Source: Michael Ballanger 10/15/2024

Market Update: Oil and Copper Show Weakness Amid Strong Stock Performance

Michael Ballanger from GGM Advisory Inc. shares insights on the market’s current conditions, focusing on oil, copper, gold, and silver.

Current Market Trends

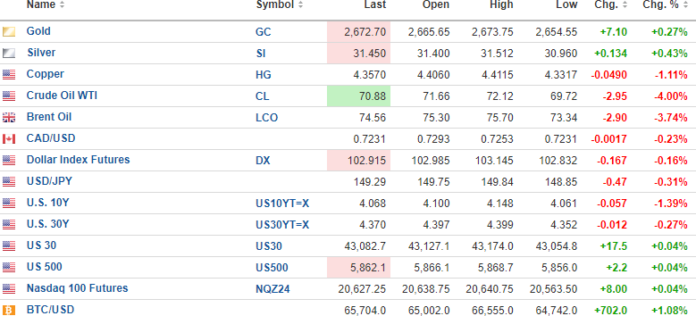

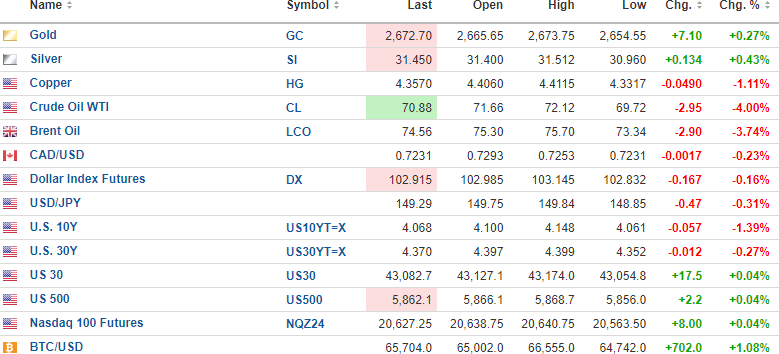

This morning, the USD Index futures dropped 0.167% to 102.915, while the 10-year yield decreased by 1.39% to 4.068%, and the 30-year yield fell 0.27% to 4.37%. In the commodities space, metals showed mixed results: gold rose by 0.27%, and silver increased by 0.43%. Conversely, copper dipped 1.11% to $4.35 per pound, while oil faced a sharp decline of 3.74%, trading at $70.88 per barrel. On the stock market, futures are positive, with the DJIA futures up 0.04%, the S&P 500 futures also up 0.04%, and NASDAQ futures rising by 0.04%. Bitcoin, a risk indicator, climbed by $702 to $65,704, an increase of 1.08%.

Thanks to the “Seasonal MACD Buy Signal” from The Stocks Trader’s Almanac, the market is entering the Best Six Months of the trading year, with major averages near all-time highs. On October 14, the DJIA reached a new high of 43,139, and the S&P 500 had its all-time high last Friday.

The NASDAQ Composite achieved its peak of 18,671 on July 11, remaining 169 points away from that record. The Russell 2000 index, which represents small caps, last hit an all-time high in October 2021, currently trading at $230.72, just $7.83 below its peak. It’s unusual to see such high market performance in mid-October, especially in a presidential election year when markets typically experience weakness. The current market behavior appears to defy historical patterns, largely influenced by the algorithms that now dominate more than 70% of NYSE trading volume.

Despite this, the markets seem to be nearing overbought conditions. The S&P is currently 11.1% above its 200-day moving average, indicating a significant extension. Respecting seasonality, if we see no major pullback by the end of this week, I may consider adding calls in anticipation of a potential year-end rally.

Focus on Copper

Today’s analysis includes the copper chart, specifically highlighting the 100-day moving average at $4.36 per pound. With current prices below this level at $4.35, along with an overnight low of $4.3317, a close below the 100-day moving average could test the convergence zone between the 50-day moving average at $4.27 and the 200-day moving average at $4.24. This trend could impact Freeport-McMoRan Inc. FCX, potentially pushing the stock below the gap created after the announcement of the Chinese stimulus package, which saw the stock rise from $45 to open at $48.10 the following day.

A few weeks ago, I felt uncertain about selling my FCX calls and half of my shares when they were around $51.50. However, experience has taught me that sometimes one must take action when market conditions shift. Late September saw copper become overbought, marking a change in conditions. I am hopeful these conditions may soon shift positively again.

Important Disclosures

- Michael Ballanger: I or my family members own securities of Freeport-McMoRan Inc. Companies mentioned in this article were chosen based on my research and understanding of the sector.

- Opinions expressed here are those of the author and not of Streetwise Reports or its officers. The author is responsible for the accuracy of these statements. Streetwise Reports did not compensate the author for this publication. Authors must disclose shareholdings and economic relationships with companies discussed.

- This article is for informational purposes only and does not constitute investment advice or a solicitation. Readers should seek advice from personal financial advisors and conduct their own research. By accessing this article, readers confirm acceptance of Streetwise Reports’ terms of use and legal disclaimers.

- Michael Ballanger Disclosures

This letter makes no guarantees regarding the accuracy of the data provided. It does not intend to give investment advice and represents my views while outlining my trades. Always consult your registered advisor before making investment decisions. Junior mining stocks and options come with significant risks that may result in losses. These investments are only suitable for experienced investors. Consult a financial advisor if you are unsure of the risks involved.

Market News and Data brought to you by Benzinga APIs