Monolithic Power Systems Set for Q3 Earnings Report Amid Strong Performance

Company Overview and Upcoming Earnings

Monolithic Power Systems, Inc. (MPWR), located in Kirkland, Washington, specializes in semiconductor-based power electronics solutions across various markets including automotive, consumer, and industrial sectors. With a market capitalization of $44.1 billion, MPWR is anticipated to release its fiscal Q3 earnings results following market close on Wednesday, October 30.

Analytical Insights and Previous Quarter Performance

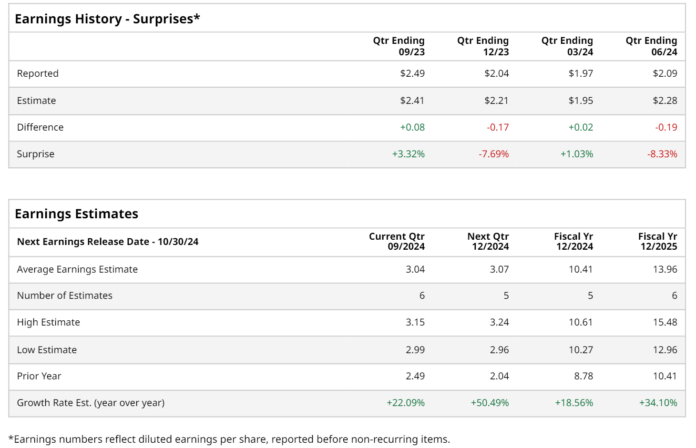

Experts forecast that MPWR will announce earnings of $3.04 per share for Q3, marking a 22.1% increase compared to the $2.49 per share recorded in the same quarter last year. In the past four quarters, the company met or exceeded Wall Street’s earnings expectations twice, while falling short on two occasions. In Q2, MPWR reported adjusted earnings per share of $3.17, surpassing the consensus estimate of $3.07, which represented a 12.4% growth from the previous year. This performance was largely driven by an impressive 290% rise in revenue from its enterprise data segment, driven by increased demand for AI power solutions, which helped offset declines in other segments.

Future Earnings Projections

Looking ahead, analysts predict that MPWR will achieve an EPS of $10.41 in fiscal 2024, reflecting an 18.6% growth from $8.78 in fiscal 2023. For fiscal 2025, EPS is expected to reach $13.96, a 34.1% year-over-year increase.

Stock Performance and Market Comparisons

Year-to-date, MPWR shares have surged by 45.6%, significantly outperforming the S&P 500 Index, which is up 22.5%, and the Technology Select Sector SPDR Fund, returning 19.5% during the same timeframe.

Factors Behind MPWR’s Growth

The company’s continuous innovation and leadership in miniaturization, along with a diverse portfolio of over 1,700 patents, have propelled its performance. The rapid demand for AI power solutions and strategic partnerships, including one with Nvidia (NVDA), have also played key roles in the company’s stock price increase.

Following its strong Q2 earnings announcement on August 1, MPWR’s stock jumped by 1.4%. The Q2 revenue was reported at $507.4 million, exceeding Wall Street’s estimates of $489.9 million and reflecting a 15% increase year-over-year.

Analysts’ Ratings and Price Target

Overall, analysts remain optimistic about Monolithic Power Systems, giving it a consensus rating of “Strong Buy.” Out of the 11 analysts covering the stock, eight recommend “Strong Buy,” two suggest “Moderate Buy,” and one rates it as a “Hold.” This sentiment is slightly lower than three months ago when nine analysts rated it as “Strong Buy.”

The average analyst price target for MPWR stands at $971.75, pointing to a potential upside of 5.8% from the current trading price.

More Stock Market News from Barchart

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.