Analysts Predict Growth for TDIV ETF and Key Holdings

In our latest analysis at ETF Channel, we examined the underlying assets of several ETFs. Specifically, we found that the First Trust NASDAQ Technology Dividend Index Fund ETF (Symbol: TDIV) has an implied target price of $88.09 per unit based on its holdings.

TDIV Trading and Potential Upside

Currently, TDIV is priced around $80.42 per unit. This suggests that analysts foresee a potential upside of 9.53% for this ETF in the coming year, as indicated by the average targets for its underlying stocks. Among these stocks, three stand out with considerable upside potential: Silicon Motion Technology Corp (Symbol: SIMO), Adeia Inc (Symbol: ADEA), and Telefonica Brasil SA (Symbol: VIV).

Key Holdings with Significant Growth Potential

Silicon Motion Technology Corp, priced recently at $57.00 per share, has an average analyst target of $85.78, suggesting a remarkable upside of 50.49%. Meanwhile, Adeia Inc’s current price of $12.34 points to a potential increase of 21.56% if it reaches an average target of $15.00. Moreover, Telefonica Brasil SA, trading at $9.40, has a forecasted target of $11.22, which implies a 19.41% upside.

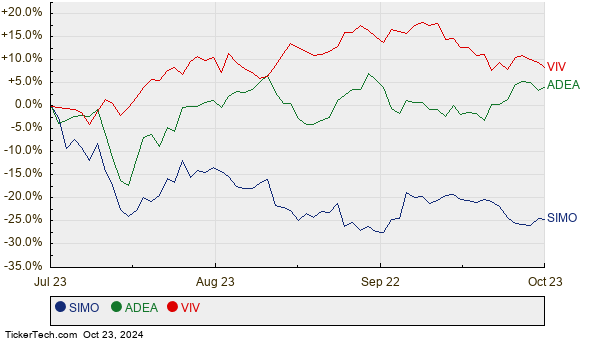

Below is a chart displaying the twelve-month price performance of SIMO, ADEA, and VIV:

Summary Table of Analyst Target Prices

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| First Trust NASDAQ Technology Dividend Index Fund ETF | TDIV | $80.42 | $88.09 | 9.53% |

| Silicon Motion Technology Corp | SIMO | $57.00 | $85.78 | 50.49% |

| Adeia Inc | ADEA | $12.34 | $15.00 | 21.56% |

| Telefonica Brasil SA | VIV | $9.40 | $11.22 | 19.41% |

Analysts’ Targets: Reality or Optimism?

These predictions prompt questions: Are the analysts justified in their targets, or are they being overly optimistic? It’s essential to evaluate if their forecasts are based on current data, especially in light of recent company and industry developments. A high target price relative to trading prices may indicate optimism, but it could also signal a future downgrade if the predictions are based on outdated factors. Investors should conduct thorough research to understand these dynamics.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• ETFs Holding CFMS

• ARQQ shares outstanding history

• TGI Average Annual Return

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.