“`html

Hologic, Inc. Prepares for Fourth Quarter Financial Results with Promising Segment Growth

Hologic, Inc.’s HOLX Diagnostics segment, excluding COVID-19 assay and related revenues, is expected to have significantly benefited from the robust Panther utilization in its Molecular Diagnostics franchise. Higher gantry deliveries and robust service revenues are likely to have contributed to the Breast Health segment’s performance. Furthermore, MyoSure is likely to have emerged as the key driver of the GYN Surgical division’s revenues.

We anticipate that the company’s fiscal 2024 fourth-quarter financial results, slated to be released on Nov. 4 after the closing bell, will reflect these aspects.

Stay informed about quarterly releases: Check Zacks Earnings Calendar.

In the meantime, click here to see if the stock might be a worthwhile investment before earnings.

Segment Performance Insights

Diagnostics

Hologic’s core Molecular Diagnostics business continues to drive the Diagnostics segment forward. The company’s Panther platform offers efficiency, automation, simplicity, and an expanding array of testing options. Reports indicate a rise in Panther placements globally during the fourth quarter of fiscal 2024, with revenues per Panther and the number of assays performed both likely on the upswing, positively affecting the overall revenues.

The BV/CV/TV vaginitis panel is anticipated to continue its impressive growth, currently ranking as the second largest globally. Additionally, STI testing remains a strong contributor, boosting U.S. revenues and performing well internationally. Higher sales of non-COVID-19 respiratory assays are expected to reflect broader adoption of the four-plex COVID, Flu A, Flu B, and RSV assay. The Biotheranostics sector is also projected to support growth in the Molecular Diagnostics area.

The Cytology and Perinatal business may have experienced a strong international outlook due to the adoption of the Genius AI Digital Diagnostics system. After a surge in U.S. sales in fiscal 2023 attributed to logistical challenges, modest growth in cytology sales is expected for the upcoming quarter.

Our forecasts suggest a 3.1% increase in Diagnostics revenues for the fourth quarter of fiscal 2024.

Breast Health

Hologic is poised to benefit from the ongoing strong demand for Breast Health products and services. Product revenues are likely to reflect an increase due to higher sales volumes in digital mammography systems, particularly the 3Dimensions systems, along with related software and workflow products.

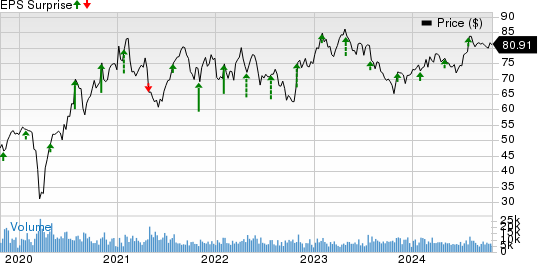

Hologic, Inc. Price and EPS Surprise

Hologic, Inc. price-eps-surprise | Hologic, Inc. Quote

Furthermore, the Breast Imaging sector may have seen solid growth in both domestic and international markets. Increased gantry shipments combined with higher service revenues are expected to contribute to this sector’s success, as it’s likely that more gantries were delivered compared to fiscal 2023.

In July 2024, Hologic acquired UK-based Endomagnetics, enhancing its portfolio in interventional breast health with innovative solutions for breast surgery localization and lymphatic tracing. This acquisition is anticipated to bring in approximately $4 million to $5 million in revenue during the fiscal fourth quarter, aligning with Hologic’s expectations.

Our projections indicate a 4.4% increase in the Breast Health segment revenues for the fourth quarter of fiscal 2024.

GYN Surgical

The GYN Surgical segment is likely to report strong performance driven by key products, MyoSure and the Fluent Fluid Management System. Contributions from the Laparoscopic portfolio are expected to be strong as well, although revenues from this line are smaller compared to other areas of the Surgical business.

International growth for MyoSure is expected to surpass that of the U.S. market, attributed to less developed markets and a growing demand for minimally invasive treatments for uterine polyps and fibroids. Such factors are projected to significantly enhance the performance of the International Surgical Business during the fiscal fourth quarter.

Our forecast anticipates a 4.9% increase in GYN Surgical revenues for the fourth quarter of fiscal 2024 compared to the previous year.

Skeletal Health

This segment has faced challenges due to a temporary halt in shipments resulting from issues related to electromagnetic compatibility. This situation has likely caused a drop in sales volume for Horizon DXA systems. Hologic has been actively addressing this issue with its suppliers and anticipates resuming shipments soon. Meanwhile, sales volumes for the Insight FD systems have also decreased due to competitive pressures. However, improvements are expected, leading to a slight increase in business revenues.

Our model predicts a 1.4% growth in Skeletal Health revenues for the fourth quarter of fiscal 2024.

Anticipations for Hologic’s Earnings

Our proven model indicates that stocks with a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold), combined with a positive Earnings ESP, are more likely to surpass estimates. This fits Hologic’s profile:

Earnings ESP: Hologic currently has an Earnings ESP of +0.21%. For insights into identifying promising stocks before earnings reports, check out our Earnings ESP Filter.

Zacks Rank: Hologic holds a Zacks Rank of #3. For further details, you can access the complete analysis here.

“`

Top Medical Stocks Set for Earnings Surprises

Insightful Picks for Upcoming Earnings Reports

Here are several medical stocks worth considering for potential earnings beats, as they showcase a strong combination of factors that could lead to positive surprises:

Becton, Dickinson and Company (BDX) holds an Earnings ESP of +0.91% and a Zacks Rank #2. The company plans to announce its third-quarter 2024 results on Nov. 7. Historically, BDX has exceeded earnings estimates in three of the last four quarters, with a notable average beat of 6.2%. The Zacks Consensus Estimate for its third-quarter EPS reflects an expected increase of 10.2% compared to the previous year.

Haemonetics (HAE) shows an Earnings ESP of +0.18% and carries a Zacks Rank #2. Results for the second quarter of fiscal 2025 will be shared on Nov. 7. In the past four quarters, HAE has beaten expectations three times, achieving an average surprise of 3.5%. Analysts anticipate a 10.1% rise in the Zacks Consensus Estimate for the second-quarter EPS from last year.

Masimo (MASI) boasts an Earnings ESP of +0.40% and has a Zacks Rank #2. The company is set to release its third-quarter 2024 results on Nov. 5. Impressively, Masimo has surpassed earnings forecasts for all four prior quarters, with an average surprise of 14.6%. The Zacks Consensus Estimate for MASI’s EPS in the third quarter is projected to increase by 33.3% from the same quarter in the previous year.

Highlighted Stocks for the Coming Month

Recently, experts compiled a list of seven top stocks from Zacks Rank #1 Strong Buys, identifying these selections as “Most Likely for Early Price Pops.”

Since 1988, stocks from this exclusive group have outperformed the market more than twofold, achieving an average annual gain of +23.7%. Therefore, it is wise to pay close attention to these seven handpicked stocks.

Becton, Dickinson and Company (BDX) : Free Stock Analysis Report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Masimo Corporation (MASI) : Free Stock Analysis Report

Read this article on Zacks.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.