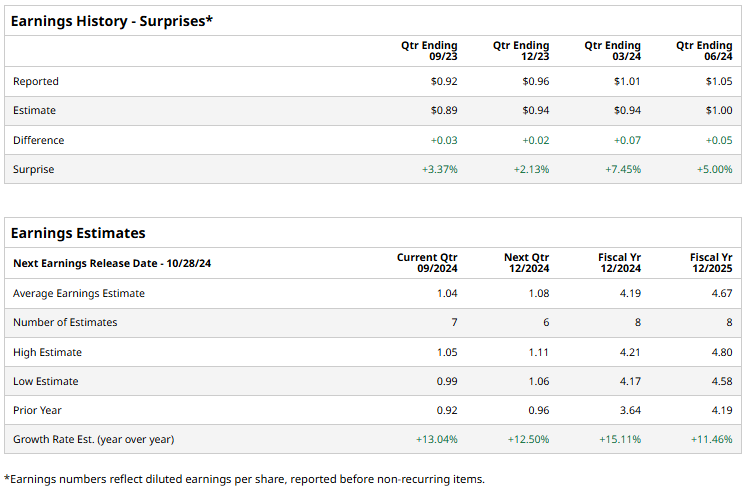

Ahead of the announcement, analysts predict that Welltower will report funds from operations (FFO) of $1.04 per share, representing a 13% increase from $0.92 per share reported in the same quarter last year. Remarkably, welltower has exceeded Wall Street’s FFO estimates for the past four consecutive quarters. In its last reported quarter, the company’s FFO per share rose by 16.7% year-over-year to $1.05, surpassing consensus estimates by 5%.

Future Projections Remain Positive

For the fiscal year 2024, analysts expect Welltower to achieve an FFO per share of $4.19, which would be a 15.1% increase from $3.64 in fiscal 2023. Additionally, in fiscal 2025, FFO per share is projected to grow by 11.5% to $4.67.

WELL Stock Outperforms Major Indices

Welltower’s stock has increased by 45% year-to-date, significantly outpacing the S&P 500 Index’s 22.5% gains and the Real Estate Select Sector SPDR Fund’s (XLRE) 10.9% returns during the same period.

Solid Q2 Performance Fuels Stock Activity

Welltower shares saw a slight uptick after the release of Q2 earnings on July 29, when the company reported a substantial 41.4% year-over-year increase in normalized FFO to common stockholders, amounting to $637.5 million. Additionally, its total revenue grew by 9.6% to $1.8 billion, driven primarily by increased resident fees, services, and higher interest income. Notably, resident fees and services surged by 20.2% to $1.4 billion, while interest income climbed 63.9% to $63.5 million compared to the previous year.

Caution with Rental Income Trends

Despite these gains, Welltower faced challenges in rental income, which fell by 12.4% year-over-year to $335.8 million. Other income decreased significantly by 61.7%, down to $32.1 million. Following a brief rise in stock prices, WELL shares experienced a slight decline in subsequent trading sessions.

Market Ratings Reflect Moderate Optimism

Currently, the consensus opinion on WELL stock is moderately bullish with an overall “Moderate Buy” rating. Among 19 analysts covering the stock, 11 recommend a “Strong Buy,” one advises a “Moderate Buy,” and seven suggest a “Hold.” Although WELL is trading above its average price target of $129.47, the Street-high target of $190 indicates a potential upside of 45.3% from current levels.

More Stock Market News from Barchart

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the author’s and do not necessarily reflect those of Nasdaq, Inc.