UBS Adjusts Newmont’s Outlook: Shareholder Activities Highlight Industry Trends

On October 30, 2024, UBS revised its assessment of Newmont (BRSE:NEM), changing its rating from Buy to Neutral.

Current Investor Sentiment

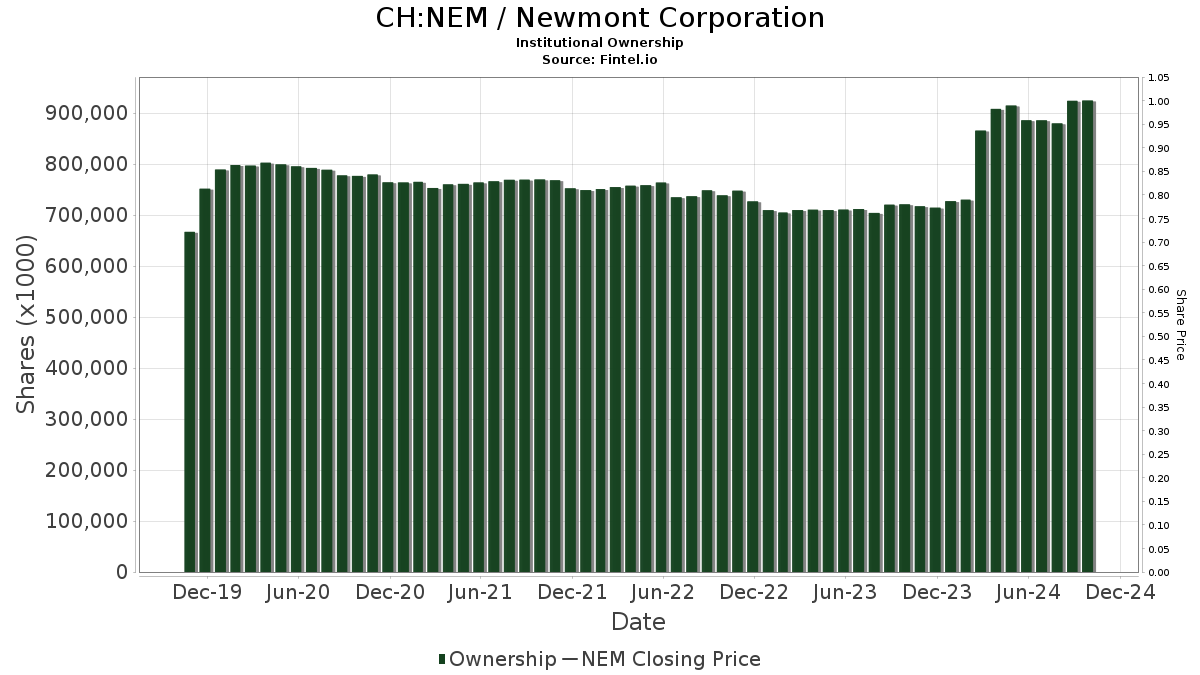

As of now, 1,894 funds or institutions report holding positions in Newmont, reflecting an increase of 59 holders, or 3.22%, in just the last quarter. The average portfolio weight of all funds invested in NEM stands at 0.44%, which is a notable increase of 14.17%. In the past three months, the number of shares owned by institutions rose by 5.66%, totaling 928,594K shares.

Institutional Investor Movements

Among significant shareholders, Van Eck Associates holds 48,950K shares, translating to 4.30% ownership of Newmont. This is down from 50,918K shares previously, indicating a decrease of 4.02%. However, the firm has boosted its portfolio allocation to NEM by 4.77% over the previous quarter.

Another notable investor, GDX – VanEck Vectors Gold Miners ETF, owns 43,624K shares, accounting for 3.83% of the company. This marks an increase from 42,864K shares, representing a rise of 1.74%. The fund increased its portfolio stake in NEM by a significant 21.08% last quarter.

The VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 36,485K shares, or 3.20%. This is an increase from 36,275K shares, up by 0.58%. Its allocation to NEM saw a growth of 14.26% in the last quarter.

Similarly, VFINX – Vanguard 500 Index Fund Investor Shares owns 29,595K shares, reflecting 2.60% ownership. This is a slight uptick from 29,044K shares, showing an increase of 1.86%. The fund also raised its portfolio allocation in NEM by 12.69% during the past quarter.

Lastly, VIMSX – Vanguard Mid-Cap Index Fund Investor Shares holds 24,702K shares, representing 2.17% ownership. This is a small drop from 25,041K shares, indicating a decrease of 1.37%. Nevertheless, it has increased its allocation to NEM by 18.97% over the last three months.

Fintel is recognized as a leading platform for investment research, serving individual investors, financial advisors, and small hedge funds. It provides comprehensive data, including fundamentals, analyst reports, ownership details, and more to guide investment decisions.

This article originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.