If you’re young and already investing for retirement, congratulations. You have just won the investing lottery.

That’s because the long-term power of compounding is heavily on your side. And that can lead to a massive difference in your ultimate retirement savings.

For example, if you invest $10,000 in the market at 55, and make a compound return of 10% per year, about the average for the stock market over time, that investment will grow to $25,937 in the 10 years before retirement. However, if you invested that amount at age 35, letting your savings compound for three times as long for 30 years, it wouldn’t grow into a pile three times large but seven times as large, at $174,494!

Of course, the 10% compound rate is just the rough annual return of the general stock market over time. But as a young person, you also have the opportunity to take more risks and/or and aim for higher returns.

That’s why the following exchange-traded funds (ETFs) should be considered for every young person’s retirement portfolio.

Invesco NASDAQ 100 ETF (QQQM)

While some would opt for a plain vanilla, conservative index fund that tracks the S&P 500, recent history has shown that betting on an index ETF that tracks the Nasdaq 100 index is likely the better long-term bet. As far as Nasdaq tracking ETFs are concerned, the Invesco NASDAQ 100 ETF (NASDAQ: QQQM) seems like a superior choice.

While there is of course overlap between the largest companies in the Nasdaq and the S&P 500, the Nasdaq is more heavily concentrated on the technology sector. The QQQM has 50.1% of its holdings in the technology sector, while the SPDR S&P 500 ETF Trust (NYSEMKT: SPY) which tracks the general S&P 500 index, only has 31% allocated to tech.

As we’ve seen over the past 20 years, the inventions of the internet, the smartphone, cloud computing, and artificial intelligence have catapulted newer Nasdaq companies ahead of the general S&P 500 over the long term.

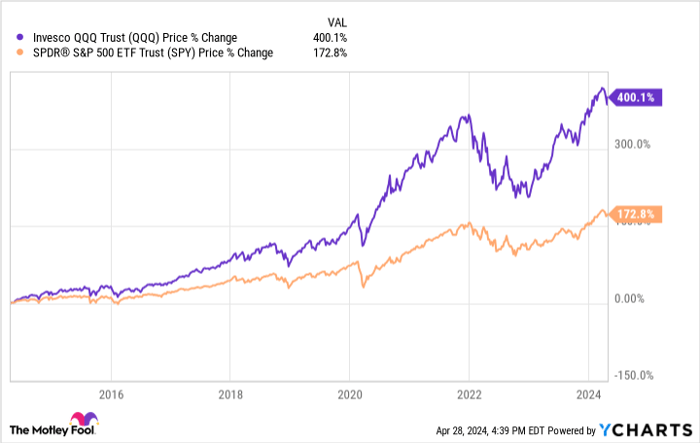

Over the past 10 years, the QQQ (the older cousin of the QQQM, which I’ll get to in a minute) has delivered 2.3 times the return of a generic S&P 500 index fund. That’s huge outperformance for a mere decade.

QQQ data by YCharts

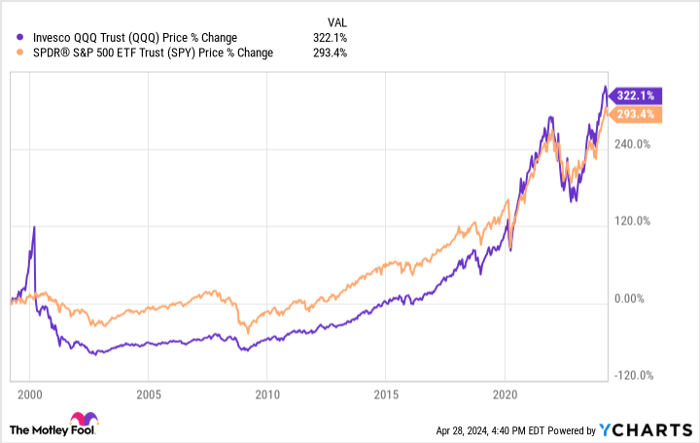

Of course, when zooming out further to a 25-year performance, the return is much closer, with the QQQ returning 322.1% and the SPDR returning 293.4%.

QQQ data by YCharts

But there’s a caveat here. Like most ETFs, the QQQ was created in 1999, at the very height of the internet bubble. When a sector or sub-sector gets super-hot, that’s usually when lots of ETFs around that theme emerge. You can see that the QQQ actually had negative returns from inception for the next 16 years. And yet, in spite of the ETF being formed at the top of a internet bubble, the QQQ has still outperformed the general market over the long term.

Of course, if one thinks the tech sector is in a bubble now, you may want to hold off on the QQQ. But over the course of time, I’d expect the most groundbreaking and value-creating companies to still come from the tech sector. After all, technological innovation is a thing that improves all other sectors.

Moreover, the composition of leading tech companies is different now than in 1999. The Magnificent Seven and many other tech names are highly profitable, earn terrific returns on capital, and are now even returning more cash to shareholders. That’s far different from the more speculative and unprofitable companies that led the 1990s internet bubble.

Interestingly, there are two large ETFs that track the Nasdaq from Invesco: the QQQ and the QQQM. The QQQ again, formed in 1999, but the QQQM was formed just in 2020. Because of the inner-workings of how ETFs work, the QQQ is actually more expensive for Invesco, so it formed the QQQM in 2020 with a more efficient cost structure. The result is that the QQQM only has a 0.15% expense ratio, while the QQQ maintains a 0.20% expense ratio.

Why would anyone actually buy the QQQ over the QQQM? There is one reason, but perhaps only relevant if you’re an extremely large fund that often trades indexes frequently: liquidity. The QQQ, by virtue of being more established and larger, is a more liquid index, with a narrower “spread” between bid and ask prices, with $170 billion in assets, versus just $9 billion for the QQQM. That could potentially make the QQQM harder to trade with good execution if you often trade very large amounts of the ETF.

But for young individual investors employing a buy-and-hold strategy, there’s virtually no reason to pick the QQQ. So, QQQM it is.

Vanguard Information Technology Index Fund ETF Shares (VGT)

Of course, the Nasdaq 100 isn’t exclusively a technology index. It just happens to be a newer stock exchange where the bulk of major technology stocks have listed. After all, Costco Wholesale is in its top 10 holdings. Moreover, if a major technology stock happens to be listed on the New York Stock Exchange rather than the Nasdaq, it won’t be in the QQQ. For example, Salesforce is a major technology large cap company, but since it’s listed on the NYSE, it isn’t included in the Q’s. The same goes for other major technology companies such as Oracle.

For 100% technology exposure at a rock-bottom expense ratio of just 0.10%, the Vanguard Information Technology Index Fund ETF Shares (NYSEMKT: VGT) is a great option. In this ETF, you’ll get a highly diversified mix of large, mid-sized, and small technology companies encompassing software, semiconductors, communications equipment, and other tech-related fields. The ETF actually holds 313 stocks today, so it’s actually more diversified than the QQQ, despite being concentrated in just a single sector.

Image source: Getty Images.

But there are also some drawbacks to the VGT as opposed to the QQQ. While it technically holds more positions, it’s also more concentrated. The top three holdings — Microsoft, Apple, and Nvidia each make up more than 10% of the ETF individually and cumulatively encompass about 45% of the entire index. So, if any company-specific disaster should befall these three stocks, that would harm the ETF’s performance. Of course, to the extent those declines would be due to a competitor taking market share, a rise in smaller holdings may offset the decline in these big three.

Except it’s also possible that potential disruptor might not be in the ETF. Curiously absent from the VGT are large companies such as Alphabet and Amazon. Those companies are categorized by Vanguard as a communications services and retail stock, respectively — not tech. But of course, each of those companies is competing against Microsoft in cloud infrastructure. So, if Amazon and/or Google were to find some way to dominate the cloud market at Microsoft’s expense (the VGT’s largest holding), the VGT might suffer.

Still, the VGT is a compelling choice, with a 20.38% annualized return over the past 10 years, and a 13.24% annualized return since inception in 2004.

WisdomTree U.S. Quality Dividend Growth Fund (DGRW)

While younger investors should definitely focus on growth, they also shouldn’t ignore dividends. After all, dividends provide some returns during periods of market declines, and those dividends can then be reinvested in stocks at cheaper prices. According to asset manager Fidelity, dividend payments have actually contributed 40% to the total return for U.S. stocks since 1930.

Even better? A dividend that grows. Great dividend growth stocks can make investors absolute fortunes over time, especially if that great dividend growth stock can grow its payout at a higher rate than inflation.

Consider Warren Buffett’s investment in American Express, which he made in the early 1990s at a cost of $1.287 billion. But after 30-plus years of dividend increases — including a recent 17% hike announced in March — Buffett will receive $424.5 million in dividend payments this upcoming year alone. That amounts to a 33% yield on his original investment.

The WisdomTree U.S. Quality Dividend Growth Fund (NASDAQ: DGRW) seeks out these American Express-like holdings (AmEx is of course part of the ETF) by applying a screen for earnings growth and quality to 300 U.S. large-cap stocks with market caps over $2 billion. “Quality” is of course an amorphous term, which in this case means high returns on capital.

Since inception in 2013, the ETF has compounded at a 13.52% annualized rate, or 13.2% after taking out the ETF’s 0.28% expense ratio. The average dividend yield of the ETF is 1.94%, but as Buffett’s AmEx investment has showed, 30 years of growth will make that yield on an investment today much more appetizing when you reach retirement.

Should you invest $1,000 in Invesco NASDAQ 100 ETF right now?

Before you buy stock in Invesco NASDAQ 100 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Invesco NASDAQ 100 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of April 22, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. American Express is an advertising partner of The Ascent, a Motley Fool company. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Billy Duberstein has positions in Alphabet, Amazon, Apple, Costco Wholesale, and Microsoft. His clients may owns shares of the companies mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Costco Wholesale, Microsoft, Nvidia, Oracle, and Salesforce. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.