Allegion plc’s fourth-quarter 2023 adjusted earnings of $1.68 per share exceeded expectations, marking a remarkable 5% year-over-year upturn. This achievement reflects a phoenix-like rise from the ashes of pandemic-induced economic downturn.

Revenue Resurgence

Despite reporting revenues of $897.4 million — a commendable increase of 4.2% from the preceding year — the company narrowly missed the Zacks Consensus Estimate of $913 million. However, acquired assets and favorable foreign exchange fluctuations contributed to this striking revenue surge, underscoring Allegion’s tenacious recovery from the economic fallout of the pandemic.

The company’s revenue bump, -particularly in the non-residential business segment, reflects a phoenix-like resurgence—a testimony to Allegion’s adaptability and resilience against myriad market challenges.

Margin Miracle

The reported quarter witnessed a profusion in Allegion’s gross profit and gross margins, which escalated by 9.9% and 220 basis points (bps) to $385.3 million and 42.9%, respectively. This feat was buoyed by the company’s unwavering determination to navigate the turbulent waters of the pandemic economy. Such a recovery is a testament to Allegion’s remarkable ability to spread its wings and stay afloat amidst adversity.

Financial Fortitude

Allegion exited the fourth quarter of 2023 with impressive financial fortitude, boasting cash and cash equivalents of $468.1 million, up from $288.0 million in the preceding year. Long-term debt also plummeted from $2.1 billion to $1.6 billion, demonstrating the company’s remarkable financial resurgence amidst the post-pandemic economic landscape. The increase in net cash generated from operating activities and free cash flow further underscores the company’s rejuvenation from pandemic-induced economic challenges.

2024 Outlook: A Vision of Vigor

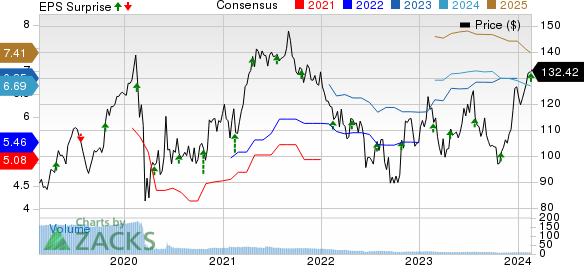

Despite carrying a Zacks Rank #4 (Sell), Allegion anticipates an upward trajectory in its 2024 revenues, with expected organic sales of 1-3% and adjusted earnings to range between $7.00 and $7.15 per share. Furthermore, the company foresees a free cash flow of $540-$570 million, and its expected tax rate is anticipated to be 18-19%. This forecast reflects Allegion’s indomitable spirit to emerge stronger and more resilient from the economic trials of the past few years.

Industry-Wide Renaissance

Allegion’s financial renaissance is not a solitary event. Fellow industrial companies, such as Tetra Tech, A. O. Smith Corporation, and Illinois Tool Works Inc., have also exhibited commendable rebounds, underscoring a broader revival within the industrial sector. As the post-pandemic economy continues to gain momentum, these companies are emblematic of the phoenix-like resurgence that has pervaded various sectors in the aftermath of the economic upheaval resulting from the pandemic.

While Allegion’s success is remarkable in its own right, it is also part of a larger narrative of hope and financial resurgence across industrial sectors, reminiscent of a phoenix’s rise from the ashes.

Rebirth and Resilience

Indeed, the financial accomplishments of Allegion and its industry peers are not merely statistics but symbols of the phoenix-like resilience that has characterized the post-pandemic economic landscape. In the wake of unprecedented global challenges, these companies have exhibited an unwavering spirit—like a phoenix rising from the ashes—propelling them to soar to new heights amidst economic adversity.

Allegion’s Q4 success is not just the story of one company’s financial victory; it is a testament to the collective resilience and adaptability that has carried the industrial sector from the depths of economic despair to the cusp of renewal.