EOG Resources Prepares for Q3 Earnings Amid Market Challenges

EOG Resources, Inc. (EOG), located in Houston, Texas, stands as a prominent player in the oil and gas sector. With a market cap of $72.8 billion, this independent exploration and production company is engaged in the extraction and distribution of crude oil, natural gas liquids, and natural gas, focusing mainly on productive basins. Investors are eager for EOG’s upcoming fiscal third-quarter earnings announcement, scheduled for after market close on Thursday, Nov. 7.

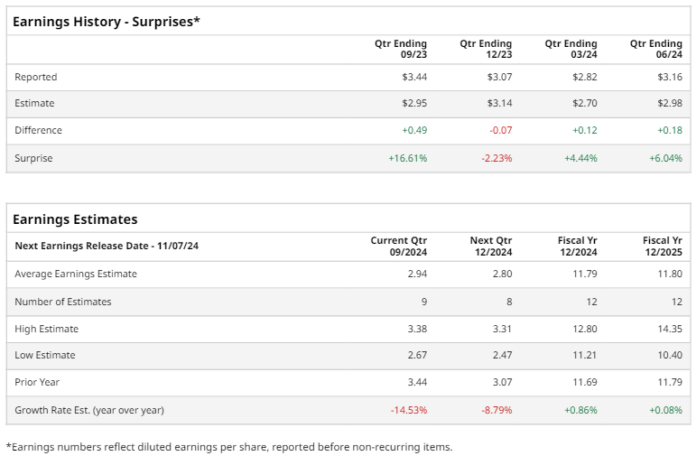

Analysts Predict Earnings Decline

Leading up to the earnings report, analysts predict EOG will report a diluted profit of $2.94 per share, representing a 14.5% decline from the $3.44 earned per share during the same quarter last year. EOG has demonstrated a mixed performance, surpassing consensus estimates in three of the last four quarters but failing to meet expectations on one occasion.

Looking Ahead to Fiscal 2024 and 2025

For the full fiscal year of 2024, analysts anticipate EOG’s earnings per share (EPS) will be $11.79, a slight increase from the $11.69 reported for fiscal 2023. Expectations for 2025 are modest, with EPS predicted to rise to $11.80.

Mixed Performance Against Competitors

Over the last year, EOG’s stock has trailed the performance of the S&P 500, which has seen gains of 38.6%. In contrast, EOG shares have decreased by 5.6%. The company also fell short of the Energy Select Sector SPDR Fund’s (XLE) performance, which reported only slight losses during the same period.

Challenges Facing EOG

Several factors contribute to EOG’s current difficulties. An uneven macroeconomic environment marked by slowed growth in domestic oil supply and fluctuating natural gas prices has created significant uncertainty for the company. Additionally, geopolitical tensions in the Middle East, worries about decreasing demand in China, and projections of an impending crude oil surplus further complicate the outlook.

On Aug. 1, EOG shares dipped over 2% following the release of its Q2 results, despite reporting adjusted EPS of $3.16, which exceeded Wall Street’s expectations of $2.98. However, the company’s revenue for the quarter totaled $6 billion, falling short of the anticipated $6.1 billion.

A Bullish Outlook from Analysts

Despite the challenges, analysts maintain a relatively optimistic perspective on EOG stock, issuing a “Moderate Buy” rating overall. Of the 27 analysts who monitor the stock, 14 have given a “Strong Buy” rating while 13 recommend a “Hold.” The average price target set by analysts is $141.89, suggesting a potential upside of 12.9% from current levels.

More Stock Market News from Barchart

On the date of publication, Neha Panjwani did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is for informational purposes only. For more details, please refer to the Barchart Disclosure Policy here.

The views and opinions expressed herein are the author’s and may not reflect those of Nasdaq, Inc.