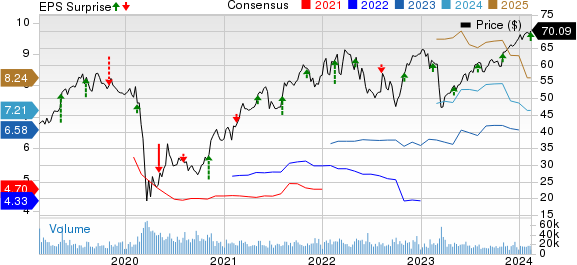

American International Group, Inc. (AIG) has reported an impressive fourth-quarter 2023 performance that surpassed earnings expectations. The company’s adjusted earnings per share of $1.79 exceeded the Zacks Consensus Estimate by 12.6%, underlining a substantial 31.6% year-over-year increase in the bottom line.

Operating revenues experienced a commendable 4.6% year-over-year increase, reaching $12.7 billion, thus outperforming the consensus predictions by 9.7%.

Factors Behind the Strong Results

The robust quarterly results were attributed to the exceptional underwriting performance in the International business and North America Personal Insurance business of the General Insurance unit, alongside increased net investment income. These positive elements, however, were somewhat mitigated by elevated expenses, reduced sales of Variable Annuities in the Life and Retirement unit, and lower financial lines premiums in the General Insurance segment.

AIG’s Operational Update

Notably, premiums saw a 9.9% year-over-year decline to $8.5 billion in the fourth quarter. However, total net investment income of $3.9 billion marked a substantial 20.7% year-over-year increase, surpassing the consensus estimate by 11.7%. Additionally, the total benefits, losses, and expenses of American International Group experienced a moderate 0.7% year-over-year uptick to $11.2 billion.

Moreover, AIG witnessed an adjusted return on common equity of 9.4%, showcasing a noteworthy 190 basis points improvement over the previous year’s performance.

A Steady Ascent for AIG

AIG’s successful completion of two secondary offerings of Corebridge in the fourth quarter of 2023, reducing its stake to 52.2%, represents a strategic move. It reflects the company’s commitment and vision, rendering optimism for an accomplished deconsolidation of Corebridge anticipated in 2024.

Segmental Performances

General Insurance

In the General Insurance segment, net premiums written stood at $5.8 billion in the fourth quarter, signifying a promising 2.6% year-over-year growth. The unit’s underwriting income experienced a 1.1% year-over-year upswing to reach $642 million in the quarter, chiefly bolstered by the strength in International Commercial lines and Personal Insurance.

Furthermore, the segment’s performance was complemented by a notable reduction in catastrophe losses, which plummeted to $122 million, down from $248 million in the preceding year.

Life and Retirement

The Life and Retirement segment displayed premiums and fees amounting to $3.2 billion in the fourth quarter, marking a substantial 13.6% year-over-year increase, largely attributable to improved pension risk transfer volumes. Additionally, the segment’s adjusted revenues surged 13.9% year over year, reaching $6 billion, surpassing the Zacks Consensus Estimate by 24.2%.

Adjusted pre-tax income for the unit rose by a commendable 12.3%, signaling the sustained growth trajectory.

Financial Position and Capital Deployment

As of December 31, 2023, AIG’s cash balance had strengthened to $2.2 billion from $2 billion at the end of 2022. The company also witnessed notable enhancements in its total assets and total equity, reinforcing its sturdy financial position.

Furthermore, AIG’s commitment to shareholders was evident through rewarding them with $1 billion in repurchases and dividends worth $256 million, further substantiating the company’s sound capital deployment strategy.

An Ever-Evolving Journey

Although AIG’s 2023 total revenues saw a decline compared to the previous year, the company’s adjusted earnings displayed remarkable improvement, reflecting the company’s resilience and adaptability to the evolving market dynamics.

Continued Industry Resilience

Among other industry players, CNO Financial Group, Inc. (CNO), Radian Group Inc. (RDN), and Assurant, Inc. (AIZ) also outshone the Zacks Consensus Estimate in their fourth-quarter 2023 results, showcasing the collective strength and resilience of the insurance sector.

These players, along with AIG, demonstrated exemplary performances, underscoring the industry’s robustness despite prevalent challenges.

Strategic Initiatives in Motion

AIG’s prudent decision making, strong operational performance, and strategic initiatives such as Corebridge deconsolidation lay a solid foundation for potential future growth and sustained value creation for its shareholders.