The utility sector is typically burdened with concerns about high debt due to the capital-intensive nature of its operations, but it’s precisely this that offers a silver lining to investors looking for value. Amidst fears of increased interest rates impacting utility earnings, a window of opportunity has opened up, making it a fortuitous moment for long-term investors to dive in with even modest sums such as $500. Let’s take a closer look at two standout utility stocks, namely NextEra Energy (NYSE: NEE) and Black Hills (NYSE: BKH).

1. NextEra: A Duopoly Worth the Hype

At the heart of NextEra Energy’s business sits Florida Power & Light, the dominant electric utility in sunny Florida. Operating in a region witnessing sustained population growth, the company has enjoyed a burgeoning customer base synonymous with increased revenues.

But what truly sets NextEra apart is its expansive clean energy arm, making it a global leader in renewable power. This has not only been a catalyst for long-term growth but has also translated into an impressive track record of dividend hikes, averaging a remarkable 10% annualized uptick over the last decade. With a projected 10% dividend growth in 2024 and robust earnings expansion forecasted till at least 2026, NextEra is undoubtedly primed for the future.

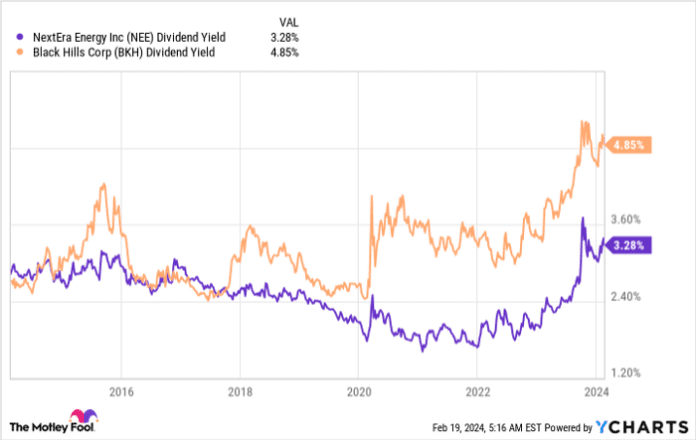

All this history doesn’t come cheap, usually commanding a premium valuation. However, a recent pullback in the wake of rising interest rates means that NextEra’s stock now offers a 3.6% dividend yield, perched at near-decade highs, presenting a compelling buying opportunity for astute investors.

2. Black Hills: Small in Size, Big in Returns

Boasting a market cap of just $3.5 billion, Black Hills may seem diminutive compared to the behemoth NextEra. However, what it lacks in size, it makes up for in its stellar track record. Surprisingly, Black Hills has notched up dividend hikes for 53 consecutive years, a feat which elevates it to the rarefied air of a Dividend King.

Although smaller in scale, Black Hills’ operations across various states have witnessed customer growth nearly three times faster than the general U.S. population expansion. Pair this with its currently attractive 5% dividend yield, hovering near its highest levels in a decade, and the stock appears to be in a prime position for investment, despite concerns over rising interest rates.

It’s a Win-Win

Whether you’re looking for robust dividend growth or a reliable high yield, these two stocks offer a compelling investment thesis. Both NextEra Energy and Black Hills can be acquired for less than $500 per share, making them an attractive prospect for investors looking to dip their toes in the market with a limited budget.

Should you invest $1,000 in NextEra Energy right now?

Before you buy into NextEra Energy, consider this:

The Motley Fool Stock Advisor analyst team recently highlighted the 10 best stocks they believe investors should consider for strong returns, with NextEra Energy not making the cut. The selected stocks are anticipated to yield significant gains in the years to come.

Stock Advisor empowers investors with a straightforward blueprint for success, offering guidance on portfolio construction, regular analyst updates, and two new stock picks per month. Since 2002, the Stock Advisor service has outperformed the S&P 500 by a factor of over three times*.

Explore the 10 highlighted stocks here

*Stock Advisor returns as of February 20, 2024

Reuben Brewer has positions in Black Hills. The Motley Fool has positions in and recommends NextEra Energy. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.