The Internet-Delivery Services industry, featuring stalwarts such as GoDaddy GDDY, MakeMyTrip MMYT, QuinStreet QNST, and Asure Software ASUR, is experiencing a resurgence as economies gradually open up. This resurgence has seen these companies reclaiming their pre-pandemic business activities. Moreover, the industry is poised to benefit from a more substantial Internet presence in emerging markets, a burgeoning affluent middle class, and the swift adoption of smartphones. These factors bode well for the Internet-Delivery Services industry’s future prospects as online delivery services are yet to penetrate beyond major metropolitan areas, indicating vast room for expansion.

Painting the Landscape of the Industry

The Zacks Internet – Delivery Services industry encompasses various companies that offer a gamut of services through Internet-based platforms. These include food delivery, online travel booking, direct marketing and media services, web hosting, and more. While leveraging technology and the Internet to power their businesses, the industry also faces significant challenges. Expansion into new markets is bound to generate volume with time and hefty upfront costs but could squeeze profitability. Additionally, heightened operating expenses linked to hiring new employees and aggressive sales and marketing strategies to capture a larger market share may strain margins in the near term.

3 Determining Trends for the Future

Smartphones & Internet Penetration Act as Key Catalysts: The ubiquity of the Internet and the surging use of smartphones are reshaping the delivery services landscape, benefiting participants. The companies in the industry are reaping the rewards of the escalating number of Internet users and the proliferation of 4G Volte technology (soon to be complemented by the advent of 5G technology).

Shifting Consumer Preferences: The industry is set to benefit from evolving consumer preferences, favoring convenience and accessibility, with a migration from offline to online food ordering and the rise in online travel booking. However, the industry is hinged on consumer spending, and any slowdown in the global economy could pose a risk.

Higher Upfront Costs to Hurt Profitability: Despite being restricted to major metropolitan areas, online delivery holds promises for growth, but it comes with significant upfront expenses. Further, the focus of industry giants like Amazon and Alphabet (Google) on reinforcing their delivery systems adds to the competitive pressures for industry players, threatening their position in the market.

Industry Prospects Side with Zacks Ranking

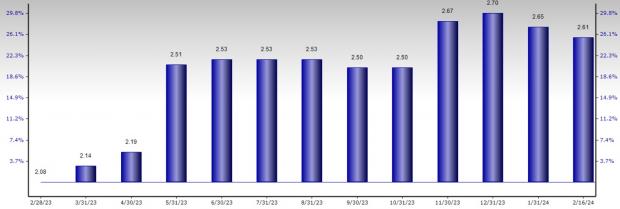

The Zacks Industry Rank places the Internet-Delivery Services industry in a favorable position, nestled in the top 42% of about 250 Zacks industries. According to research, industries positioned in the top 50% of the Zacks ranking tend to outperform those in the bottom 50% by more than 2 to 1. This positive positioning is a result of the optimistic earnings outlook for the constituent companies, with analysts displaying strong confidence in the industry’s earnings growth potential. The industry’s earnings estimate for 2024 has soared by 25.5% in the past 12 months.

Estimate Revision for 2024

Before diving into potential stock picks, let’s explore the industry’s recent stock-market performance and valuation outlook.

Industry Performance & Valuation Snapshot

Over the last year, the Internet-Delivery industry has outpaced the S&P 500 composite but lagged behind the broader Zacks Computer and Technology sector. The industry has delivered a 37.5% surge compared to the S&P 500’s 23% and the sector’s 45.9%.

One-Year Price Performance

Industry’s Current Valuation

At a forward 12-month price-to-sales (P/S) ratio of 1.07X, the Internet-Delivery industry is trading at a discount to the S&P 500’s 4.05X and the sector’s 4.67X. Over the past five years, the industry has traded in the range of 0.57X to 1.34X, with a median of 0.89X.

Price-to-Sales Ratio (Industry vs. S&P 500)

Price-to-Sales Ratio (Industry vs. Sector)

4 Leading Stocks in Focus

GoDaddy: A key player in Internet domain registration, web hosting, and e-business-related software and services, GoDaddy is currently positioned at Zacks Rank #2 (Buy). The company is witnessing robust traction across its Applications & Commerce business, along with an expanding global footprint. Its Create & Grow solutions are driving growth in the Application & Commerce segment, while its Website plus marketing segment is benefiting from enhanced customer engagement through new product launches. The ongoing growth in bookings, renewals, and registrations and the expansion of the GoDaddy Registry present significant growth drivers for the company.

Surge in Earnings for Online Service Companies

The business landscape is akin to the tumultuous sea, at times calm and reflective and at others, the waves are choppier and the currents stronger. This observation holds true for several companies that have managed to ride the high tides and come out stronger than ever, defying initial expectations amidst the ongoing economic turmoil.

GoDaddy Inc.

Anchored by strong customer additions and strategic price increases across various sectors, GoDaddy Inc. (GDDY) has been a standout performer in the market. The Zacks Consensus Estimate for 2024 earnings has been revised upwards to $4.64 per share over the last seven days, showcasing an upward trajectory that sets a promising tone for the company’s market performance.

MakeMyTrip Limited

MakeMyTrip Limited (MMYT) is another sailing success story. The company, offering a myriad of travel products and solutions in India and the United States, has witnessed a 2024 earnings estimate revision from $1.13 to $1.17 per share over the past 30 days. This upwards trajectory is a testament to the company’s resilience and adaptability amidst the challenging travel landscape.

QuinStreet, Inc.

QuinStreet, Inc. (QNST), a provider of online direct marketing and media services, has been reaping the rewards of an accelerated shift towards online business models. Although the Zacks Consensus Estimate for fiscal 2024 earnings took a slight dip to 16 cents from 32 cents in the past 30 days, the company’s ability to weather the storm and navigate through volatile market conditions is commendable.

Asure Software Inc

Asure Software Inc. (ASUR), a cloud computing firm, has remained unwavering in its commitment to modernize business processes for its clients. Despite a stable Zacks Consensus Estimate for 2024 earnings at 66 cents per share over the past 60 days, the company’s strategic initiatives and customer-focused approach continue to set it apart in the competitive market.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028. See This Stock Now for Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GoDaddy Inc. (GDDY) : Free Stock Analysis Report

MakeMyTrip Limited (MMYT) : Free Stock Analysis Report

QuinStreet, Inc. (QNST) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.