AMD Faces Challenges Amid Competitor Gains, Analyst Says

Oppenheimer analyst Rick Schafer has maintained a Perform rating on Advanced Micro Devices, Inc AMD.

Schafer expresses concern regarding AMD’s long-term prospects in a declining PC market, particularly as it competes with stronger companies. In a landscape dominated by Nvidia Corp NVDA and Intel Corp INTC, both of which are solidifying their positions in the CPU and GPU sectors, AMD’s revenue and gross margins face significant hurdles.

Related Read: Why Nvidia, AMD And Other Chipmakers Are Moving Lower In Tuesday’s Premarket

The challenge seems profound. Schafer pointed out that AMD’s continued pursuit of a lower-margin gaming business hampers its profitability. Additionally, he flagged concerns regarding structural issues from Arm Holdings plc ARM.

The analyst forecasted revenue and earnings per share (EPS) for the third quarter to reach $7.6 billion and $1.17, slightly above consensus. However, he revised his fourth-quarter sales estimate downward from $7.7 billion to $7.5 billion, attributing this to subdued expectations for the PC and gaming sectors.

Schafer also underscored AMD’s recent AI event, which outlined a timeline for the MI family of products, featuring MI325 launching in Q4 2024, MI350 in the second half of 2025, and MI400 set for 2026. Notably, AMD’s AI division has expanded from no revenue to approximately $4 billion.

Nevertheless, initial projections of ~$8 billion in sales for the MI300 this year have been adjusted to around $5 billion. He anticipates stable PC sales, continued growth in embedded systems, and server CPU growth of over 25% in the calendar year 2025, but remains cautious due to persistently high AI expectations in the data center space.

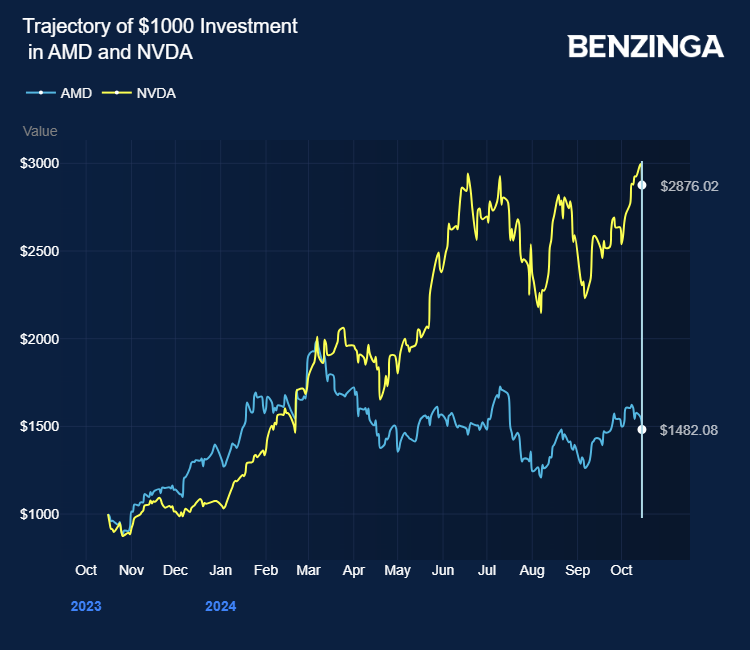

This year, AMD’s stock has risen by 12%, lagging behind the PHLX Semiconductor Sector SOX, which saw a 30% increase. Currently, AMD trades at 26 times (excluding cash) the estimated earnings for 2026, compared to the sector average of 24 times.

Facing an uphill challenge, Schafer also warned that gaining market share for MI300 will be tough against Nvidia’s leading accelerator lineup, which includes the CUDA software ecosystem and GB200 rack systems.

Looking ahead, he expects AMD’s third-quarter revenue to reach $6.70 billion with an EPS of $0.91, while forecasting fourth-quarter sales of $7.50 billion and an EPS of $1.18.

Price Action: At the last check on Tuesday, AMD stock was down 4.72%, trading at $157.50.

Further Reading:

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs