Nvidia’s Stock Surge: Is There More Growth Ahead?

For investors who haven’t purchased Nvidia (NASDAQ: NVDA) stock, it’s easy to feel like they’ve missed out. With a remarkable increase of 243% in just the last year and an astonishing 543% over the past three years, many are left wondering if the opportunity has passed. Instead of focusing on missed chances, let’s explore what the future might hold for Nvidia and its continued growth potential.

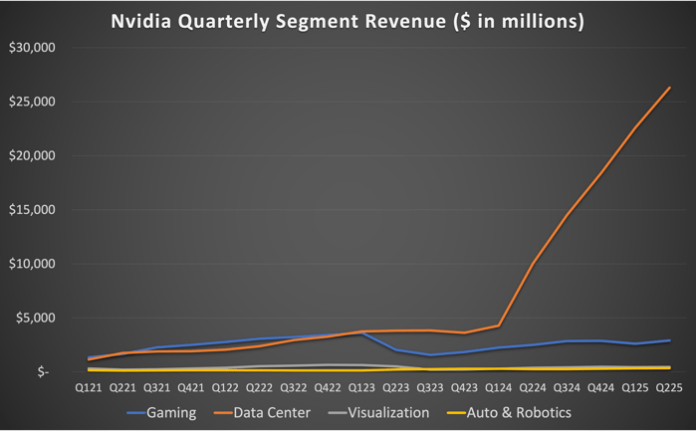

Nvidia is not solely an artificial intelligence (AI) firm. The company operates four different business segments, each of which has experienced growth both from the last quarter and year-over-year in its latest financial report. The data center division, which fuels the increasing demand for advanced AI chips, is expanding rapidly, suggesting that more growth could be on the horizon.

Data source: Nvidia. Chart by author.

Future Outlook: A $1 Trillion Investment on the Way

Back in February, Nvidia CEO Jensen Huang predicted, “There’s about a trillion dollars’ worth of installed base of data centers. Over the course of the next four or five years, we’ll have $2 trillion worth of data centers that will be powering software around the world.”

Nvidia currently boasts a market capitalization of approximately $3.4 trillion. If Huang’s forecast proves accurate, that would likely translate into significant additional sales for Nvidia as a leading player in the AI industry. Recent reports suggest that Huang’s prediction is increasingly becoming a reality.

Microsoft has revealed the dramatic increase in its data center expenditures. In its recent 10-K annual report for fiscal year 2024, which concluded in June, Microsoft disclosed $108.4 billion in financial lease commitments for data centers over the next five years. This figure is nearly $100 billion higher than two years ago, with leases extending for as long as 20 years.

Many investors did not foresee the explosive growth of AI data centers, but this sector still has significant expansion potential. This makes a compelling case for considering Nvidia stock now. Additionally, Nvidia has promising avenues in other sectors like automotive and robotics, especially as advances in self-driving technology and automation continue.

A New Opportunity: Don’t Miss Out Again

Do you ever feel like you’ve missed the chance to invest in some of the most successful companies? If you do, you might want to pay attention now.

Occasionally, our team of analysts identifies a “Double Down” stock—visionary companies poised for significant growth. If you are worried you’ve missed your opportunity, this may be the perfect moment to invest before it slips away. The historical figures are illustrative:

- Amazon: A $1,000 investment when we doubled down in 2010 would be worth $21,285!*

- Apple: A $1,000 investment when we doubled down in 2008 would be worth $44,456!*

- Netflix: A $1,000 investment when we doubled down in 2004 would be worth $411,959!*

Currently, we are issuing “Double Down” alerts for three exceptional companies. Opportunities like this may be rare.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 21, 2024

Howard Smith holds positions in Microsoft and Nvidia. The Motley Fool is long on, and recommends Microsoft and Nvidia. The Motley Fool also recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. For more details, refer to the Motley Fool’s disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.