AMD’s Stock Rises Ahead of Anticipated Earnings Report

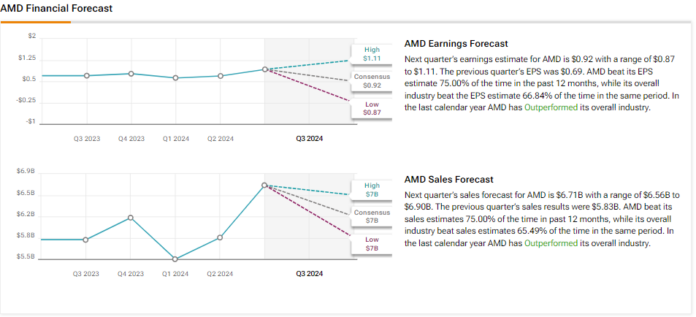

Shares of chipmaker Advanced Micro Devices (AMD) are on the rise today as investors eagerly anticipate its Q3 earnings results, scheduled for October 29 after the market closes. Analysts forecast earnings per share (EPS) of $0.92 on revenues projected at $6.71 billion. This represents year-over-year increases of 15.7% and 31.4% respectively, according to TipRanks data.

The expected EPS growth outpacing revenue growth indicates strong operational efficiency. AMD has a track record of exceeding earnings estimates, achieving this feat six times in the past eight quarters. Analysts at Piper Sandler suggest that this trend may continue in the current quarter.

Analyst’s Optimism Amid Mixed Investor Sentiment

Five-star analyst Harsh Kumar, holding a Buy rating with a price target of $200, believes AMD’s performance—especially in its data center segment—could exceed expectations largely due to the popularity of its MI300 GPU. Furthermore, he predicts GPU revenue to surpass the $5 billion goal set for Fiscal Year 2024, a key indicator for many investors. Kumar has achieved an impressive 81% accuracy on his AMD stock ratings, with an average return of 28.1% per rating.

Despite this optimistic assessment, investor sentiment appears to be waning. According to TipRanks, 1.2% of AMD shareholders reduced their positions in the past month. However, with average portfolio allocation at 7.31% among the 6.2% of portfolios tracked by TipRanks, this could be indicative of routine portfolio rebalancing rather than an outright lack of confidence, especially with AMD’s stock appreciating nearly 12% in the last quarter.

What Do Analysts Think of AMD Stock?

Overall, Wall Street analysts maintain a Strong Buy consensus rating on AMD. This rating stems from 25 Buy recommendations and six Holds with no Sell ratings in the past three months. After a significant 67% rise in its share price over the last year, the average price target for AMD stands at $188.96—indicating a potential upside of 21%.

See more AMD analyst ratings

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.