Xylem Inc. Poised for Growth as Earnings Report Approaches

Analysts Anticipate Increased Profits Ahead of Q3 Earnings Announcement

Xylem Inc. (XYL), based in Washington, D.C., specializes in designing, manufacturing, and servicing engineered products and solutions. With a substantial market capitalization of $33.3 billion, Xylem’s wide range of products includes water and wastewater pumps, testing equipment, industrial pumps, valves, heat exchangers, and dispensing equipment. The company, recognized as a leading global provider of water technology, is set to release its fiscal third-quarter earnings for 2024 before market hours on Thursday, October 31.

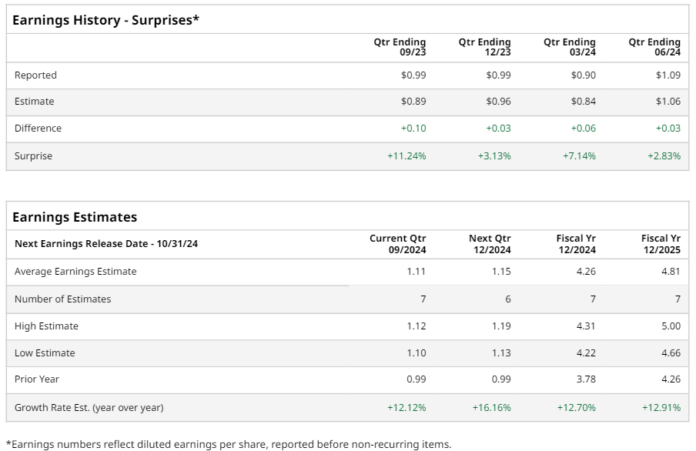

Leading up to the announcement, analysts predict that XYL will report earnings of $1.11 per share on a diluted basis, representing a 12.1% increase from last year’s $0.99 per share. Notably, Xylem has consistently outperformed Wall Street’s earnings per share (EPS) estimates in its last four quarterly reports.

For the current fiscal year, analysts estimate XYL’s EPS to reach $4.26, which is a 12.7% increase from $3.78 in fiscal 2023. Looking ahead, expectations for fiscal 2025 suggest an EPS rise of 12.9%, leading to a forecasted $4.81.

Over the past year, XYL stock has significantly outperformed the S&P 500 ($SPX), which gained 34.4%. Xylem shares increased by 51.6% during this period, surpassing the Industrial Select Sector SPDR Fund’s (XLI) growth of 35.8% as well.

The company’s remarkable performance can be attributed to various factors, such as heightened demand for its measurement and control solutions, robust growth in its water infrastructure and water solutions segments, and the strategic acquisition of Evoqua. This acquisition has enhanced Xylem’s water treatment capabilities and diversified its revenue streams.

On July 30, XYL shares fell over 5% following the announcement of its Q2 results. The company reported an adjusted EPS of $1.09, exceeding Wall Street’s expectations of $1.06. Additionally, revenue reached $2.17 billion, surpassing forecasts of $2.16 billion. For the full year, Xylem anticipates adjusted EPS to fall between $4.18 and $4.28.

Analysts maintain a generally positive outlook on XYL stock, assigning it a “Moderate Buy” rating overall. Among the 18 analysts reviewing the stock, 10 suggest a “Strong Buy,” one recommends a “Moderate Buy,” and seven advise a “Hold.” The average price target among analysts stands at $156.40, indicating a potential upside of 14.4% from current levels.

More Stock Market News from Barchart

On the date of publication, Neha Panjwani did not hold positions in any of the securities mentioned in this article. All information and data presented in this piece are intended solely for informational purposes. For further details, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.