The Building Boom in Non-Residential and Manufacturing Construction

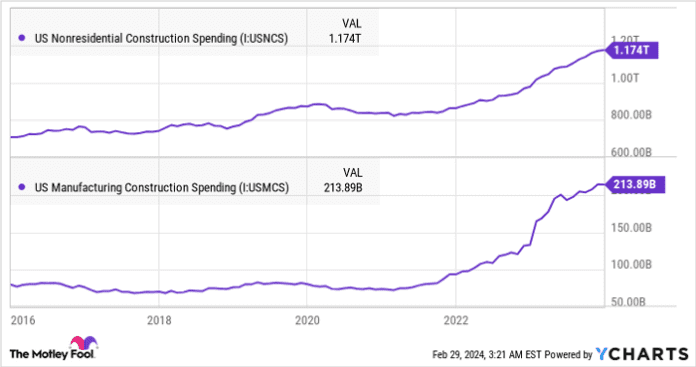

Steering our gaze toward the incessant rumbles in the economy, amidst the dizzying whirl of uncertainty, there exists a beacon of relentless growth – non-residential construction, in particular, manufacturing construction spending. The numbers paint a vivid landscape, with an impressive surge to a staggering $214 billion in 2023. A narrative that seems to resonate with potential and unyielding possibility, with companies like Comfort Systems USA (NYSE: FIX), Carrier (NYSE: CARR), and German stalwart Siemens (OTC: SIEGY) perched on the edge of this industrial whirlwind.

Journey through the Construction Spend Landscape

Plotting a course through the annals of history, we witness the ebbs and flows of non-residential construction, awakening in 2017, stumbling amidst the pandemic-induced chaos of 2020, only to emerge revitalized in the vigor of 2022. Manufacturing construction spending, a tale of lofty ascension, bolstered by the monumental CHIPS and Science Act of that fateful summer.

Even when adjusting for the inflationary tides that swell investment figures, the spending spree retains its gravity, with the Treasury Department affirming, “The boom finds its roots in the fervor of construction for the realms of computer, electronic, and electrical manufacturing.”

US Nonresidential Construction Spending data by YCharts

Lurking beneath the surface of these promising trends are questions that beg answers:

- How will the impacts of the CHIPS Act resonate amidst global supply chains still reeling from the aftershocks of lockdowns, steering investments toward local sourcing and vital technologies like semiconductors?

- What strategic shifts will mounting geopolitical tensions bring, nudging investments toward self-sufficiency in critical technology domains?

- How will the tide of industrial software and automation breakthroughs navigate the landscape, enabling reshoring and investments in markets endowed with heightened labor costs?

Comfort Systems USA: Riding the Wave of Innovation

Embarking on a voyage with Comfort Systems USA, a company entrenched in mechanical, electrical, and plumbing contracting services, beckons an odyssey of potential amidst the digital storm. As its backlog swells with promises of growth, the echoes of 2020 and the resurgence of 2022 paint a vivid picture of evolution.

Chart by author. Data source: Comfort Systems USA presentations.

Anchored in the realms of new construction, Comfort Systems derives a substantial chunk of its revenue (55% in 2023) from these burgeoning landscapes. A keen focus on manufacturing (34% of 2023 revenue) and technology (21%) sets the stage for an enthralling performance in line with the Treasury Department’s orchestrated spending.

Amidst the tides of change, words from CEO Brian Lane resonate deeply as he articulates the trajectory of revenue, veering toward the domains of data centers, life sciences, food, chip fabs, and battery plants – the epicenter of investment allure. While clouds of uncertainty hover over the commercial office buildings and residential markets in 2024, a paltry 7.7% and 3.5% of revenue last year paint a starkly contrasting picture.

A glance at valuation may hint at a seemingly well-rounded stock, trading at slightly under 27 times its projected 2024 earnings. Yet, with its backlog burgeoning – a monumental $870 million upsurge from the third to the fourth quarter of 2023, fueled by three individual $200 million-plus orders in the sectors of manufacturing, technology, and healthcare – Comfort Systems’ trajectory seems poised for an upward spiral.

As orders cascade in and the backlog teems with promises, the crescendo of Comfort Systems’ revenue and profits seems destined to scale new heights.

Carrier: Crafting Success in HVAC Realms

Both Carrier and Siemens stand tall as frontrunners in providing equipment to behemoths like Comfort Systems and a pantheon of other industry contractors. Carrier, a steadfast provider of heating, ventilation, and air conditioning (HVAC) solutions – churning out chillers and rooftop compressor units anna building controls – emerges as a cornerstone of the construction narrative.

Steadfast in its commitment to HVAC solutions, Carrier doubles down on its core following the orchestration of divestitures like the sale of its Chubb fire and security business in 2022, alongside the recent agreement to divest its security arm, Global Access Solutions, to the wings of Honeywell. Fueled by acquisitions like the stake in Toshiba Carrier Corporation and the monumental $12 billion acquisition of Viessmann Climate Solutions, Carrier’s forte in the residential HVAC realm may face headwinds, but its commercial HVAC business seems poised for a trajectory in harmony with the factors propelling Comfort Systems.

Siemens: Pioneering Technological Frontiers

Siemens, a vanguard of innovation, crafts building automation controls as part of its cogent smart infrastructure ensemble. Recording a 15% rise in smart infrastructure revenue in America, coupled with a 4% uptick in orders in the first quarter of fiscal 2024 ended December 31st, 2023, the company navigates with a discernible flourish.

Gesturing at the horizon, Siemens radiates promise, boasting undervaluation when juxtaposed against its industry compatriots. Embracing smart infrastructure as a lynchpin, Siemens charts a course for revenue growth of 7% to 10% in 2024, a testament to its unwavering stance in the market.

Dive deeper into Siemens’ tale, where automation and industrial software reign supreme under its digital industries segment. Amidst the temporary blips in the automation sector – a fallout of dealers destocking following a bout of aggressive inventory building (a storyline mirrored by Rockwell Automation) – Siemens emerges as a beacon of reliability, poised for a trajectory that parallels the investments cascading into manufacturing prowess.

Trading at a valuation South of 15 times its current free cash flow, Siemens exudes the aura of a hidden gem in the investment realm.

Should you invest $1,000 in Comfort Systems Usa right now?

Before embarking on the journey of investing in Comfort Systems USA, ponder this:

The Motley Fool Stock Advisor sages recently unfurled the map to what they deem the 10 best stocks poised to weather the investment storm. Surprisingly, Comfort Systems USA finds itself on a distinct path, paving the way for monster returns in the years to come.

Stock Advisor casts an inviting glow, offering a blueprint for success, replete with insights on portfolio construction, analyst updates, and a revelation of two new stock picks each lunar cycle. The service gleams with a track record that has lapped the S&P 500 thrice since 2002*.

Witness the rise of the 10 stocks

*Stock Advisor returns as of February 26, 2024

Lee Samaha dances with investments in Honeywell International and Siemens Aktiengesellschaft. The Motley Fool finds itself devoid of any stake in the wonderlands of these stocks. Accords dictate disclosure.

As the sun sets on the horizon of conjecture, words weave a tapestry that might not mirror the reflections of Nasdaq, Inc.