“`html

The Upcoming Election: How Chaos Could Impact Your Investments

Editor’s note: In November 2023, Senior Analyst Louis Navellier hosted the “Californication of America” event, predicting that Joe Biden wouldn’t be the Democratic nominee. Instead, he foresaw a leader from California steering the country’s future. This prediction has proven accurate…

Now, Louis has an even bolder forecast regarding impending chaos in the nation and the stock market following the presidential election. To discuss these events, he’ll host “The Day After Summit” on Tuesday, October 29, at 7 p.m. Eastern Time. Reserve your spot here.

Today, Louis shares his prediction, explains why chaos shouldn’t intimidate you, and highlights potential profit opportunities.

“The enemy within”…

That’s how Donald Trump labels his Democratic opponents.

Kamala Harris has cautioned her supporters that a second Trump term could pose a “huge risk for America.”

Each side perceives the other not merely as a poor choice but as a significant threat to American identity.

If you think the outcome of this year’s election will be decided on November 5, think again.

Instead, I predict another fiercely contested election—after the votes are cast.

Don’t merely take my word for it…

During a recent panel discussion in Singapore, billionaire investor Ray Dalio voiced his apprehensions about the peaceful transition of power.

According to Dalio, if Trump faces a narrow defeat, it’s “almost an even probability” he will challenge the results. If Harris experiences a close loss, expect the Democrats to respond similarly, believing they have too much at stake.

As investors, we have to stay vigilant. This uncertainty will stir chaos in the stock market.

Big Market Moves Can Mean Big Profits

The fallout from a contested election won’t just affect Washington D.C.; it will also have repercussions on Wall Street.

I believe the market’s “fear gauge,” known as the VIX, could double or even triple, leading to wild swings in stock values in the days and weeks following the election.

This scenario may seem alarming, especially for new investors.

However, for seasoned investors like myself, these conditions represent some of the best opportunities for significant gains.

Simply put, larger market movements often create greater chances for profit.

I’m already strategizing with millions of my own dollars at stake.

By preparing for the anticipated volatility, you may not only avert losses from the forthcoming market reactions but also seize opportunities that could yield triple returns or more within weeks.

I’ll explain how shortly.

Before that, let’s revisit the stock market’s behavior during the last significant election dispute back in 2000.

35 Days of Legal Battle

In the 2000 presidential election, over 100 million ballots were cast, with the outcome hinging on just 537 votes in Florida.

If you remember that time, many voters used punch-card ballots, and some had issues resulting in “hanging chads” which led to confusion over vote counts.

This resulted in extensive legal challenges and debates over recounts, which ultimately lasted 35 days before the Supreme Court declared George W. Bush the winner.

This period of uncertainty unsettled many Americans and rattled investors as well.

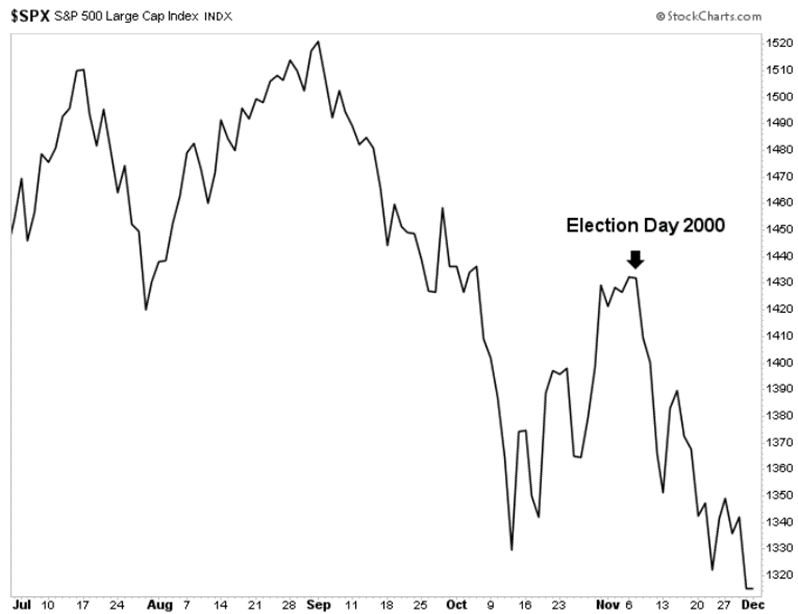

In the election week, the S&P 500 dropped 4.3%. Typically, the S&P experiences an average weekly loss of just 0.5%, making that drop ten times more significant.

After the Supreme Court’s ruling, the S&P 500 fell another 4.9%.

The 2000 election chaos can be visualized in the chart below.

This previous election did not stir nearly as much contention as the upcoming battle between Trump and Harris.

Thus, I predict the market instability following the November 2024 election will overshadow even the 2000 turmoil.

You may think you’re preparing for a repeat of the contested outcomes from 2000 or even 2020.

However, I foresee this situation unfolding differently than anything we’ve previously encountered.

This is largely due to another significant event impacts markets—all occurring while investors grapple with a contested election.

Another Layer of Volatility

During the same week as the upcoming Election Day, the Federal Open Market Committee is slated to meet in Washington to discuss interest rates.

Few people realize this is an incredibly crucial matter. Some months ago, the Fed altered its meeting schedule in an unusual manner.

It decided to…

“`

Anticipating Interest Rate Moves: What Investors Should Know Post-Election

As the election unfolds, financial markets brace for a crucial update from the Federal Reserve.

What to Expect from the Fed After Election Day

On November 7 at 2 p.m. Eastern Time, the Federal Reserve will announce its decision regarding key interest rate cuts. Currently, market analysts predict a quarter-point reduction, although there’s potential for a half-point cut similar to September’s announcement, or no changes at all. These possibilities represent three key variables that investors will be watching closely the day after the election.

Typically, Fed decisions significantly influence market movements. However, the potential uncertainty following a divisive presidential election could amplify stock market volatility. With the nation on edge, the Fed’s action could create additional market swings.

Strategies for Navigating Market Chaos

On Wall Street, I am known as a “quant” for my analytical approach. Rather than relying on instincts for stock selection, I utilize computer models to highlight stocks with strong growth potential and favorable momentum. This method has allowed me to achieve over four decades of success in the field, including outperforming the S&P 500 by a remarkable 3-to-1 for 23 consecutive years.

Throughout my career, I have identified pivotal investments in influential companies like Microsoft Corp. (MSFT) at $0.38, Apple Inc. (AAPL) at $0.37, and Nvidia Corp. (NVDA) at under $0.25, all before their significant expansions. My recent successes include closing trades in:

- Rambus (RMBS) for 133% gains in 17 months.

- Super Micro Computer (SMCI) for a 593% gain on one-third of the position sold.

- Gatos Silver (GATO) for a gain of 45.6% in just one month.

- e.l.f. Beauty (ELF) for 68.5% gains across 16 months.

In the face of post-election volatility, I will continue to rely on these models to identify promising investment opportunities. Experience has taught me that having systematic approaches is crucial, especially in uncertain markets like the one that may follow the election.

Currently, I am excited about a specific model I have developed, which was initially accessible only to large institutional investors. However, I aim to provide everyday investors with access to this information ahead of Election Day to recognize hidden profit opportunities.

To learn more, I invite you to my “Day After Summit” on Tuesday, October 29, at 7 p.m. Eastern Time. During this event, I will share strategies for navigating the upcoming market turbulence. Additionally, I will offer a post-election trade suggestion that can potentially yield results regardless of election outcomes.

Don’t miss out – sign up for the summit at this link.

If you’re unable to attend, staying committed to your long-term investments will be key to maintaining confidence in the aftermath of market fluctuations. In time, the right strategies will prevail.

Sincerely,

Louis Navellier

Editor, Market 360