The current investor-friendly steps in the Transportation – Equipment and Leasing industry provide a solid foundation for growth. However, challenges such as inflation, interest rates, and supply-chain disruptions may impact the industry’s demand for containers. Despite these challenges, the industry offers a compelling investment opportunity, especially in the context of three key players: Wabtec Corporation (WAB), GATX Corporation (GATX), and Trinity Industries, Inc. (TRN).

Industry Overview

The Zacks Transportation – Equipment and Leasing industry consists of companies offering equipment financing, leasing, and supply-chain management services. These companies cater to a wide range of customers, including businesses in various sectors such as automotive, electronics, transportation, grocery, and home furnishing. The industry also provides locomotives and technology-based equipment, systems, and services to freight rail and passenger transit industries.

Key Trends Influencing the Industry

Strong Financial Returns for Shareholders: Many industry players are restarting measures such as dividend payouts and share buybacks, indicating confidence in their financial strength.

For example, GATX’s board announced a 5.5% dividend hike in January 2024, marking the 106th consecutive year of dividend payments. Wabtec also increased its dividend by 17.6% in February 2024, alongside a $1 billion share buyback authorization.

Economic Uncertainty Remains: Despite signs of easing inflation, economic uncertainty and rising inflation can lead to market volatility, affecting shipping stocks.

Supply-Chain Disruptions & High Costs: Ongoing supply-chain disruptions and high operating costs continue to impact the industry’s performance.

Zacks Industry Rank Indicates Encouraging Prospects

The Zacks Transportation – Equipment and Leasing industry ranks in the top 6% of Zacks industries, indicating promising prospects. However, the Zacks Industry Rank suggests neutral near-term prospects.

Before discussing potential stocks to invest in, it’s important to analyze the industry’s recent stock market performance and current valuation.

Industry Performance and Valuation

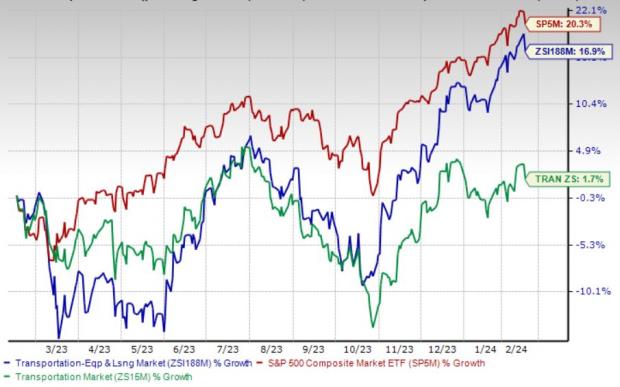

The Transportation – Equipment and Leasing industry has underperformed the S&P 500 but outperformed the broader sector over the past year, gaining 16.9% compared to the S&P 500 Index’s 20.3% movement and the sector’s 1.7% surge during the same period.

Based on the forward 12-month price-to-earnings (P/E) ratio, the industry is currently trading at 14.00X, while the S&P 500’s ratio stands at 20.56X. The industry’s P/E ratio has ranged from 8.75X to 16.73X over the past five years.

Three Transport Equipment Leasing Stocks to Consider

Here are three Zacks Rank #2 (Buy) stocks well-positioned for potential growth.