In the aftermath of a seismic quarterly earnings triumph last Friday, The Travelers Companies TRV and World Acceptance WRLD emerge as the venerated vanguards of financial fortitude worth considering for the discerning investor.

Let’s delve into their quarterly assessments and future prospects to understand why now is a golden opportunity to delve into these tantalizing stocks.

The Travelers Companies Q4 Performance

A purveyor of diverse commercial and personal property and casualty insurance products, The Travelers Companies joins a robust cohort of standout insurance entities, including Progressive PGR and CNA Financial CNA.

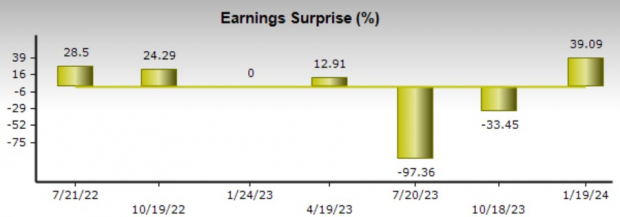

The Travelers Companies’ fourth quarter results serve as irrefutable evidence for investor attention, as Q4 EPS achieved a historic $7.01 per share, surpassing estimates of $5.04 per share by 39%. Noteworthy is the 106% year-over-year surge in Q4 earnings from $3.40 per share in Q4 2022.

With core income soaring to $1.62 billion and Core Return on Equity scaling to 24%, both reaching record highs for the quarter, the company’s performance is bolstered by robust underwriting and investment outcomes. Overall, The Travelers Companies concludes fiscal 2023 with annual earnings up 6% to $13.13 per share and full-year core income escalating by approximately 1% to $3 billion.

Image Source: Zacks Investment Research

World Acceptance Q3 Review

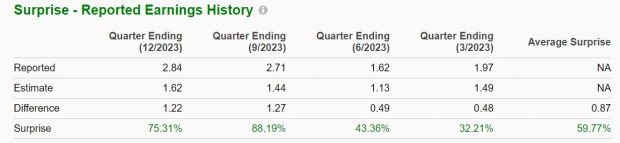

Specializing in small-scale consumer loans, World Acceptance soared in the fiscal third quarter, with earnings of $2.84 per share eclipsing the Zacks Consensus of $1.62 per share by 75%, a stark contrast from an adjusted loss of -$0.78 per share in the corresponding quarter. Remarkably, World Acceptance has outperformed earnings projections in each of its last four quarterly reports, with an average earnings surprise of 59.77%.

Image Source: Zacks Investment Research

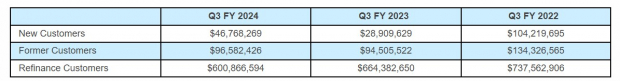

Notably, net income skyrocketed to $16.7 million from $5.8 million a year ago. World Acceptance witnessed a notable resurgence and enhancement in gross loan origination balances, escalating from $28.9 million in the prior year quarter to $46.76 million.

Image Source: BusinessWire

EPS Growth & Outlook

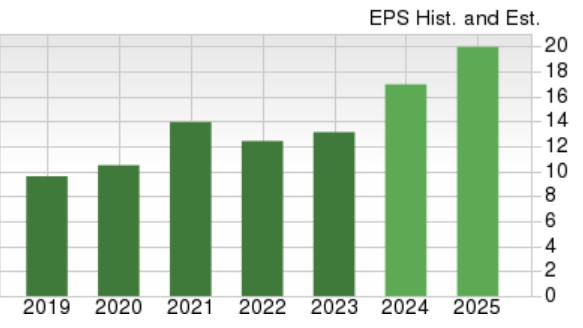

Zacks estimates project a momentous 31% surge in The Travelers Companies’ annual earnings this year, poised to ascend by another 15% in FY25 to reach $19.88 per share. These anticipated fiscal 2025 EPS projections signify a remarkable 42% growth over the past five years, foreshadowing the continued steady expansion of this insurance juggernaut.

Image Source: Zacks Investment Research

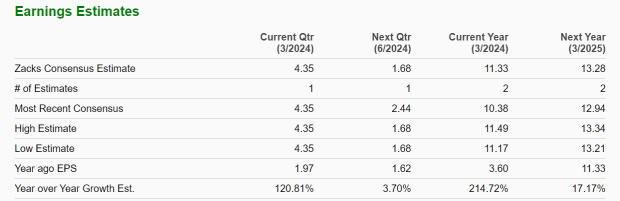

As for World Acceptance, FY24 earnings are projected to ascend meteorically by 215% to $11.33 per share compared to $3.60 per share last year. Furthermore, FY25 EPS is anticipated to expand by an additional 17% to $13.28 per share, signaling the company’s resurgence from the pandemic-induced stagnation, with earnings reaching $8.03 per share in 2019.

Image Source: Zacks Investment Research

Bottom Line

The Travelers Companies and World Acceptance vividly reaffirm their status as compelling growth stocks. Expectations point to a probable uptrend in earnings estimate revisions in the coming weeks and now seems opportune to invest in these expansive financial entities, each flaunting a Zacks Rank #2 (Buy).

World Acceptance Corporation (WRLD) : Free Stock Analysis Report

The Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

CNA Financial Corporation (CNA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.