The global shipping industry acts as the lifeblood of a robust economy, ensuring the continuous delivery of goods to consumers worldwide. Amid the COVID-19 pandemic and ongoing geopolitical tensions, the industry has encountered significant challenges, including additional costs and delivery delays in the Red Sea region.

As the world strives for a return to normalcy, the shipping sector faces a challenging path to recovery due to high costs and port congestions. Despite these obstacles, certain companies are demonstrating potential for substantial growth as the industry rebounds.

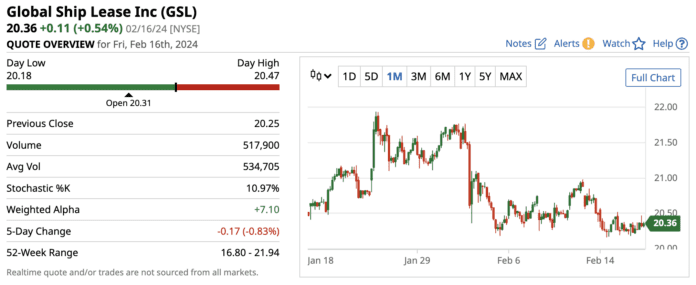

The Rise of Global Ship Lease, Inc. (GSL)

First on the list is UK-based Global Ship Lease, Inc. (GSL), a company that leases its container ships under fixed-rate time charters. GSL focuses on small and mid-sized Post-Panamax containerships, with a total of 68 containerships under its ownership, including 36 wide-beam Post-Panamax vessels.

GSL reported positive financial results, with a 1.2% year-over-year increase in operating revenue and a 3.2% rise in year-over-year performance for the first nine months. While quarterly net income saw a slight decrease, the 9-month net income surged by 9.3%. The company’s adjusted EBITDA also experienced a substantial year-over-year increase, demonstrating its resilience and strategic advancements.

Kirby Corporation (KEX)

Kirby Corporation operates as a domestic tank barge operator, serving the marine transportation and distribution & services segments. The company reported robust financials for Q4’23, including a significant increase in earnings per share and total revenue, reflecting its strong position in the market. With positive cash flow and optimistic expectations for 2024, Kirby’s resilience makes it an attractive option for investment in the shipping industry.

Star Bulk Carriers Corp (SBLK)

Star Bulk Carriers Corp, based in Greece, operates a fleet of dry bulk carrier vessels, managing a broad range of cargo types. Despite the challenging conditions faced by the industry, the company exhibited strong financial performance and effective cost management. The ongoing merger with Eagle Bulk is expected to be a significant catalyst for the company’s future growth, offering investors a promising opportunity.

Final Thoughts: Cautious Optimism in the Shipping Sector

Investing in shipping stocks represents a compelling opportunity for those seeking growth potential in their portfolios. As the industry moves towards recovery, 2024 could emerge as a promising year for investors, provided consumers continue their spending trends. Prior to making any investment decisions, it’s essential to conduct thorough research and seek advice from financial professionals.

More Stock Market News from Barchart

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.