2024 has been a testament to the resilience of stocks. Despite concerns about lingering inflation, soaring treasury yields, and the Federal Reserve’s rate-cutting plans, the S&P 500 has gained a commendable 7.4% this year. However, this situation has created a cognitive dissonance of sorts. Namely, stocks have become expensive, on balance, relative to corporate earnings.

For example, the S&P 500 is currently trading at 24 times trailing earnings, well above its 10-year average multiple of around 20. The key takeaway is that stocks may be poised for a pullback because of the juxtaposition of high valuations against a backdrop of cooling economic activity and stubborn inflation.

Image Source: Getty Images.

While this remains speculative, savvy investors know that being prepared is key to capitalizing on market opportunities as they arise. If the market indeed dips in response to these headwinds, one supercharged Vanguard exchange-traded fund (ETF) stands out as the go-to play: the Vanguard S&P 500 Growth Index Fund ETF Shares (NYSEMKT: VOOG). Read on to find out more.

VOOG: A Cut Above the Rest

The VOOG distinguishes itself with the following metrics:

- Expense ratio: 0.10%

- Dividend yield: 0.87%

- 10-Year average return: 14.4%

- Number of stock holdings: 228

- Average annual earnings growth rate: 18.6%

- Price-to-earnings ratio: 35

These metrics not only showcase VOOG’s cost-effectiveness and growth potential, but also its ability to provide a steady income stream.

When compared to its chief counterpart, the Vanguard S&P 500 ETF (NYSEMKT: VOO), the VOOG stands out for two major reasons:

- Focused Growth: VOOG specifically targets the growth segment of the S&P 500. It is poised to benefit from key trends such as artificial intelligence, weight loss drugs, and next-generation software innovations. In contrast, the VOO offers exposure to the entire S&P 500, a broad index that includes companies with varying levels of earnings growth.

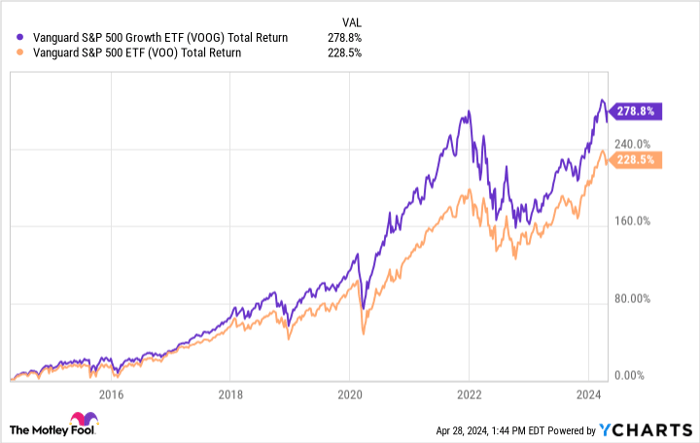

- Valuation and Performance: The VOOG’s hefty price-to-earnings ratio reflects a premium for growth, justified by its holdings’ robust earnings growth rate. Over the past 10 years, the VOOG has markedly outperformed VOO, making it an attractive option for investors seeking unusual levels of growth over long periods.

VOOG Total Return Level data by YCharts

Key takeaways

As we consider the investment landscape of 2024, two key takeaways become apparent:

- Preparation for Volatility: The current market conditions underscore the need for investors to be prepared for volatility. The VOOG’s strong performance history and focus on growth-oriented stocks make it a compelling option for those looking to capitalize on a sharp pullback in the coming months.

- Strategic Investment Choice: VOOG’s competitive expense ratio, solid dividend yield, and impressive growth metrics position it as a top strategic choice for cost-conscious investors who demand elite performance. Its focus on the growth segment of the S&P 500 makes it a more attractive buy than many similar passively managed large-cap growth funds like VOO.

In conclusion, the VOOG offers a unique combination of earnings growth, low costs, a decent yield, and superb long-term performance, making it a top watchlist candidate ahead of a possible market correction. In other words, this Vanguard ETF should be at the top of your “to-buy” list if the market reverts to the mean later this year.

Should you invest $1,000 in Vanguard Admiral Funds – Vanguard S&P 500 Growth ETF right now?

Before you buy stock in Vanguard Admiral Funds – Vanguard S&P 500 Growth ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Admiral Funds – Vanguard S&P 500 Growth ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of April 22, 2024

George Budwell has positions in Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.