Robust Industry Trends Signal Opportunity

Amidst a climate where self-care is not merely a luxury but a necessity, the Cosmetics industry is experiencing a surge in demand for skincare and personal care products. The golden age of beauty has arrived, and companies that focus on strategic product launches position themselves to reap the influx of opportunity. The cosmetic space is not without its challenges—ruffling its smooth complexion there lurk inflationary winds and supply-chain bottlenecks; however, embracing omnichannel capabilities could be the saving grace.

About the Industry

The Zacks Cosmetics industry offers a wide array of beauty and personal care products. These companies cater to the skincare, fragrance, makeup, and hair care needs of consumers by selling products through various channels—from retailers to e-commerce platforms.

Influence of Industry Trends

Innovation & Digitization – Major Movers: The beauty landscape is shaped by consumer expectations for inventive, scientific formulations, and a pivot towards e-commerce capabilities. Companies in the Cosmetics industry rally behind unique product offerings to meet changing consumer trends, resulting in a growing demand for organic skincare and “clean beauty” products. The landscape is also enhanced by strategic alliances and acquisitions, thus underlining the industry’s forward trajectory.

Strong Demand for Skincare & Makeup: The trend of robust demand for skincare and personal care products is steadfastly enriching the prospects within the Cosmetics industry. A burgeoning focus on self-care and the popularity of makeup products has contributed to sector growth. Additionally, the fragrance and haircare categories are basking in renewed customer interest, giving further impetus to the industry.

Inflationary Headwinds: Amidst the blooming prospects, cosmetic companies find themselves in a tussle with inflationary pressures and supply chain disruptions. Rising costs and frenzied competition necessitate companies to allocate significant resources towards research and development, thereby impacting profit margins.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Cosmetics industry stands at a credible position within the Zacks Industry Rank. The industry is currently housed within the broader Zacks Consumer Staples sector and retains a solid near-term prospects—signaling positive earnings outlook for the constituent companies.

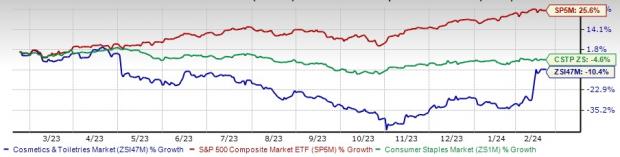

Industry Vs. Broader Market

While the Zacks Cosmetics industry has underperformed in comparison to the broader market, the potential for growth cannot be overlooked. The ultra-competitive cosmetics industry has seen a decline in its stock performances, but there are signs of a vigorous rebound lurking.

One-Year Price Performance

Industry’s Current Valuation

The industry’s valuation indicates an optimistic picture, with the industry currently trading at 33.70X compared with the S&P 500’s 20.70X and the sector’s 17.12X. This sets the stage for an intriguing investment prospect.

Price-to-Earnings Ratio (Past 5 Years)

Cosmetic Stocks Worth Watching

Inter Parfums: For those seeking an investment standout, Inter Parfums offers allure—boasting a significant leap in shares over the past three months and an optimistic consensus outlook for the current fiscal year earnings per share (EPS).

Price and Consensus: Inter Parfums (IPAR)

The Estee Lauder Companies: With a robust online presence and a strong foothold in emerging markets, The Estee Lauder Companies present an intriguing prospect amidst industry growth.

Beauty Stocks on the Rise

The financial market is basking in the glow of some of the renowned beauty stocks that are gaining strong momentum and resilience in the ongoing market upheaval. The highly volatile stock market has seen some star performers in this sector, creating an optimistic wave of interest among investors. Let’s delve into the compelling financial outlook of some of the key players in this vibrant industry.

Estee Lauder Companies Inc. (EL)

With the iconic Estee Lauder Companies Inc., we see a formidable company unleashing its innovative power to reach new heights. Brimming with creativity and financial fortitude, EL is making a bold statement in today’s competitive market. EL’s commitment to driving consumer-centric innovation and revamping its global asset base is a testament to its unwavering focus and potential for long-term growth. The company is diligently pursuing its Profit Recovery Plan, a strategic roadmap aimed at fortifying its profitability while nurturing a robust sales growth environment. EL’s stock has surged 18.3% over the past three months, reflecting the market’s affirmation of its solid strategic trajectory.

Price and Consensus: EL

.jpg)

Coty

Plunging into the world of beauty, we encounter Coty, a manufacturer, marketer, and distributor of beauty products that has attracted widespread interest in the market. Leveraging the ongoing premiumization trends, Coty is riding the wave of favorable momentum in core categories and significant innovation. The company’s strategic focus on six pillars for sustainable growth has bolstered its position in the industry. Coty’s stock has surged by 10.2% in the past three months, affirming its strong market presence and future potential.

Price and Consensus: COTY

.jpg)

Helen of Troy

Turning our attention to Helen of Troy, a provider of consumer products across Beauty, Housewares, and Health & Home segments, we witness a company making substantial investments in its Leadership Brands. Helen of Troy is spearheading innovative strategies to drive growth and strengthen its market presence. This proactive approach includes enhancing production and distribution capacity, investing in consumer-centric innovation, and embracing digital marketing. The stock has soared by 18.9% over the past three months, underscoring its notable performance and promising outlook.

Price and Consensus: HELE

.jpg)

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2023. Previous recommendations have soared +143.0%, +175.9%, +498.3%, and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

The Estee Lauder Companies Inc. (EL) : Free Stock Analysis Report

Helen of Troy Limited (HELE) : Free Stock Analysis Report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

Coty (COTY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.