This piece of financial insight delves into the changing tides of the market, the shifting landscape of technology stocks, and offers an intriguing glimpse into the world of gold investments.

The Changing Market Landscape

The past year witnessed significant gains led by a handful of colossal market players. However, these same stocks struggled in 2022, prompting a resurgence in a broader market participation in 2024. The recent breakout of the advance-decline line of the S&P 1500 index, a metric gauging stocks on the rise versus those on the decline, signifies a positive shift in market breadth. This shift indicates a rising tide lifting all boats, not just a select few.

While large technology and prominent stocks are displaying signs of weakness, some of the market’s tech giants are beginning to falter in comparison to broader market indexes. With improved market breadth, weaker mid and small-cap stocks are showing early signs of strength. Additionally, sectors apart from technology, such as Procter & Gamble and the Energy sector, are gaining momentum—a promising sign for market expansion.

Exploring the Gold Market

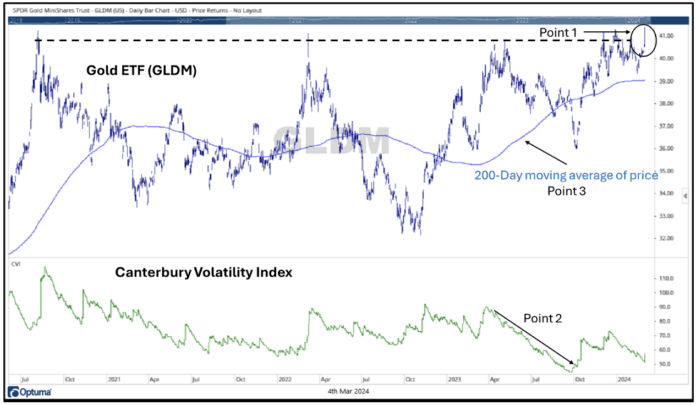

Diverging from equities, this week’s spotlight shines on the gold market, particularly focusing on a gold ETF, GLDM, for a technical analysis.

Gold often serves as a portfolio diversifier, showcasing varying correlations with bonds and equities over time. Recent weekly data displays positive correlations of gold with stocks and bonds, along with a few favorable technical indicators—a noteworthy development for potential investors.

- This gold ETF recently achieved an all-time high, breaking out after a prolonged sideways trend.

- Despite a decline in gold prices from April to October 2023, volatility decreased, an uncommon occurrence during price decline. This trend reversed with gold’s rally, seeing a subsequent decline in volatility as the ETF hit a new high.

- The 200-day moving average of gold’s price trended upwards as the metal reached a new high, indicating a promising long-term trend.

Concluding Remarks

The current market scenario presents a blend of opportunities and challenges, with technology stocks losing their lead amid broader market participation. Diversification and stability in portfolios are crucial, ensuring resilience in the face of shifting market dynamics. The team at Canterbury continues to seize opportunities, with recent investments in Procter & Gamble, Dover Corporation, and Gold.

As market landscapes evolve, so must investment portfolios. An adaptive investment approach ensures alignment with market fluctuations, offering agility in both bullish and bearish conditions.

The opinions expressed here are solely those of the author and do not necessarily reflect Nasdaq, Inc.’s views.