Box Partners with Amazon to Boost Generative AI Capabilities

Box (BOX) has entered into a noteworthy partnership with Amazon’s (AMZN) cloud division, Amazon Web Services. This collaboration enables organizations of all sizes to harness generative AI (Gen AI) to enhance productivity and innovate new applications.

With the launch of Box AI, customers now have direct access to advanced foundation models through Amazon Bedrock, beginning with Anthropic’s Claude and Amazon Titan. This integration allows businesses to securely and swiftly create Gen AI applications by merging powerful AI models with their data stored on Box’s Intelligent Content Management platform.

Additionally, organizations can leverage a Box connector for Amazon Q Business, which helps them retrieve information quickly, summarize data, generate content, and efficiently carry out tasks using their private data managed in Box.

Positive Market Response to Box’s Growth Strategy

Box shares have seen a healthy increase due to its expanding partner network, which has significantly contributed to its revenue growth.

Year-to-date, BOX shares have climbed 25.6%, slightly ahead of the Zacks Computer and Technology sector’s rise of 25.5%, as well as the Zacks Internet – Software industry’s gain of 22.3%.

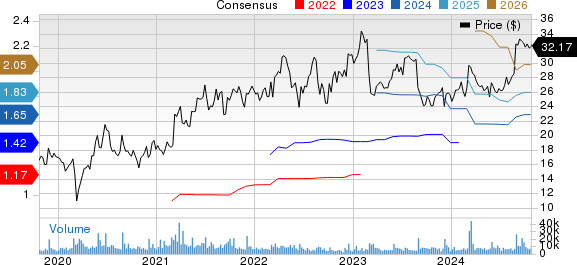

Box, Inc. Price and Consensus

Box, Inc. price-consensus-chart | Box, Inc. Quote

The company’s recent success can be attributed to its adeptness in cloud management and AI technology, coupled with strong partnerships with prominent tech firms like Microsoft (MSFT), Apple, IBM, Alphabet (GOOGL), and Salesforce.

A significant move was Box’s extended collaboration with Microsoft to integrate Azure OpenAI Service with Box AI. Moreover, a partnership with Alphabet aims to leverage Google Cloud’s generative AI capabilities for better enterprise workflows.

The launch of a new Box app for Apple Vision Pro represents another innovative step, revolutionizing how teams collaborate and engage with content.

Box’s international reach has expanded too, thanks to collaboration with Asahi Group Japan, The Norinchukin Bank, and Hitachi High-Tech Corporation, where BOX AI will enhance data management and streamline unstructured data handling.

Box has also been chosen by Oxera as their cloud platform partner, enabling the efficient management of content across its operations. This illustrates Box’s commitment to helping organizations maximize their data’s value while ensuring compliance and security.

Box’s Optimistic Q3 Financial Projections

For the third-quarter of fiscal 2025, Box forecasts revenues between $274 million and $276 million, reflecting a 5% growth compared to the previous year. This projection anticipates a foreign exchange headwind of about 130 basis points.

Additionally, Box expects mid-single-digit growth in fiscal third-quarter billings. The Zacks estimate for revenue stands at $275 million, representing a year-over-year increase of 5.2%.

On a non-GAAP basis, the company predicts earnings to be between 41 and 42 cents per share, adjusted for a 2-cent foreign exchange headwind. The consensus for earnings has risen slightly to 42 cents per share, indicating a 16.7% year-over-year growth.

In the past four quarters, Box has exceeded Zacks Consensus Estimates three times, with an average surprise of 5.9%.

At present, BOX shares appear overvalued with a Value Score of D. It is trading at a forward Price/Sales ratio of 4.07X, contrasting with the industry average of 2.69X. This premium can be justified by Box’s expanding portfolio and a robust partner ecosystem.

Box currently maintains a Zacks Rank #2 (Buy), suggesting a favorable opportunity for investors interested in acquiring the stock.

7 Best Stocks for the Next 30 Days

Experts have identified 7 elite stocks from the extensive list of Zacks Rank #1 Strong Buys, considering them “Most Likely for Early Price Pops.”

Since 1988, this selection has consistently outperformed the market, averaging gains of +23.7% annually. It merits your attention.

See them now >>

For the latest stock recommendations, download 5 Stocks Set to Double. Click to get this complimentary report.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Box, Inc. (BOX): Free Stock Analysis Report

To access the original article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.