The Aaron’s Company, Inc. AAN reported a wider-than-expected loss per share in the first quarter of 2024. Also, its revenues missed the Zacks Consensus Estimate and declined year over year.

Aaron’s delivered an adjusted loss of 15 cents per share, wider than the Zacks Consensus Estimate of a loss of 8 cents. The company’s bottom line compared unfavorably with adjusted earnings of 66 cents per share in the year-ago quarter. The soft bottom-line performance can be attributed to the decline in revenues, and higher other operating expenses and write-offs. This was partly negated by reduced personnel costs.

Consolidated revenues declined 7.7% to $511.5 million, driven by soft lease revenues and fees at the Aaron’s business, and a dip in retail sales at the BrandsMart business. The figure lagged the Zacks Consensus Estimate of $517 million.

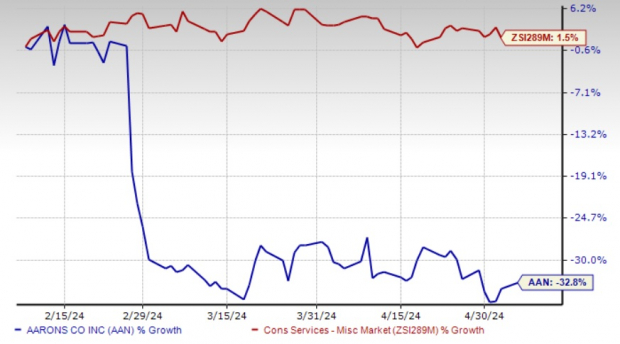

We note that shares of this Zacks Rank #5 (Strong Sell) company have declined 32.8% in the past three months against the industry’s 1.5% growth.

Image Source: Zacks Investment Research

Breaking up the components of consolidated revenues, lease revenues and fees dropped 7.4% year over year to $346 million, and retail sales decreased 9% to $136.9 million. Non-retail sales, which mainly include merchandise sales to franchisees, declined 5.4% year over year to $22.6 million, while franchise royalties and other revenues decreased 2.8% to $5.9 million from the year-ago quarter.

In the Aaron’s business segment, revenues declined 7.5% year over year to $381.1 million due to a 4.8% dip in the lease portfolio size at the end of the quarter and a reduction of 110 basis points (bps) in the lease renewal rate to 87.4%. The company noted that lease portfolio size gradually improved in the quarter, driven by growth in lease merchandise deliveries. At the beginning of the first quarter, the lease portfolio size was down 7% year over year.

Same-store lease portfolio size declined 1.4% year over year compared with a dip of 6% in the year-ago quarter. E-commerce revenues rose 20.8% year over year and represented 24% of lease revenues. For the first quarter, our model had predicted Aaron’s business revenues of $390.4 million, indicating a year-over-year decline of 5.3%.

In the BrandsMart segment, revenues decreased 8.1% to $132.5 million in the first quarter of 2024, mainly driven by a 9.4% decline in comparable sales. The decline in comparable sales was attributed to the ongoing weakness in customer traffic and customers’ shift to lower-priced products across major categories.

The segment’s e-commerce product sales slipped 9.2% year over year, representing 8.7% of the total product sales. E-commerce sales were mainly impacted by an increased shift to lower-priced products and a change in the category mix. Our estimate for BrandsMart segment revenues was $133 million for the first quarter, reflecting a year-over-year decline of 7.7%.

The Aaron’s Company, Inc. Price, Consensus and EPS Surprise

The Aaron’s Company, Inc. price-consensus-eps-surprise-chart | The Aaron’s Company, Inc. Quote

Margins

Aaron’s gross profit declined 7.48% year over year to $273.9 million, while the gross margin expanded 20 basis points (bps) to 53.5%. In the first quarter, the company reported an operating loss of $12.4 million against the year-ago quarter’s operating profit of $12.7 million.

Adjusted EBITDA declined 50.4% year over year to $22.7 million due to lower lease revenues and fees at the Aaron’s business, and soft retail sales at BrandsMart, along with higher operating expenses and write-offs. The adjusted EBITDA margin declined 390 bps to 4.4%. We had estimated an adjusted EBITDA of 22.6 million, implying an adjusted EBITDA margin of 4.3%.

Financial Position

Aaron’s ended the quarter with cash and cash equivalents of $41 million, a debt of $212.9 million, and shareholders’ equity of $670.5 million. In first-quarter 2024, it used $18.5 million of cash from operating activities.

At the end of first-quarter 2024, the company generated a negative adjusted free cash flow of $33.2 million. Capital expenditure was $20.9 million in the first quarter. It paid out dividends of $3.8 million in the first quarter.

For 2024, AAN expects a capital expenditure of $85-$95 million and an adjusted free cash flow of $15-$30 million. The company expects cash provided by operating activities of $99-$114 million for 2024.

Outlook

For 2024, AAN anticipates revenues of $2.055-$2.155 billion, while the adjusted EBITDA is projected to be $105-$125 million. AAN envisions the adjusted bottom line between break-even and earnings of 25 cents per share for 2024. Loss, on a GAAP basis, is expected to be 25-40 cents a share.

For the Aaron’s business, revenues are expected to be $1.46-$1.52 billion, whereas the adjusted EBITDA is likely to be $137.5-$152.5 million for 2024.

For BrandsMart, revenues are anticipated to be $610-$650 million, whereas the adjusted EBITDA is forecast at $7-$12 million for 2024.

Eye These Better-Ranked Picks

Some better-ranked companies are Skechers SKX, Gildan Activewear GIL and Kontoor Brands KTB.

Skechers, which designs, develops, markets and distributes footwear for men, women and children in the United States and overseas, sports a Zacks Rank #1 (Strong Buy) at present. SKX has a trailing four-quarter earnings surprise of 34.1%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Skechers’ current financial-year sales and EPS suggests growth of 10.3% and 15.2%, respectively, from the year-ago quarter’s reported figures.

Gildan Activewear is a manufacturer and marketer of premium quality branded basic activewear. GIL currently carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Gildan Activewear’s current financial-year sales and EPS suggests growth of 2.7% and 14.4%, respectively, from the year-ago reported figures. GIL has a trailing four-quarter earnings surprise of 5.6%, on average.

Kontoor Brands, an apparel company, carries a Zacks Rank of 2 at present. KTB has a trailing four-quarter earnings surprise of 13%, on average.

The Zacks Consensus Estimate for KTB’s 2024 EPS indicates an increase of 10.6% from the year-ago period’s reported level.

Where Will Stocks Go…

If Biden Wins? If Trump Wins?

The answers may surprise you.

Since 1950, even after negative midterm years, the market has never had a lower presidential election year. With voters energized and engaged, the market has been almost unrelentingly bullish no matter which party wins!

Now is the time to download Zacks’ free Special Report with 5 stocks that offer extreme upside for both Democrats and Republicans…

1. Medical manufacturer has gained +11,000% in the last 15 years.

2. Rental company is absolutely crushing its sector.

3. Energy powerhouse plans to grow its already large dividend by 25%.

4. Aerospace and defense standout just landed a potentially $80 billion contract.

5. Giant Chipmaker is building huge plants in the U.S.

Hurry, Download Special Report FREE >>

The Aaron’s Company, Inc. (AAN) : Free Stock Analysis Report

Skechers U.S.A., Inc. (SKX) : Free Stock Analysis Report

Gildan Activewear, Inc. (GIL) : Free Stock Analysis Report

Kontoor Brands, Inc. (KTB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.