Industry Description

The Zacks Mortgage & Related Services industry includes providers of mortgage-related loans, refinancing, and other loan-servicing facilities. It’s been a tough ride for the industry, with banks pulling out due to heavier compliance and capital demands. This withdrawal has allowed non-banks to snatch up a larger piece of the mortgage loans pie. And, players in this realm are heavily reliant on interest rates set by the Federal Reserve, as these rates sway the decisions of customers seeking mortgages. Plus, these companies rake in investment income from financial assets like residential or commercial mortgage-backed securities and asset-backed securities.

3 Mortgage & Related Services Industry Trends to Watch

High Mortgage Rates Keep Homebuyers on the Sidelines: The mortgage market has been in a pickle ever since the central bank started cranking up interest rates. The average rate on a 30-year mortgage hiked to a daunting 7.79% late October, marking its highest level since late 2000. The result? Less people wanting to purchase homes or refinance. That’s hitting mortgage demand hard and it’s not looking good for the industry players.

Industry Players to Resort to Cost Controls: Mortgage companies are still quite hands-on, which can be costly. But with high mortgage rates scaring off homeowners from buying or refinancing, companies are being forced to trim their workforce and consider adopting automation technology to keep up.

Servicing Segment to Offer Support: With other areas taking a hit, industry players are banking on the servicing segment to keep things afloat. In a high-rate environment, this segment offers a natural hedge to the origination business. And, considering the huge expected growth opportunities in servicing portfolios, it’s no wonder these companies are finding solace in this sector.

Zacks Industry Rank Reflects Bleak Prospects

The Zacks Mortgage & Related Services industry currently carries a Zacks Industry Rank #152, which places it in the bottom 40% of more than 250 Zacks industries. And, if we flip through the pages of history, it’s evident that the industry has been fighting an uphill battle. The stock-market performance and valuation picture for this sector tell a tale of woe.

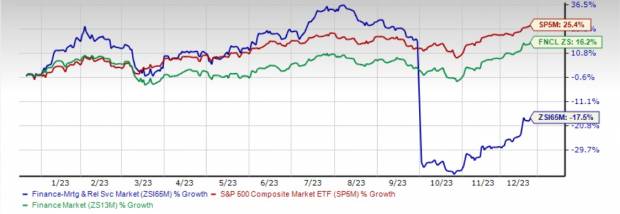

Industry Underperforms Sector and the S&P 500

The Zacks Mortgage & Related Services industry has taken a tumble, underperforming the broader Zacks Finance sector and the S&P 500 composite over the past year. Its performance doesn’t do justice to its broader sector and the larger market’s gains over the same period.

One-Year Price Performance

Image Source: Zacks Investment Research

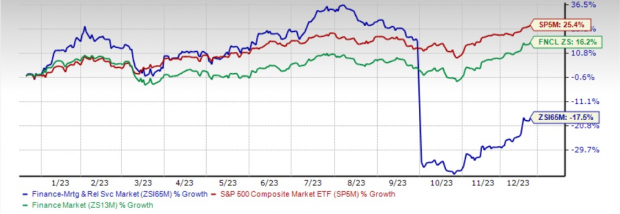

Industry’s Current Valuation

Valuation matters, and on that front, the industry isn’t doing so hot. Comparing it to the S&P 500 shows that it’s trading at a 5.32X P/B ratio, while the broader market is at 6.05X. Past performance isn’t a pretty sight either, with the industry trading between a high of 5.32X and a low of 0.78X over the last five years.

Price-to-Book Ratio (TTM)

Image Source: Zacks Investment Research

So, there you have it – a juicy snapshot of the mortgage and related services industry. It’s a rollercoaster ride, and its future is anything but certain.

3 Mortgage & Related Services Stocks to Watch

Three Stocks Making Waves in the Financial Market

Federal Agricultural Mortgage: The company, also known as Farmer Mac, is a federally chartered corporation that combines private capital and public sponsorship to create a secondary market for various loans made to rural borrowers.

The company’s business lines include agriculture finance (consisting of farm and ranch, and corporate AgFinance), rural infrastructure finance (consisting of rural utilities and renewable energy) and treasury (funding and investment).

The company is expected to enjoy strong pipelines and volumes in the upcoming years, given the expected rise in agricultural productivity to meet the global demand, a growing U.S. agriculture mortgage market and a significant scope of improvement in renewable electricity capacity. Moreover, the expanding corporate AgFinance and renewable energy business lines carry higher margins than other operations.

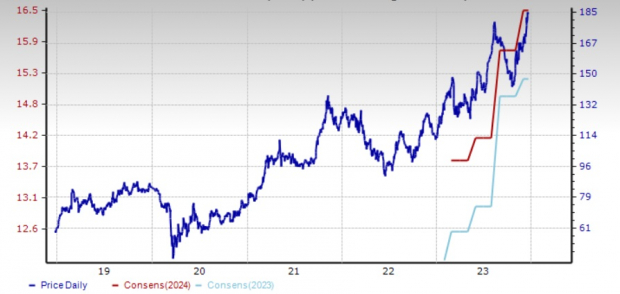

The Zacks Consensus Estimate for AGM’s 2023 and 2024 earnings has been unchanged over the past month. The Zacks Rank #1 (Strong Buy) company’s earnings for the ongoing year and 2024 are expected to rise 33.5% and 7.8% year over year, respectively. Revenues for 2023 and 2024 are expected to grow 11.5% and 8.2%, respectively.

Price and Consensus: AGM

Image Source: Zacks Investment Research

Ocwen Financial: The company is a preeminent non-bank mortgage servicer and originator that provides solutions through its primary brands — PHH Mortgage and Liberty Reverse Mortgage. Its balanced and diversified business model — diversified originations sources and servicing business — provides a competitive advantage against peers.

The company’s servicing financial performance is poised to benefit from high interest rates. Ocwen Financial has been driving expense reduction and taking right-sizing actions. Also, favorable demographics and home price appreciation are expected to drive continued growth in the reverse mortgage market.

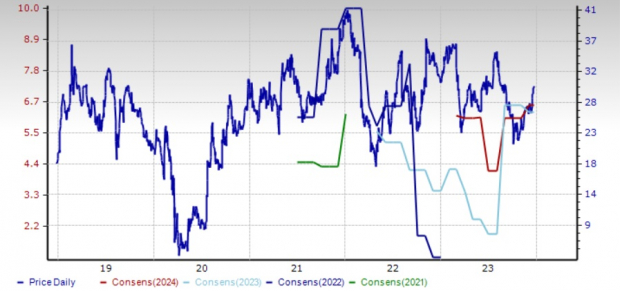

The Zacks Consensus Estimate for OCN is pegged at $6.28 and $6.54 for 2023 and 2024 earnings. Earnings estimates have been unchanged over the past month. Also, for the ongoing and the next years, its revenues are expected to increase 10% and 4.5%, respectively. The company sports a Zacks Rank of 1 at present.

Price and Consensus: OCN

Image Source: Zacks Investment Research

LendingTree: The parent company of LendingTree, LLC, is headquartered in Charlotte, NC, and has been operating solely in the United States since July 1998. Its online marketplace provides clients with product offerings from more than 600 partners.

LendingTree is committed to boosting revenues by diversifying its non-mortgage product offerings, particularly in the Consumer segment. With the launch of the LendingTree WinCard in partnership with Upgrade in February 2023, the company provided its first branded consumer credit offering. Over the past years, TREE has increased its services, such as credit cards and widened loan offerings to personal, auto, small business and student loans.

Also, LendingTree’s market-leading position and flexible business model, which provides more diversified solutions for a wider array of lenders, will enable its Home segment operations to navigate through the fluctuating macroeconomic situations and high-interest-rate environment.

The Zacks Consensus Estimate for TREE’s 2023 and 2024 earnings has been unrevised over the past month. For the ongoing year, earnings are expected to surge 99% year over year. For 2024, earnings are projected to grow 10.6% on 6.7% revenue growth. The company carries a Zacks Rank of 3 (Hold) at present.

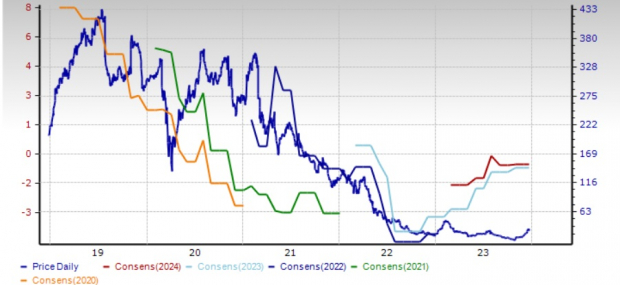

Price and Consensus: TREE

Image Source: Zacks Investment Research

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2023. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Federal Agricultural Mortgage Corporation (AGM) : Free Stock Analysis Report

Ocwen Financial Corporation (OCN) : Free Stock Analysis Report

LendingTree, Inc. (TREE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.